2 great (but very different) stocks I want to buy when they go cheap in 2025!

Image source: Getty Images

Is investing all about timing? It is not only about time of course, but time can be very important. A common stock can be a brilliant performer or a perfect investment dog, depending on when you buy or sell it. So when I’m looking for stocks to buy, I look at how attractive the business is – but also when I’d be happy to invest.

Here are two stocks on my watch list that I think are excellent businesses. I would be happy to buy shares next year if their price falls to what I consider to be an attractive level.

Dunelm

At face level, Dunelm (LSE: DNLM) may not even look expensive. After all, its price-to-earnings ratio is 14 lower than other stocks I’ve bought this year, such as Diageo.

However, I have been burned to own dealer stocks before (like my share in boohoo).

Marketing is often a low-margin business, so earnings can drop dramatically for seemingly trivial reasons. Last year, for example, Diageo’s after-tax profit margin was 19%. Dunelm was less than half that, at 9%.

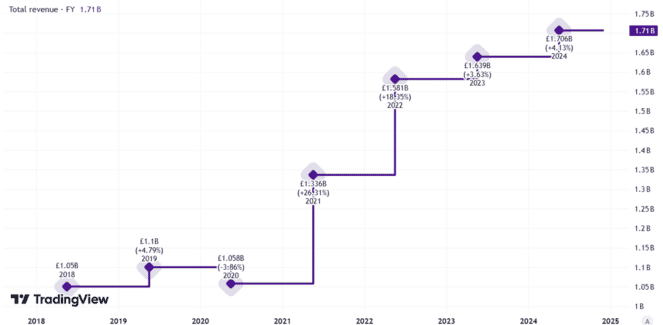

Dunelm’s business is well run, has a large store area, and is growing in digital numbers and thanks to many unique product lines it can differentiate itself from competitors. Sales have grown significantly in recent years.

Created using TradingVew

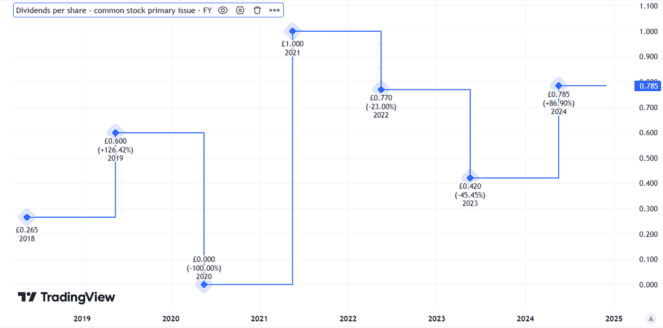

Dunelm is a strong dividend payer as well. It pays a dividend yield of 4.1%.

But the company often paid special dividends, which meant that the total yield was usually higher than the average yield alone.

Created using TradingVew

However, Dunelm’s share price has increased by 57% since September 2022.

That seems steep to me as sales growth in the most recently reported quarter was 3.5% – perfectly respectable in my opinion, but not spectacular.

A weak economy and increasingly stretched domestic budgets could eat into sales and profits in 2025, I think. If that happens and the share price drops enough, my current plan would be to buy some Dunelm shares in my portfolio.

Nvidia

I think it’s easy to watch Nvidia (NASDAQ: NVDA) price chart and immediately think “bubble!“

Indeed, a P/E ratio of 53 provides little or no margin of safety against risks such as a pullback in AI adoption once the first round of massive investment that is currently under way begins. That helps explain why I haven’t bought stocks this year.

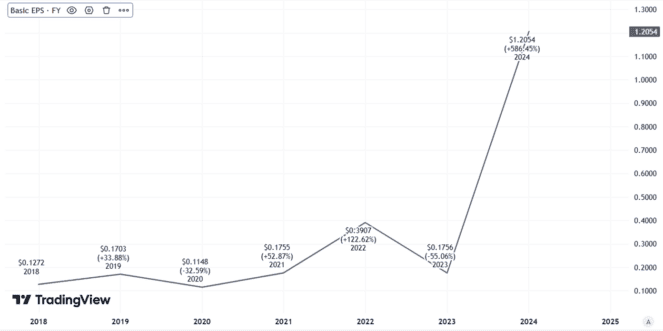

Still, that P/E ratio is over Nvidia stock up 2,175% in the last five years alone. The price has increased, but so have the income.

Created using TradingVew

Nvidia is not a meme stock without a long-term future. It is a highly profitable, successful company with a proven business model.

Its moat of competition is also huge in my opinion – competitors can’t make as many chips as Nvidia makes even if they wanted to.

Valuation alone is why I haven’t bought Nvidia stock this year. A share I would be happy to buy (in spades) in 2025 if the price looked more reasonable to me.

Source link