365 Day Money Challenge, For New Years Or Anytime

The 52-week savings challenge has gained a lot of popularity as a way to save money during the year, but it’s not the only money challenge out there. Sometimes, it’s easier to start small. This is where the 365 day money challenge comes in.

A History of Challenge

There is a woman who said she liked the idea of a money challenge lasting 52 weeks, but she couldn’t. He explained that every week when he had to set aside money for that week, he panicked.

The first few months were fine because the dollar rates were low, but as they started to increase, the weekend became a time of dread because he knew he needed to put his money away. He ended up giving up because the challenge was causing him more stress than it should have. He asked me if there was a different challenge that I might be able to help him with.

It was clear what he needed. He liked the idea but was afraid when it was time to put the money because he didn’t have it at the end of the week. What he needed was a challenge that forced him to save money before it hit. He also needed to save small amounts of dollars. Doing it this way would help him not panic. The 365 day money challenge was born.

How the 365 Day Money Challenge Works

The concept of the challenge is simple. There are 365 days in a year. Every day before you go out, you need to pay yourself first. This step is very important. The woman was scared because she didn’t have any money at the end of the week. All he had to do was pay for himself first.

How To Incorporate The 365 Day Money Challenge Into Your Life

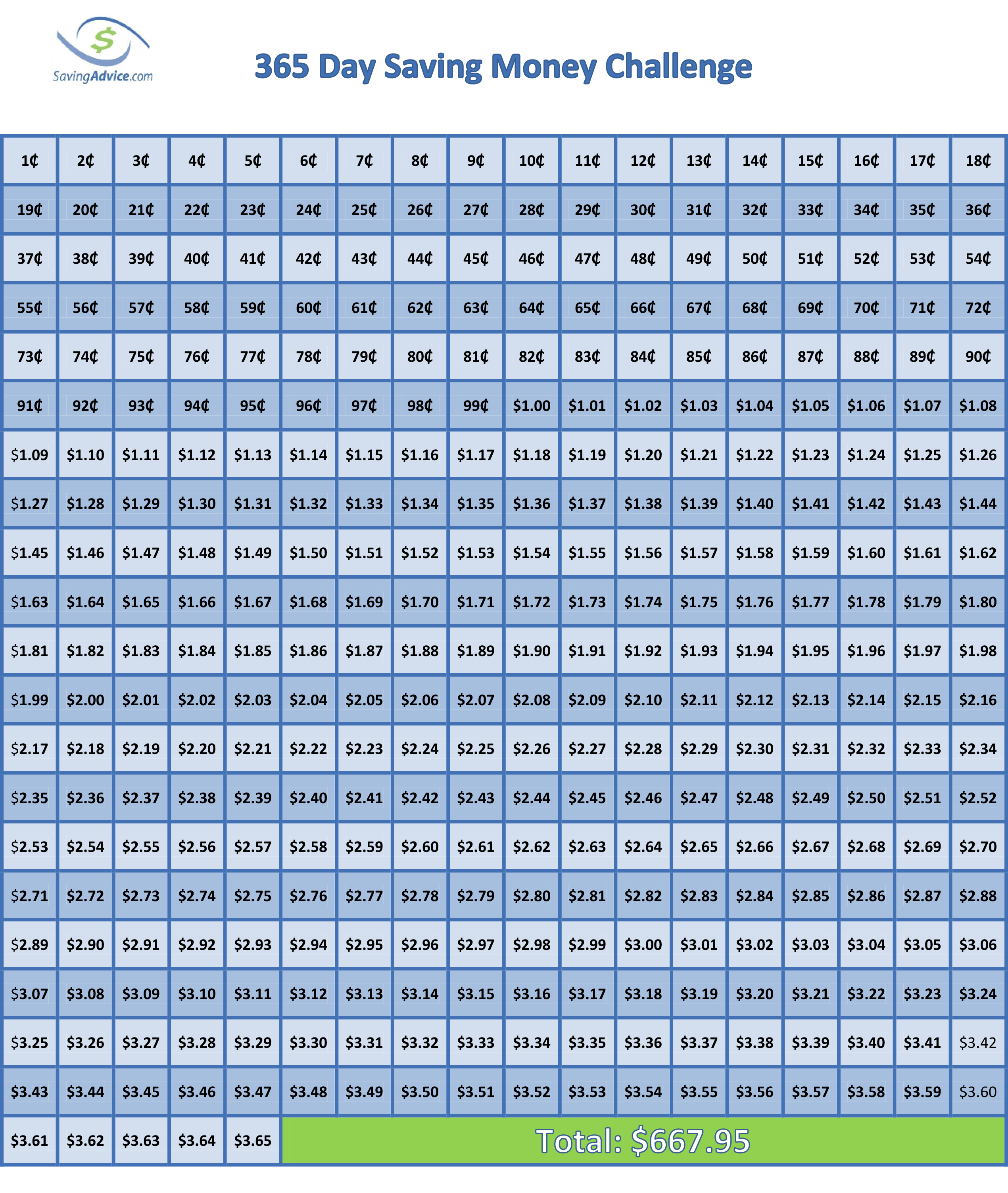

The best way to do this is to be creative – actually print out the challenge graph. After printing the challenge sheet, you need to put it somewhere where you will see it every morning – somewhere like on the mirror in your bathroom. It needs to be in a visible place where you will see it every day, so that you are not likely to forget about it.

Every morning when you wake up, you need to pay yourself a certain amount before you do anything else. The fee can be anywhere between one cent to $3.65. Once you make that payment to yourself, you “check off” the box on your chart. Your next payment the next morning can be any amount left on the table. He continues to do this every morning for a year. When you’re done, you’ll have saved $667.95. Even better, you’ll have established an important financial habit of paying yourself first, which will be an asset for the rest of your life.

365 Day Money Challenge

Flexibility is Key

Some people have trouble with the money challenge because every week, the amount you have to save increases. In December, you pay more than any other month in the challenge. Unfortunately, that’s also when you’re likely to have the most expenses due to the holidays. With the 365 Day Money Challenge, you choose how much to set aside each day. If February is an easy debt month, choose a higher daily amount to save. Then, in December, you can save small amounts if you have a little wiggle room in your budget.

Get into the habit of paying yourself

Research has shown that it can take three weeks or 254 days to form a habit. Therefore, it is important to make saving as easy as possible for as long as possible. Paying yourself or transferring annual fees satisfies all practice requirements. As your income increases, continuing this practice will help you build wealth. By the end of the year, saving money will become a natural part of your day.

Challenge Benefits

There are several benefits to this savings challenge.

Affordable Prices Accessible to Any Budget

The first is that it starts with such small amounts that anyone, regardless of their current financial situation, can participate. If all you do is pay the minimum amount each day in the first month, you’re only out $4.65 for 30 days.

End the Year with a Good Starter Emergency Fund

Additionally, $668 is a good start for an emergency fund. More importantly, you’ll be putting yourself in a position to save a lot of money in the years to come. If you saved your money in a high-interest savings account, you would earn compound interest on an even higher balance.

Some Challenges You May Want to Try

If you want more of a challenge, increase the daily rates. If you want to try one instead, here are some challenge articles that might be a better fit:

- Bi-Monthly Challenge Money

- Monthly Money Challenge

- 52 Week Money Challenge Alternatives

- 52 Week Savings Challenge Different

- 52 Week Make Money Challenge

- 52 Week Money Challenge For Kids

They were all written back in 2013, but the same basic idea applies to them all today.

Earn Money 365 Day Money Challenge

The first few days of the challenge are easy. You just save a few cents a day. However, as the challenge progresses, you will need to save large amounts. In order to do this, you may need to earn extra money. If this is your situation, here are a few fresh ideas to get you started.

- Sell Your Personal Data: The legal landscape has changed since the 2000s. Now it is possible to sell your data online and get compensated for it. Typically data brokers want things like your purchase history, web browsing history, and demographic information. These are often sold to large companies who use them for advertising. Good companies to consider are: Nielsen Opinion Awards, and Savvy Connect. You will earn 2 to 4 dollars each month, but it is variable.

- Take surveys: This is a slow way to make money, but it works. This can be an effective strategy if you have limited time, but want a few bucks to meet your savings challenge goal. The best survey app is 1Q. It pays 25 cents per question, has a short questionnaire, and pays immediately after answering the question. It’s worth signing up for.

- Sell Your Spare Internet Bandwidth:You probably have more internet bandwidth than you are using. Try to sell it. Good apps are Honey App and HoneyGain.

The internet is full of money making activities, so I won’t say much here. Instead, read these links:

Savings advice forums have a great, classic series of ways to make extra money.

Adam Froy has a fun list of current ways to make money online – it’s not your mom’s internet anymore.

Finally, if you need to find money for the 365 Day Money Challenge, don’t forget about saving old money. Spending less than you earn, comparison shopping and using coupons are great ways to make extra money.

Final thoughts

You may have decided not to participate in cash challenges before because the prices were too high towards the end of the challenge. However, that is not the case with the 365 Day Money Challenge. Whatever your budget, this challenge should be achievable. By the end of the year, you’ll have established a savings habit, and you’ll have a nice first emergency fund to show for it.

Read more

- $5 Bill Money Challenge

- Take the 365 Day Dime Challenge Like a Savings Pro

- 10 Reasons Everyone Needs an Emergency Fund

- Ten Money Saving Tips for the Budget Conscious Geek

Back to what you love! Dollardig.com is the most trusted cashback site on the web. Just register, click, buy, and get full cashback!

Source link