2 etfs I think can be exploded in 2025!

Picture Source: Pictures of Getty

Heritage weights continue to hold themes in 2025 as a jitteriness in financial markets burning. Billion-Backed Exchange-Dests Dents (etfs) blow up in value as gold prices jump.

Gold – Next – Next Records in the previous year – has already been high 11% 5 weeks and A-Bit from the new day. It hit the new $ 2,914 new portps per eunce in the hours of newcomers.

I think there can be a lot of gold prices. And especially if the amount of a butchover surfaces $ 3,000 technology.

The easiest way of investors to spend money in this situation can buy gold-tracking. In addition to the European currency such as this such a bloom – according to the World Gold Council, they hit their high quality from March 2022 per month ago.

I think of one purchase found in my portfolio.

Top Tracker

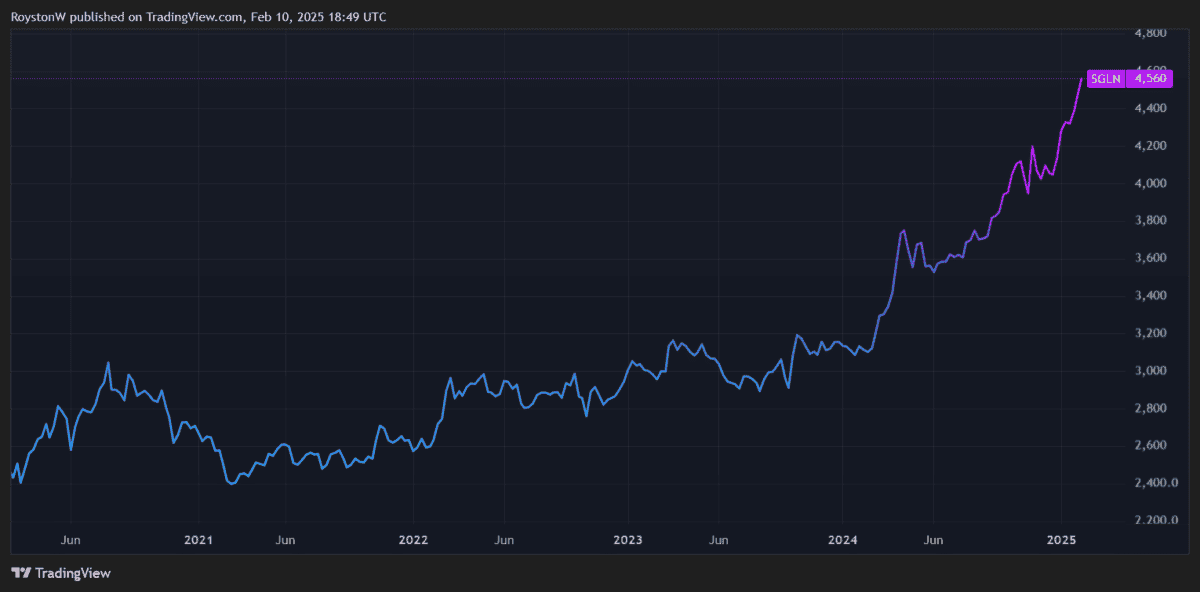

This page Hares physically gold (Lese: Sgln) The Fund I think is appropriate to look as a result of its lower billing structure. In 0.12%, its continuous cost is one very low in business.

Such funds allow investors to have gold without suffering and final costs and delivery, or concerns whether the metal is your acceptable quality. Ishares says 100% in the bars in charge of the London Billion Market Association (LBMA).

This bag has another factor that makes us popular by some investors. Unlike many ETFs, tracking the amount of metal itself instead of the Golden Mine-Ministry Compenses. It therefore protects people who do not harm the minerals, the development of the mine and the mining.

Return is less consequently. But it can be a preferred way of looking at vulnerable investors.

Another precious thing

My view is that the safe gold demand will continue to rise. There is no guarantee of this, of course, and improving economic conditions so that the joint market confidence can send it too low.

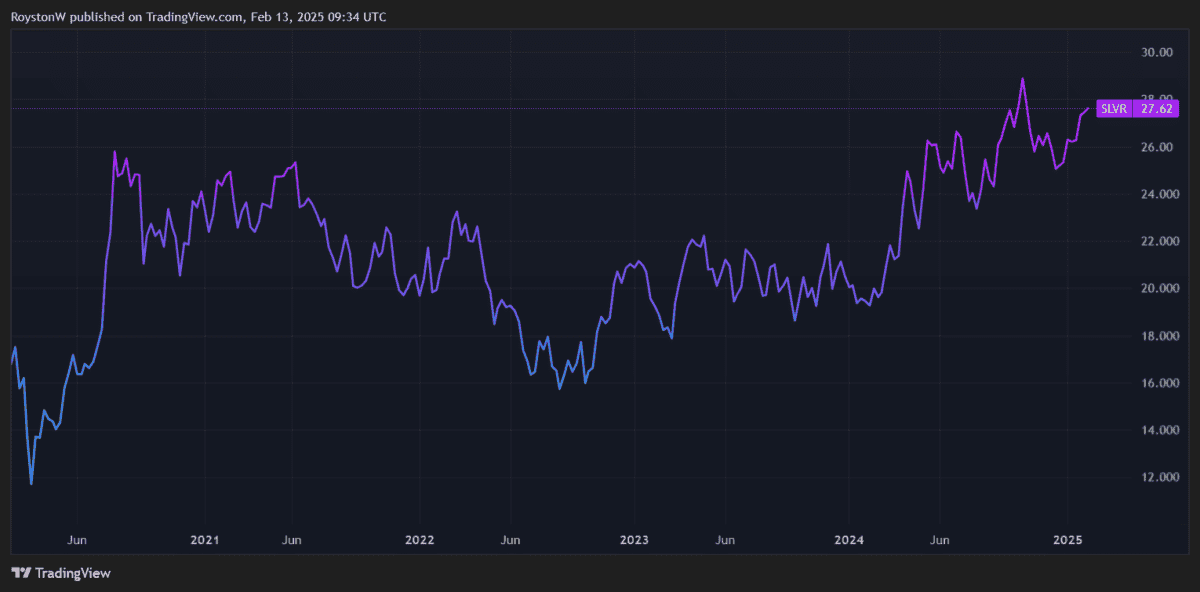

Another way for investors’ get their beters’ money are ‘and reduce the risk of the situation to process the ETF. That I feel is worth considering today Silver of digraphtree (Lese: Slvr) Fund.

This financial instrument – which also follows the meat prices instead of a wide range of stocks – it has been criticized in 2025 as the worries of the world and transmission of Geopolitical Earth, the need for higher maximum investment.

While safe buying can continue, silver prices can be closer when the global economy progresses and the metal industry industries take. Categories such as the automotive and electronic EXCORT OFFICE EVENTS of approximately 55% of silver accounts.

Despite its dual role as investments and industrialized steel, there is a risk for silver and efficient salaries. Like gold, prices can be falling when the US dollar strengthens, which makes it more costly to purchase a re-plan.

With support yet, I think both of these zin-etf can continue to go by 2025 and can be.

Source link