Cap-weighted vs. Equal-weight ETFs: Which one is right for Canadian investors?

The CAPE Ratio evaluates a stock’s price compared to its average earnings over the past 10 years, adjusted for inflation. A high CAPE Ratio suggests that stocks may be overvalued compared to historical earnings, indicating potential risk.

The picture is not as clear as it seems, however. One of the main problems of proportional measurement, as critics say, is the additional drag on performance in its own way.

Take the Invesco S&P 500 Equal Weight ETF (RSP) for example. It has a profit margin of 21% and an expense ratio of 0.20%. The Canadian-listed version is the Invesco S&P 500 Equal Weight Index ETF (EQL, EQL.F). In contrast, SPY maintains a yield of only 2% and a low expense ratio of 0.0945%.

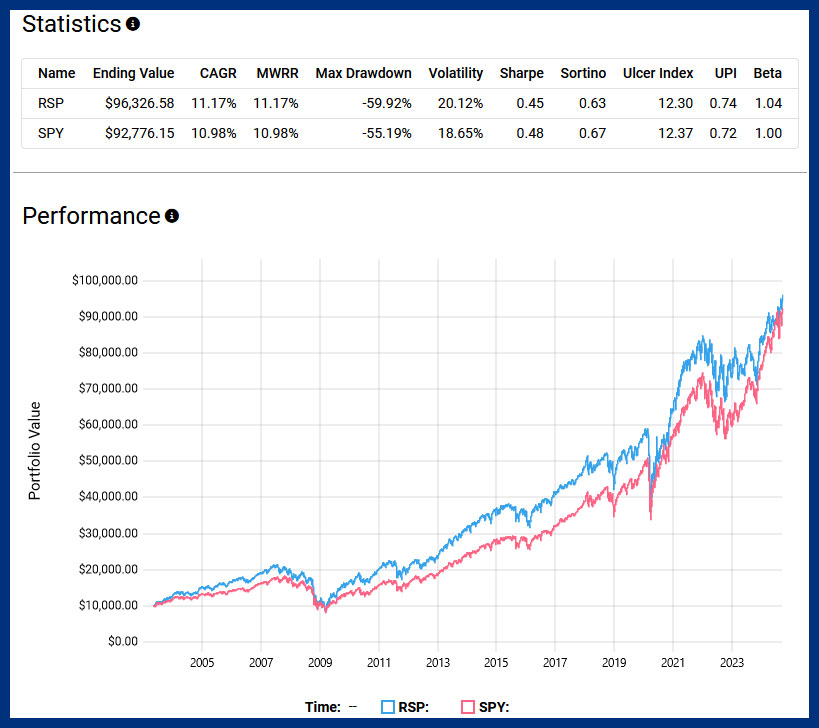

While it is true that RSP has outperformed SPY in terms of total return since its inception in April 2003, the victory is not as clear cut as it may seem. RSP’s risk-adjusted return, indicated by a Sharpe ratio of 0.45, is slightly lower than SPY’s 0.48. What does that mean? It may suggest that the RSP takes higher volatility for only marginally better returns. In addition, the RSP experienced a much deeper drawdown than the SPY. A high drawdown measures one of the largest declines from high to high over a period of time, indicating a historically high risk of loss for investors.

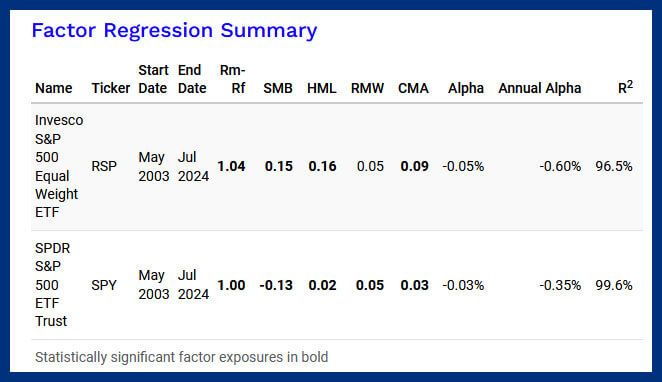

Further factor regression analysis reveals that the outperformance of RSP can be attributed to size. In essence, the RSP’s equally weighted methodology has inadvertently skewed its exposure to smaller and less well-respected companies, which have historically contributed to outperformance.

This raises an important point: If the goal is to invest in these types of companies, wouldn’t it be more direct and efficient to target them directly based on fundamental metrics instead of adopting a sleeper approach of equal weighting across the entire S&P 500?

I find myself in favor of cap weighting now. The main appeal is simplicity. Market margin strategies require fewer decisions about rebalancing or rebalancing, which in turn keeps sources of friction like profits and fees down—resulting in slower performance.

In an ideal conflict-free world, the appeal of egalitarianism is clear. However, the reality of quarterly rebalancing and the higher fees associated with equal-weight ETFs have not delivered better risk-adjusted returns over the past two decades.

Source link