Should I buy more Ferrari shares in my SIPP?

Image source: Getty Images

Unfortunately, I didn’t have €400,000 lying around until recently Ferrari (NYSE: RACE). That’s the average selling price (ASP) for new these days. But I was able to use enough money to buy a few shares in an Italian car company a while back to get my Personal Investment Pension (SIPP).

The stock has done very well, up 90% in just the last two years. This comes as a surprise when some luxury stocks are being hammered by weak Chinese sales.

Should I add to this winning stock today? Let’s take the bonnet off and take a look.

A rare animal

At first glance, Ferrari may look like just another sports car manufacturer. However, I think it is more accurate to view the Racehorse as the world’s leading luxury brand.

In Q3, the company sold only 3,383 vehicles. But it could triple that amount in a heartbeat if it chose to do so. After all, the cars are built to order for one of the most expensive clients, and the order book goes in for 2026.

The reason it doesn’t sell well is because Ferrari needs to maintain an aura of exclusivity. CEO Benedetto Vigna says seeing a Ferrari on the road should be like meeting an exotic animal.

Unfortunately, even if I had €400,000, I probably wouldn’t be able to buy a new Ferrari. There is a large waiting list of potential customers, and 74% of cars made last year were sold to existing customers.

Ferrari will always deliver one car under market demand.

Enzo Ferrari

Serious pricing power

This scarcity gives the company incredible pricing power. As mentioned, the ASP is now close to €400,000, up from €270,000 in 2015. Some special models exceed $1m.

The company also benefits from customers who pay enthusiastically to increase the prices of personal items for cars (very high income).

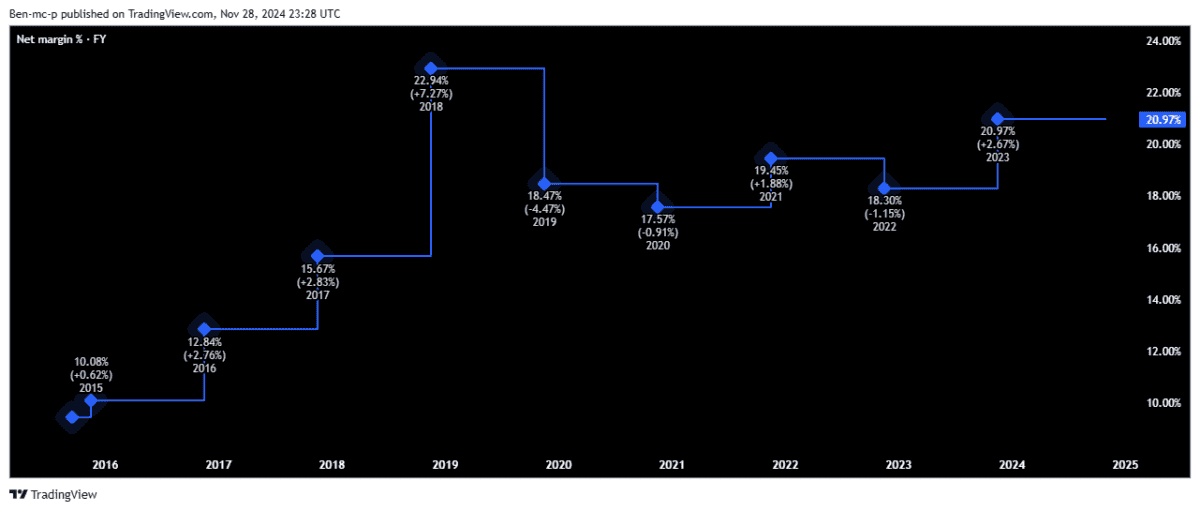

As we can see below, Ferrari’s margins have more than doubled over the past decade, from 10% in 2015 to an astounding 21% today.

Most auto firms are high-volume, low-cost manufacturers. Ferrari has flipped that on its head, with much higher margins at lower volumes.

Brand image risk

Some investors still question the case for investing in this stock. After all, if a company restricts supply to maintain high demand, where will growth come from in the long run?

It’s a valid question, and Ferrari’s continued success is linked to its growing population of billionaires and billionaires. Current trends show that this number of wealthy (and ambitious) people is growing, especially in Asia.

This should enable Ferrari to gradually increase its annual production capacity while maintaining product uniqueness. It also continues on the water by introducing a sailing racing team and building a racing yacht.

However the brand image is everything here. If that were to diminish in any way, the company’s reputation and pricing power would be threatened.

Will I buy more shares?

I was expecting a nice pullback in the stock price for the whole year. There has been a little – 13% since August – but not enough for me. The stock still trades at a high price-to-earnings (P/E) ratio of 47.

That’s actually more than a luxury peer Hermès (43).

Therefore, I will continue to wait patiently for my opportunity to buy more shares.

Source link