Forget the FTSE 100. Smaller dividends may be better for passive income!

Image source: Getty Images

I FTSE 100 remains a popular place to hunt for shares. Investors are able to receive attractive dividend yields, some of which are in the double-digit range.

In addition, UK blue-chip stocks have market-leading positions, strong balance sheets, and multiple sources of income. And so that they can bring a steady income regardless of the weather.

However, the stock index’s upside has declined in recent years. And it’s possible that buying small caps for a second income would be a better idea. Here is the reason.

Better yield

According to Octopus Investments, investors can get a better dividend yield by casting their net outside the FTSE 100 as well. FTSE 250 references.

According to the investment giant, the yield on UK small-cap stocks this year is below the Footsie average of less than 4%. However, by 2025, the yield improves to 4.33%.

This beats the 3.97% and 3.88% averages for the FTSE 100 and FTSE 250* respectively.

Top cover

Of course there is more to rational dividend investing than just thinking about yield. The dividend yield is important when consumer payment projections are built on sand.

But based on dividend cover, dividend forecasts for smaller stocks actually look more robust than those for the broader FTSE 100 and FTSE 250. Dividend cover measures how many times predicted payouts are covered by expected earnings.

The budget cover for British small caps is more than tripled by 2024, and is going to more than 3.5 times next year, according to Octopus. Both figures comfortably beat the widely-watched safety benchmark by two times.

High quality small stock

Interesting data, I’m sure you agree. But I personally do not believe that investors should consider buying small stocks for dividends. Payments to businesses like these can be very vulnerable during a recession.

They can also overestimate share price weakness on the basis of company-specific news, or unfavorable sector or economic conditions. As always, creating a diversified portfolio can be the best way to go.

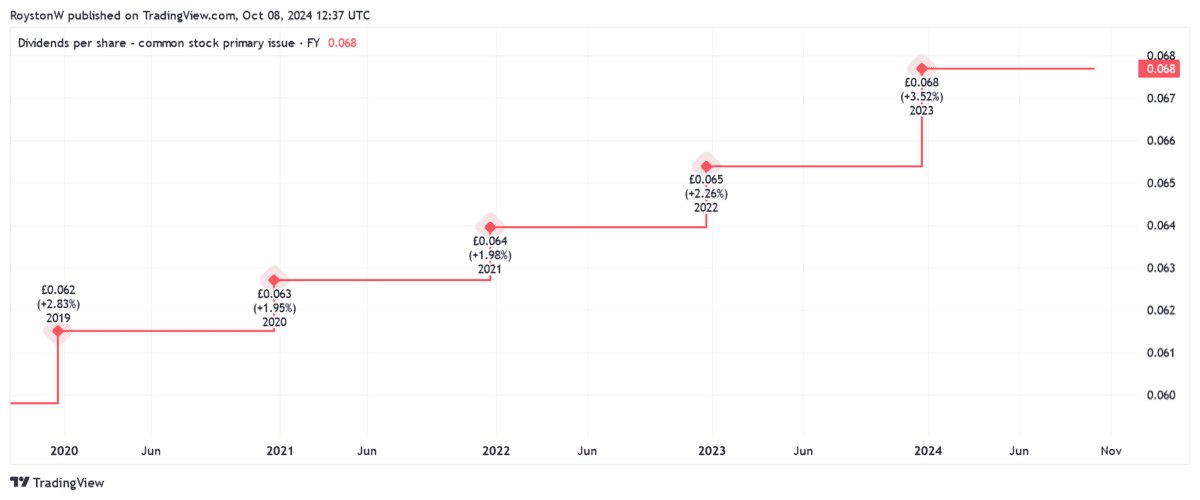

One small stock that attracts my attention today Impact Healthcare REIT (LSE:IHR). At 7.8% and 8.2% for 2024 and 2025, respectively, its dividend yields are really big.

Like any real estate stock, the company is vulnerable to changes in interest rates. Higher rates impact net asset values (NAVs) and borrowing costs go up.

But on balance, I think Impact – which owns and lets residential care homes – is a rock-solid stock to consider. It doesn’t just work in a very defensive market. The business also has its tenants locked into long leases (its weighted unexpired lease term is over 20 years).

Under real estate investment trust (REIT) rules, it is also required to pay out at least 90% of the annual rental income in dividends. This can make it a reliable and kind supplier in the long run.

* Figures refer to the FTSE 250, excluding information technology stocks.

Please note that tax treatment depends on the individual circumstances of each client and may change in the future. The content of this article is provided for informational purposes only. It is not intended to be, and does not constitute, any form of tax advice.

Source link