2 Unreasonable Growth Shares to Consider in 2025!

Image source: Getty Images

Looking for the best growth stocks to buy in the new year? Here are two of my favorites.

I put my money where my mouth is and bought my own portfolio.

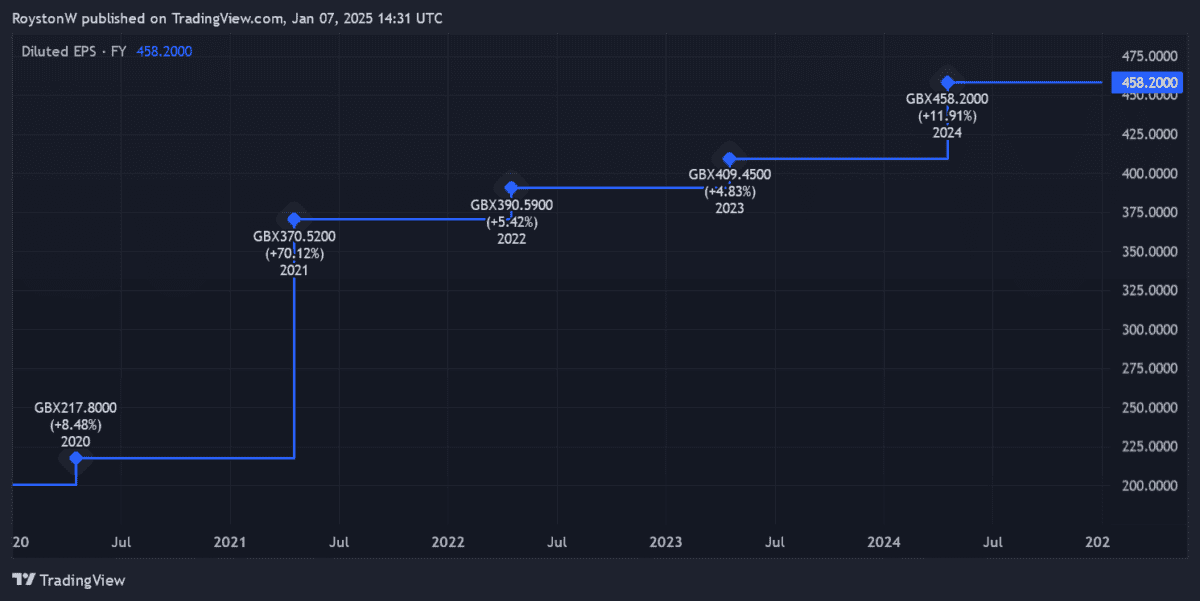

Games Workshop

Last year was a milestone for the tabletop gaming giant Games Workshop (LSE:GAW) as it enters the FTSE 100 first of all.

Salary here has grown steadily and rapidly in recent years, as the chart below shows. Tabletop wargaming is not everyone’s cup of tea. But it’s growing rapidly as global interest in fantasy grows, and board games in general are enjoying a renaissance.

By using it Warhammer product line, Games Workshop is at the forefront of this booming industry. It also aims to break into the mainstream by presenting film and TV content with Amazon in the next few years.

It’s a move that could heavily tax sales of its traditional gaming systems again create large amounts of self-earned capital.

Profits look set to keep rising for now, as new products hit the shelves and the company expands its global footprint. A trading update in late November underlined its continued trajectory, forecasting pre-tax profits of at least £120m in the six months to 1 December, up 25% year-on-year.

This supports the City’s forecasts that annual revenue will grow by 7% this financial year (until May 2025). Salary is expected to increase by another 5% next year.

Games Workshop’s strong outlook is reflected by its high price-to-earnings (P/E) ratio of 27.2 times. While I think the company deserves this premium valuation, it does mean that its shares could fall if any setbacks occur.

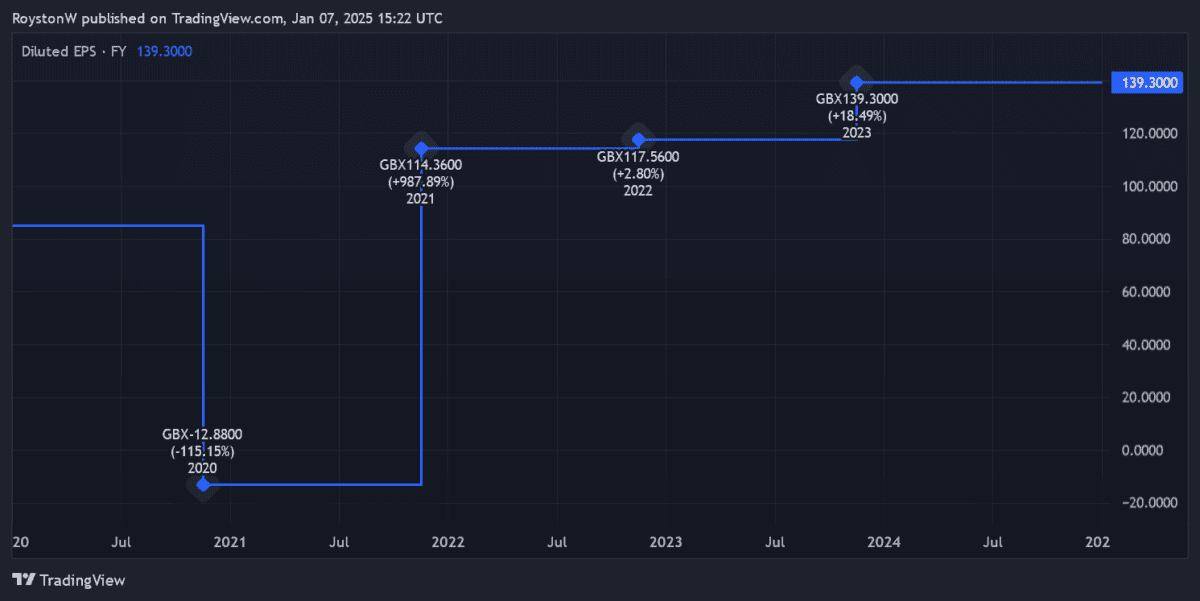

Greggs

Apart from the epidemic, Greggs (LSE:GRG) has also enjoyed impressive earnings growth in recent years. This is due to an expansion strategy that has driven sales nearly three quarters higher since 2019.

By 2024, City analysts think FTSE 250 the company’s earnings increased by 8% year-on-year. They predict further meat growth – of 7% and 8% – in 2025 and 2026.

This is perhaps not surprising given Gregs commitment to continue to grow store space from its current levels of around 2,560. It plans to have between 140 and 160 new stores by 2024 alone, and plans to have 3,500 company-owned and operated stores in the next few years.

Competition in the food-on-the-go market is intense and still a threat. But Greggs’ recipe for offering manufactured favorites (such as sausage rolls and donuts) at attractive prices helps it navigate this risk successfully. The latest figures show sales of 12.7% between 1 January and 28 September.

The baker is also successfully integrating his services to meet the needs of modern consumers. Recent moves include introducing a click and collect service, better retail locations, and extending opening hours into the evening.

Today Greggs trades at a forward P/E ratio of 20.8 times. Although the stock is cheap, I don’t think this will hurt its chances of printing more impressive gains following last year’s healthy rise.

Source link