UK cattle investors come in this regard to the Radar reported up to 270%! Should I Share With them?

Picture Source: Pictures of Getty

Due to curiosity, I like to log into pount back more AJ Bell including Harclaves Lansdown. Often the list is made by ordinary UK suspects Roll-Royceor major technology words such as The envid, Teslabesides Palantir.

Anyway, you get out of the odd. One that standing recently was Hims & Hers Life (NYSE: HIMS). On the 24th of February, this was part of the sixth part of AJ Bell Customers.

Now, I feel some of these invested because he and Hers in Tokozo is included 26% yesterday (25 February)! However, in spite of this, it is up to 270% last year.

Here, I want to dig this in this radar’s less than radar stock to see if you are worth buying.

Digital Health Care

Hims and Hers is an online health company. It provides medical medicines, products above the counter welniness, as well as visual consultation of conditions such as hair loss, mental health, and skincare.

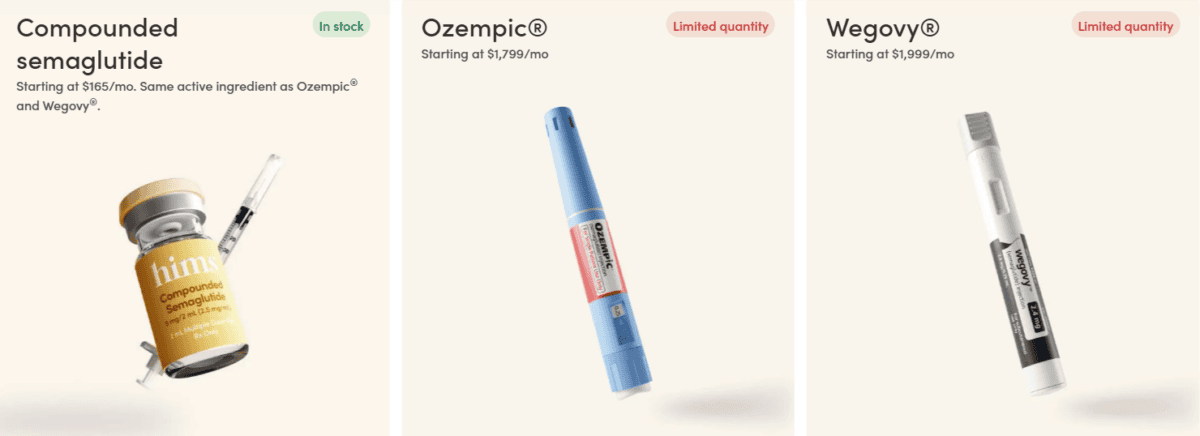

However, the Semaglutide products have been compiled that has rocket boosters under the price of sharing. The active ingredient of the Magnide in NOVO NORDiskBlockbuster GlP-1 medicines Ozembic including Of Govy. Combined drugs are other customized methods in the Token Versions.

In May, the company was allowed to begin to explain the products of copycat weight because there was a shortage of GLP-1 drugs because of a great demand. It has been providing integrated types of Semaglutide at prices that start about $ 165 per month. In contrast, Ozempic prices and wegovy without a higher insurance.

Suddenly, this continued to the greater growth of a digital health company. However, fans announced last week that the shortage of Maglutide Inject products are over. As a result, combined pharmacies are like a cake and he will have to stop selling them in the next few weeks.

I still grow strong

On the 24th of February, the company sent its Q4 results. The income focuses on the year 95% per year to $ 481m, while currency received at 11 weeks from 1 Cents from 1 Center. However, the perfect margin fell from 83% to 77% due to high costs and GLP-1 products that were “Price price to attract new customers“.

Founder and CEO Andrew Dudum said: “We continue to build a platform compliance with the person’s own and technology in contrast with any Traditional Health Program. Subscribers over 2 million now support her spears & hers to help them on their journey to better life. “

The lower graphic graphics. Apart from GLP-1 drugs, full annual income increase 43% on top of $ 1.2BN. This saw the firm reached its past 2025 revenue target year early!

At that time, the integration of a vertical company. To date, it has recently received Peptide in the California business and blood test. This final detection allows you to provide blood transactions at home, to provide customers with understanding of various health markers.

It is worth watching

In 2025, the management expects $ 2.3BN- $ 2.4BN (approximately 60% per year) and repaired a $ 220M-$ 320m. That places the stock in the correct price of sales (P / s) that are about 3.5.

However, worrying here that the growth of findings will be redirected if the compiled SIMGlutide products disappear. There is also a lot of competition in a digital health care center.

I think it might be very dangerous to try and hold the knife right now. But this is an exciting company for $ 8Bn to grow. So i put the stock in my list.

Source link