1 growing stock that I think could hit the FTSE 100 by 2025!

Image source: Getty Images

Which stocks might be good to join FTSE 100 In the New Year? From the FTSE 250 there are several serious competitors, including Alliance Witan, This is St James’s area, Polar Capital Technology Trust Company, again Investec.

These are among the largest FTSE 250 companies by market capitalization. However, my top pick to enter Footsie next year was – until last week – outside of this team.

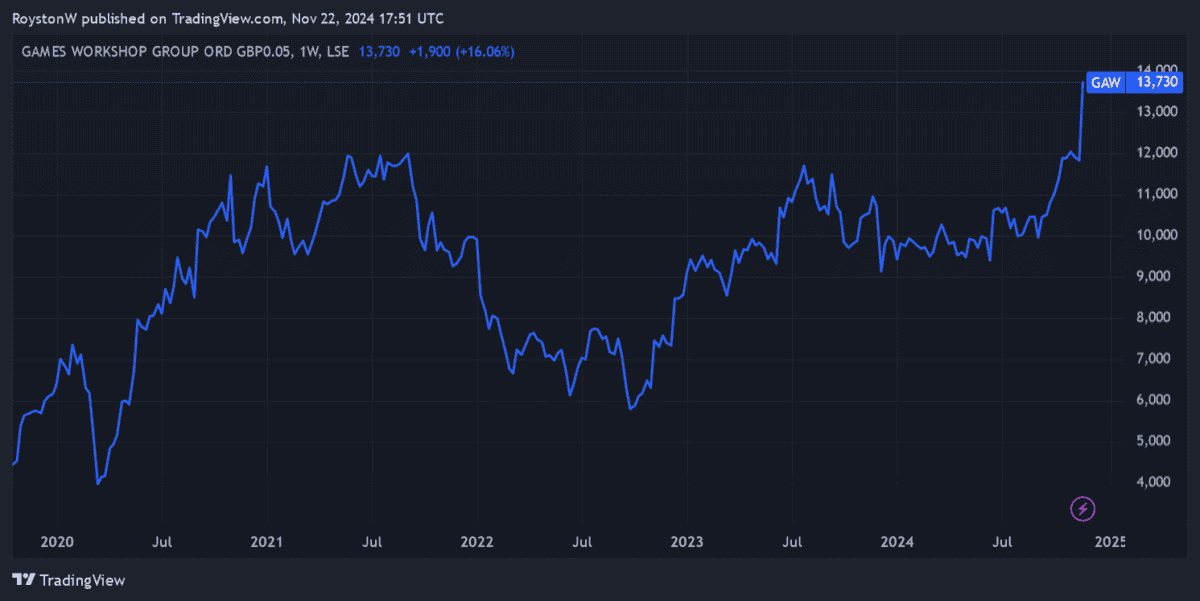

With a market cap of over £4.5bn, Games Workshop (LSE:GAW) last week pushed itself up to become the third most valuable stock in the FTSE 250. I’m sure it’s only a matter of time before it’s listed alongside the big boys of the FTSE.

The king of the market

This may surprise some. After all, its products are quite rare.

Games Workshop designs, manufactures, and sells – through its own stores and websites, as well as through third-party vendors – virtual reality war systems and their accompanying miniatures.

It also sells accessories and craft supplies that bring their products (and related story) to life, such as paints, glue, brushes, books, dice, and scenery. And it sells itself to a large market: in the first half of 2024, its revenue margin was 69.4%.

But why is the company so important? One of the reasons is that global interest in tabletop games is growing. The second is, by using fantasy universes like Warhammer 40,000Games Workshop is the best at what it does, hence those huge margins.

Predictions have been made

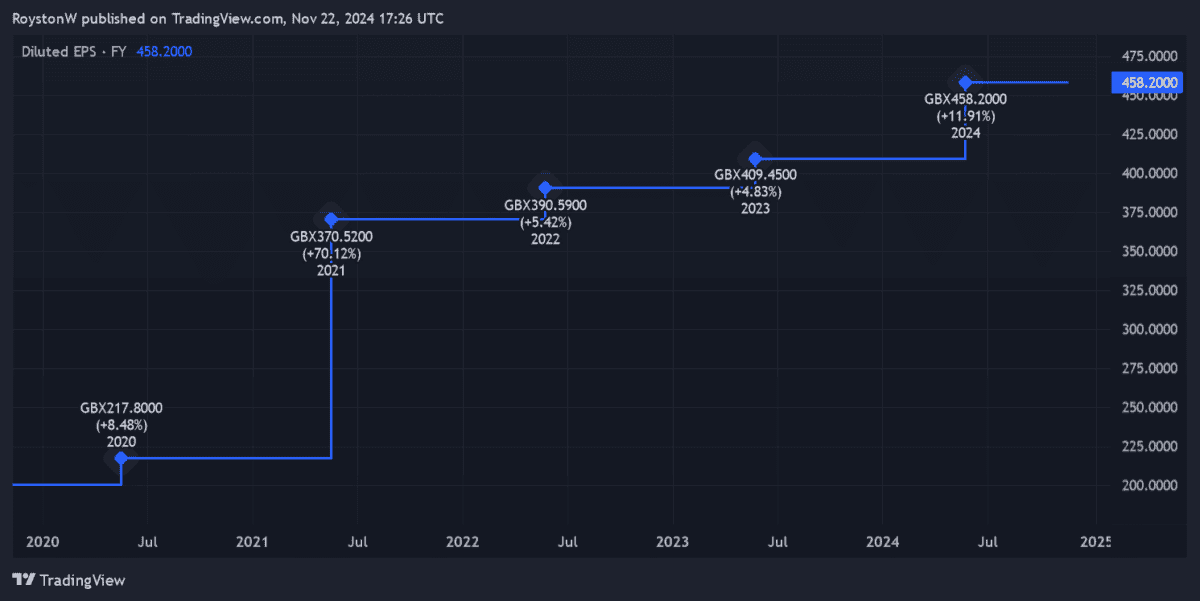

As you can see, Games Workshop’s revenue has increased significantly in the last five years alone. They grew significantly during the Covid-19 lockdown when leisure-related spending exploded. And they’ve been growing ever since.

If recent earnings are any guide, earnings growth is picking up again. On Friday, November 22, the company announced that it expects more revenue “not less than” £260m in the six months to 1 December.

That was up from £235.6m a year earlier.

Meanwhile, pre-tax profit was said to be at least £120m, up from £96.1m previously.

Both sales and profits for the period exceeded Games Workshop’s previous forecasts. Its share price jumped 17.3% as a result, recording a high closing of £137.30.

Go up

Past performance is not a reliable indicator of future performance. But I’m sure that Games Workshop – whose share price has risen 141.9% over the past five years – can continue its upward trend.

Global interest in fantasy games continues to heat up. And the business is opening new stores, establishing new distribution centers, and increasing production to meet this demand. It now has 548 stores in 23 countries.

It is also increasing licenses to media companies for its intellectual property, and is currently talking to Amazon to do Warhammer 40k movies and shows. These types of deals can be very profitable on their own, not to mention selling off a lot of money from the company’s core business.

Shares of Games Workshop now trade at a forward price-to-earnings (P/E) ratio of 27.7. A high reading like this may cause a correction in the share price if the flow of news related to the company turns negative.

However, I think the company deserves a premium valuation like this. I already hold its shares in my portfolio, and plan to buy more when I have the money to invest.

Source link