Better goal setting with S-curves

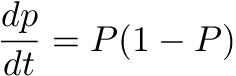

Another popular psychological strategy is to set small goals or start small. This strategy often fails due to lack of meaningful progress despite having achieved several small goals . There is a good reason for this.The curve or logistic function is a useful model to understand why this strategy rarely produces the intended results

s-curve

DW was kind enough to arrange this sigmoid for me. Imagine, that you are sitting in the lower left with a certain aspect of your life.At the bottom left is the state of the budget crisis lack of morals, incompetence in society, unfruitfulness in work, lack of education, and other things that lead you badly. The main goal is to land on the top right.High privilege is a condition of wealth

being in high shape, being famous, being overly productive, knowing everything, etc. Pick one and call it P. If this is too algebraic for you (it is for others!), just think “Production” instead of “P”.It will work if a lot of patience is given, but often this patience is difficult to achieve.

Productivity increases correspond to current production (lowest left) and to the potential for additional production (current highest)

Here is the number of criminals logistic functionWhat it means, is that since there are fewer resources, the capacity to change will be proportional to the resources. This is similar to compound interest.Compound interest by itself has not made anyone rich. Invest $1 at 8% and wait 30 years and get $10. This is nothing. But invest $100,000 at 8% for 30 years and get $1,000,000. That’s real money. Therefore, in order to go anywhere it is very important to build resources as quickly as possible. Setting small goals in this situation is a surefire way to not see results too quickly. On the other hand putting in a lot of effort is a guaranteed way to see quick and incremental gains.

Once the foundation is built, motivation should come naturally . In the middle of the curve there is a linear relationship between effort and results. Work harder and get more results. Work less and get less results. In other words, this is the stage where extra effort is rewarded more than in the beginning. It’s best to get to this stage as soon as possible, because starting too slowly makes people quit more often than not.

With more effort, the production ceiling starts to come in due to limitations of resources, customers, commitments, market size, etc. You may have found yourself with a description of a job that could be done in 3 hours even though you were supposed to work 8. If so you know what I mean about reaching the productivity limit. . In such a situation it makes no sense to increase the work effort by 25% if the profit increases by 5%. In such a situation it is better to start more projects or look for more responsibility.So there is.

Almost all ties run like an S-curve from bottom left to top right

. It is important to embed this curve in your thinking because it combines the concepts of compound growth and the law of diminishing returns. Understanding this curve reveals that on average just setting small goals to get started won’t accomplish much. Chances are there will be a few weeks of wholehearted effort and the project will be abandoned because it didn’t seem to make any difference. Instead put in a lot of effort in the beginning and keep going until the returns are straight (in the middle). Continue as soon as you see the line grow. If this growth starts to decrease it is time to set different goals (not big ones) rather than keep running for the smallest gains.

Copyright © 2007-2023 earlyretirementextreme.com

This feed is for personal, non-commercial use only.

Use of this feed on other websites violates copyright. If you see this notice somewhere other than your news reader, it makes the page you are viewing a copyright violation. Some sites use random name changing algorithms to hide the origin. Find the original, unadulterated version of this post at earlyretirementextreme.com. (Digital fingerprint: 47d7050e5790442c7fa8cab55461e9ce)First posted 2008-01-25 07:11:01.

Source link