Can these UK stocks help investors beat the FTSE 100 and S&P 500?

Image source: Getty Images

Compared to overseas equities, UK equity returns have fallen significantly over the past decade. The combination of low economic growth and political unrest has limited share price gains as investors prioritize buying foreign stocks.

However there has been a remarkable performance from some British stocks during this period. Take these two FTSE 100 blue-chips, for example:

| Stock | Average annual return since 2014 |

|---|---|

| JD Sports (LSE: JD.) | 17.5% |

| Scottish Mortgage Investment Trust (LSE:SMT) | 14.9% |

To put their strong performance in context, the annual gains of the FTSE 100 and S&P 500 at the same time stay behind, at 6.1% and 12.7%, respectively.

I hope they can continue to excel these heavyweight references in the next decade as well. Here is the reason.

Technology trust

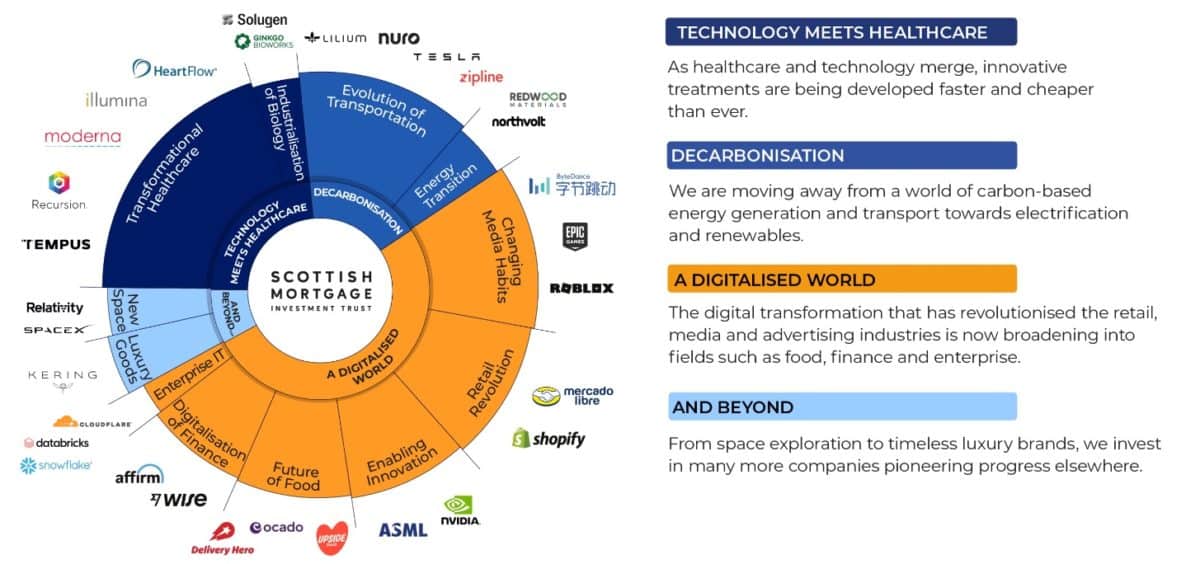

Growing demand for technology stocks has underpinned the S&P’s strong gains of the past decade. So it’s not hard to see why the Scottish Mortgage Investment Trust – which provides targeted exposure to internet retailers, software developers and the like – has delivered high returns.

To hold like Amazon, Tesla again an apple means that trust has grown significantly in hot trends such as the growth of e-commerce, the adoption of the electric vehicle (EV) and the growing sales of smartphones. Today it owns shares in 95 different companies, giving you exposure to many of the white hot growth stocks over the next decade.

All this being said, the risks of having a Scottish Mortgage are increasing. I worry that the escalating technology trade war between the US and China could dampen annual returns over the next 10 years.

In December, the US imposed new restrictions on advanced shipments of microchips to China. Within days, Beijing said it was investigating Nvidia on grounds of violating local anti-violence laws.

These tit-for-tat actions could escalate even more if tariff supporters and China critic Donald Trump returns to the White House this month. But despite this, there is a good chance in my view that Scottish Mortgage will deliver another decade of market-beating returns.

Global digitalisation is poised to continue at a rapid pace, providing confidence with greater potential for profitability. Fields like artificial intelligence (AI) and robotics in particular have a lot of room for growth.

Sports star

JD Sports had a poor 2024 as inflationary pressures and high interest rates dampened consumer spending. These remain risks across the sporting goods retailer’s markets in the US, UK and Europe in the New Year and beyond.

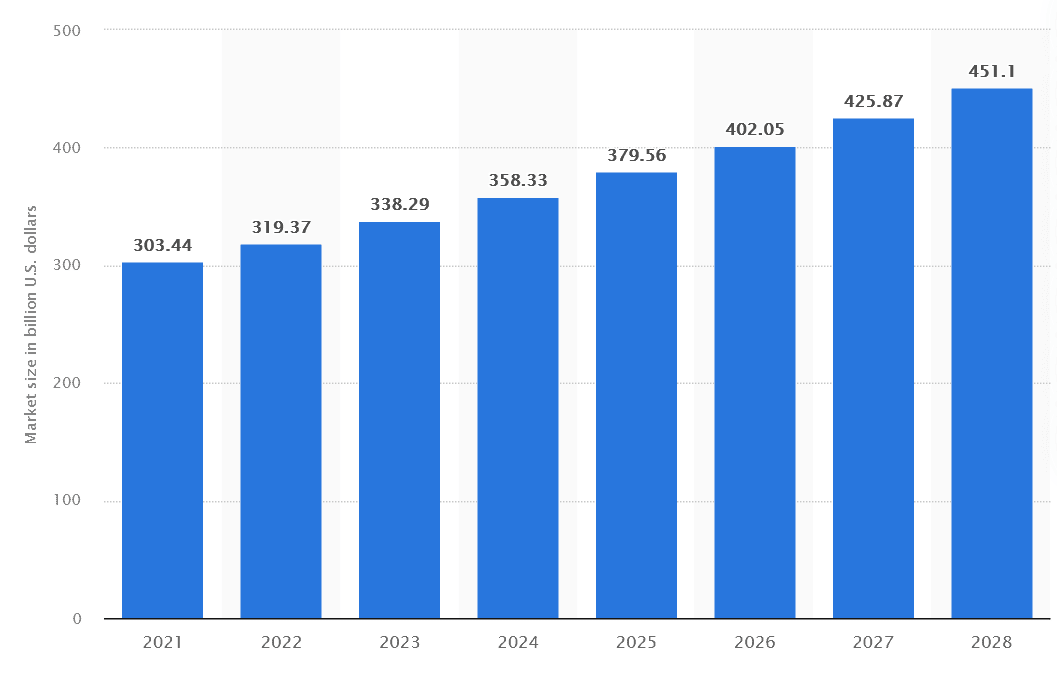

But like Scottish Mortgage, I think the potential long-term rewards here make it worth considering. The global market for active (or athletic) clothing is said to continue to take off, as the chart from Statista below shows.

As we have seen over the past decade, JD should be well positioned to capitalize on this opportunity. Under its long-term expansion plan, it plans to open between 250 and 350 stores each year until 2028.

A strong balance sheet also gives the Footsie firm scope to make acquisitions to improve capital. Its latest acquisition was France’s Courir, whose disposal in December boosted JD’s presence in Europe’s largest sneaker market.

I also like JD’s leading position in the premium athleisure market where growth is very strong. Given its low price-to-earnings (P/E) ratio of 7.5 times, I think we have significant room for share price recovery.

Source link