Do Stock Holdings Reflect Individual Risk Preferences or Growth in Daily Funding Targets? – Center for Retirement Research

I suspected that most financial assets were in 401(k) plans and most 401(k)s were directed by target date funds, but the data told a somewhat different story.

While trying to figure out people’s risk appetite by looking at the allocation of stocks in their financial portfolios, I was wondering in the world of 401(k)s about the extent to which this entire allocation would be determined by the target date pattern. funds. Obviously, my presumption was that, for all but the very wealthy, most household financial assets were in 401(k)s and that most 401(k) assets were in target date funds. It’s always useful, however, to look at a little data. It turns out that my situation is not where it is now, but it can explain where it is headed.

This idea wasn’t crazy because the 2020s represent the first time that employees could use their entire career covered by a 401(k) plan. Indeed, only about 16 percent of households approaching retirement in 2022 rely heavily on a defined benefit plan (see Figure 1). That shift suggests that most retirement savings may now be in 401(k)s or Individual Retirement Accounts (IRAs).

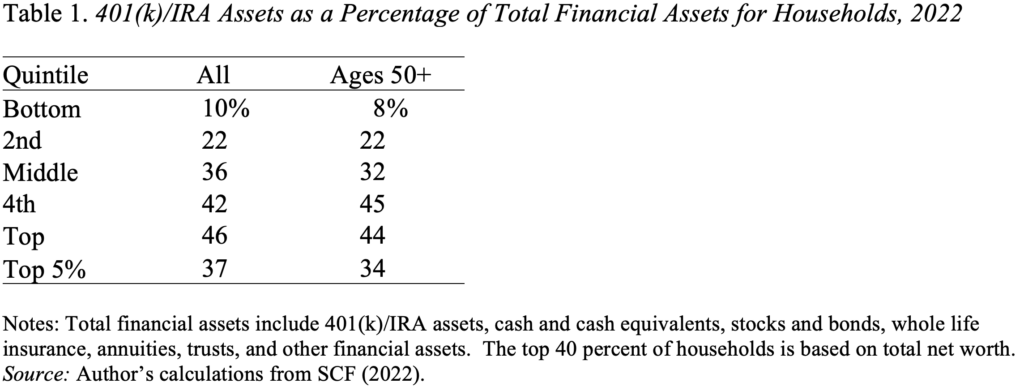

So, the question is what share of financial assets is the 401(k)/IRA balance? Those 2022 percentages by quintile of net worth show that in the top two tiers — the top 40 percent, which hold the majority of 401(k) assets — retirement assets make up about 45 percent of total financial assets (see Table 1). . The richest 5 percent reduce the percentage of the top quintile overall because they hold more in non-retirement assets. However, the percentage is much smaller than I thought.

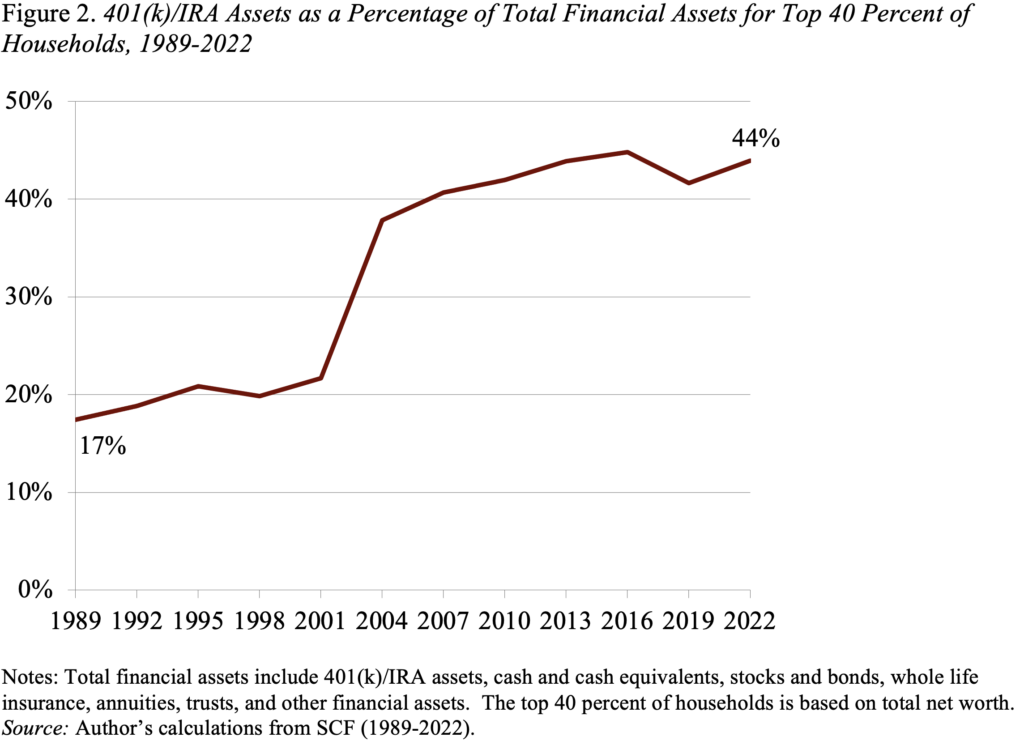

If the situation was not exactly what I imagined, is it at least trending in that direction? Indeed, the percentage has increased significantly over time, although it is unclear where it goes from here (see Figure 2).

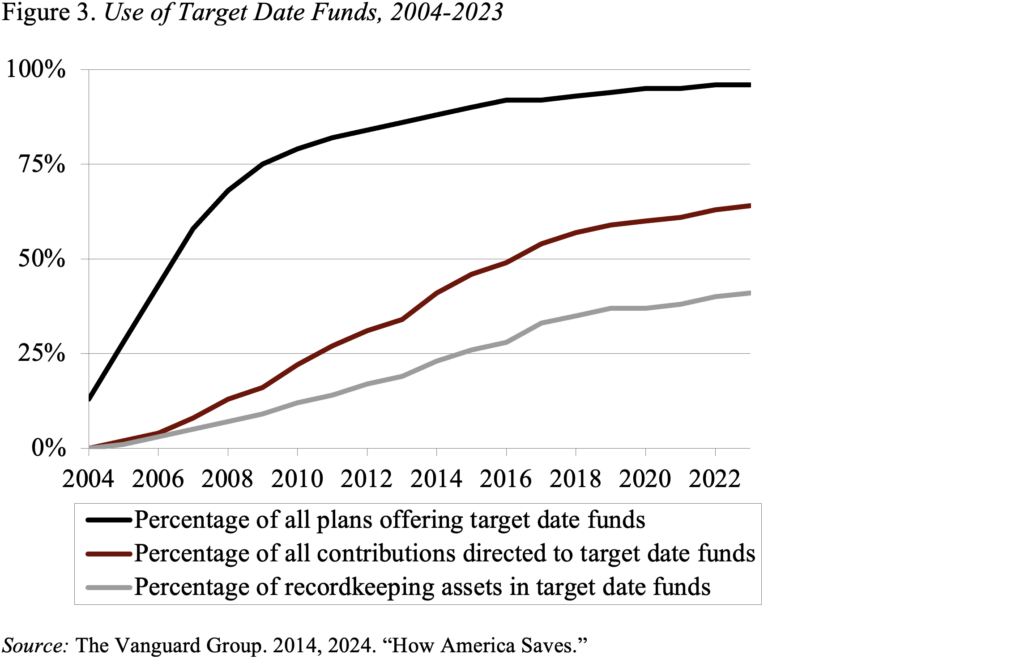

It seems I was also a bit ahead of the curve on the role of target date funds (TDFs) — funds that automatically reduce equity holdings as participants age — among 401(k)s. It’s not surprising given that the biggest change came when the Pension Protection Act of 2006 allowed plan sponsors to automatically enroll employees using TDFs as default investments. Since then, the percentage of programs offered, the percentage of targeted donations, and the percentage of assets in TDFs have all increased rapidly (see Figure 3).

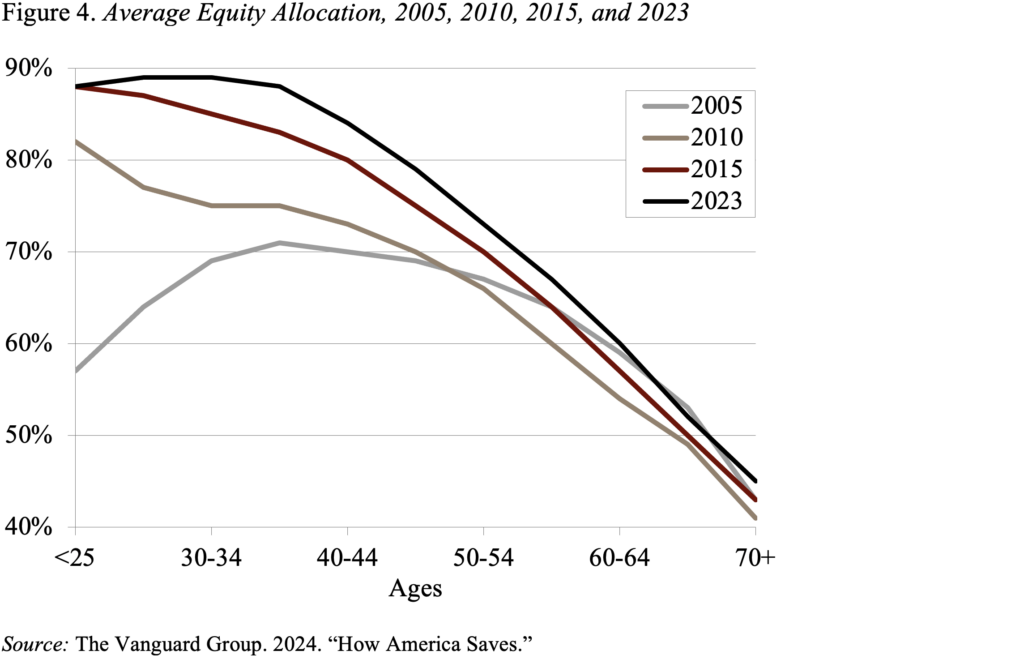

Investments in TDFs have changed the asset allocation profile and increased allocations to stocks (see Figure 4). In 2005, the stock distribution was hump-shaped; Younger participants were less likely to hold, middle-aged participants held more evenly and older participants reduced their holding more. In 2023, the equity share of participants decreases with age, starting at 88 percent for younger workers, dropping to 73 percent for those aged 50-54 and to 45 percent for those aged 70+. Not only is the pattern quite different, but the 401(k)’s share of equity assets has risen significantly.

So, the story was not as clear as I thought. For those in the top 40 percent of the wealth distribution, retirement assets are only about 45 percent of total assets and the percentage appears to be stable. Among 401(k) plans, the importance of the target date has been growing over time and may become even more important in the future. On the other hand, people often move their assets outside of 401(k) plans into an IRA and can change their allocations. So, I think people use more discretion in their holdings of equity than I thought.

Source link