With 45 years of 5%+ dividend growth, could this be the ultimate income stock?

Image source: Getty Images

Some say British American cigars (BAT) is one of the best stocks for passive income.

Each year since 1998, the tobacco giant has increased its payout to shareholders. This means that it belongs to a special group of Dividend Aristocrats, stocks that have achieved at least 25 years of dividend growth.

And during its last four fiscal years, it managed to increase its annual payout by an average of 3.3%.

However, despite this impressive performance, it may surprise you to know that there is more FTSE 100 stock made even better.

Who is that?

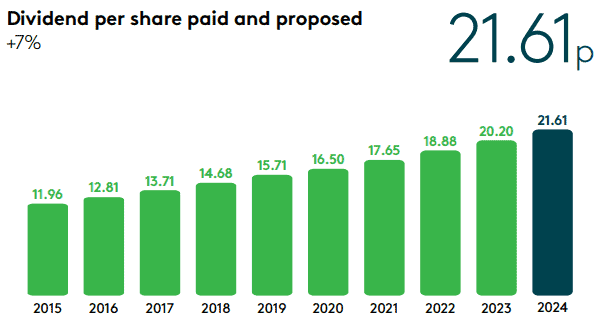

Halma (LSE:HLMA), the life-saving technology company, has increased its dividend by at least 5% a year for an incredible 45 years.

But despite this impressive track record, I don’t consider it an income stock.

This is because currently (October 8) it produces only 0.9% – below the FTSE 100 average of 3.8% and, for example, British American Tobacco (8.7%).

However, I would not immediately dismiss the idea of investing.

Halma’s yield is low because its share price has grown significantly in recent years. Since October 2014, it has quadrupled, which makes it sound like a growth stock to me.

And since its share price is currently 22% below the high reached in December 2021, now would be a good time to consider participating.

How does it grow?

Halma buys small and medium-sized enterprises with a global reach, in its chain markets of safety, health and environment.

Since 1971, it has bought more than 170 companies and says it has another 600 in its pipeline. With one acquisition, the group aims to add at least 5% to profits each year.

Its latest acquisition was Rovers, a Dutch business that designs and manufactures special equipment that helps detect cervical cancer at an early stage.

In the year ended 31 March 2024 (FY24), Rovers made a profit after tax of £3.8m on sales of £10m. Assuming all targets are met, Halma will pay £77m for the company. This is a 20.2 times profit.

This sounds expensive for a private company but should see a rise in the group’s share market value, even if nothing changes. That’s because in FY24, Halma reported earnings per share of 82.4p, which means the group is currently trading at a historical price-to-earnings ratio of 30.3.

So, all things being equal, the purchase of Rovers would add £115m (30.3 x £3.8m) to Halma’s market cap. With a price tag of ‘only’ £77m, shareholders can start reaping the benefits soon.

A warning

However, like any investment, there are risks.

We have seen that stocks are not cheap and their yields are low.

Also, its return on rental income was 1.9 percent lower in FY24, than FY14. This means that it will have to work hard just to stop.

My decision

But over the past 10 years it has grown both revenue and profit at an average of 11% per year.

And I believe the markets it operates in – particularly healthcare and environmental – could be some of the strongest in the next decade or so.

For these reasons, I will put the company on my watch list for my next investment opportunity.

Source link