Why Do Employees Desire Defined Benefit Plans? – Center for Retirement Research

A closer look at Boeing’s discussions makes this question even more confusing.

Boeing employees recently accepted the company’s third bid. The deal does not include reopening the Boeing defined benefit pension plan, which was cited as a major reason why the union rejected the second offer. Although the strike is over, I understand the fact that reopening the pension system has played a major role in the discussions.

After decades of thinking about retirement plans, my conclusion is that coverage is a big problem. Lifetime participation in any type of employer-sponsored plan almost guarantees a secure retirement. In my opinion, the 401(k)/DB debate is a joke.

However, the reopening of the pension plan was important to Boeing employees. I can think of two possible reasons: 1) the assumption that the employer pays the benefits under the defined benefit plan while the employee pays the 401(k) benefits; or 2) benefits provided under Boeing’s defined benefit plan were higher than those resulting from combined employee/employer 401(k) contributions.

No economist would accept the idea that an employer’s contribution to a defined benefit plan is an “add-on” that costs nothing to the employee. Instead, the employer decides on a bucket of money they can afford to pay for total compensation – wages, health insurance, retirement etc. – then distributes it among the various components to create the most desirable package. If employees make it clear that they want more employer contributions to a defined benefit plan, they will eventually receive lower wages, health care, or other benefits. In other words, the employee pays regardless of whether retirement benefits are provided through 401(k)s or defined benefit plans.

The second issue requires comparing the benefits paid under Boeing’s defined benefit plan and its 401(k) plan. The agreed contract included each of the following terms:

- Defined benefit plan: In 2015, Boeing eliminated all accrued benefits for current and future employees, but some active employees still have credits in the plan. Boeing will raise every dollar credit service (ie, service received before 2015) for all active workers from $95 to $105.

- 401(k) plan: Boeing will increase the employer matching contribution from 50% of the first 8% of employee contributions to 100%. In addition, the company will make an additional 4 percent employer contribution plan available to all employees (currently, only for those hired after 2015).

Our colleagues JP Aubry and Yimeng Yin created a spreadsheet for workers at two salary levels based on the following assumptions:

- Salary: 3% growth per year.

- Age: From 35 to 65.

- 401(k): Total contribution 20% (8% employee, 8% employer match, and 4% employer supplement).

- Defined benefit: A dollar per service with a $150 credit (reflecting continued growth in installed value between 2009 and the new contract).

- Rate of return: 6% and 4%.

- 401(k) residual withdrawals (to compare with defined benefit payout) based on immediateannuities.com.

You can see the results of this action in Table 1. The benefit amounts look really high because all the figures are in estimated dollars, not inflation-adjusted. What we are interested in is the difference between defined benefit and 401(k) rates. The bottom line is that a 401(k) always goes beyond a defined benefit plan. And the difference is greater at higher salaries, which is not surprising given that the defined benefit is a lower rate per year of service (although it has a rate related to the employee’s final salary) while 401(k) contributions are based on earnings.

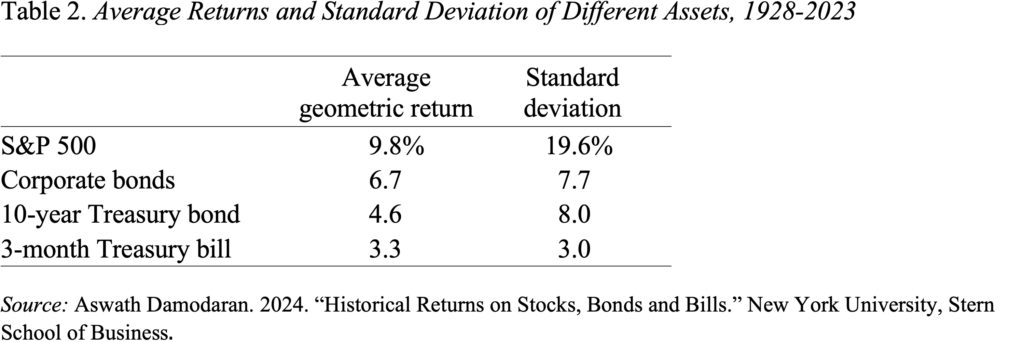

But what’s more interesting to me is that even with a 4 percent return — below the historical average return on the 10-year Treasury (see Table 2) — the 401(k) plan does slightly better at the lower income level. That means a risk-averse individual can invest only his 401(k) assets in the Treasury and get out ahead of Boeing’s defined benefit plan.

Of course, this simple exercise comes with many caveats – employees may not choose to contribute the full 8% to a 401(k), wages may grow slowly, etc. But the results make it difficult to understand the workers’ unwavering commitment. in defined benefit plans.

Source link