Do elderly adults understand the risk of health care? – Resources Center for Retirement

The wrong medicines for long and cost-effective medicines are caused by anxiety.

Homes approaching and retirement faces a variety of risks in their financial security. They can live longer than plan and reduce their resources; They can get a sudden inflation suddenly; or they can get abnormal return to their plants. Similarly is the danger that households that meet the big cost to cover long-term care costs. My colleagues and I have just completed a study based on the new survey to find out how older adults understand the risk they face.

Focusing on our concerns especially expenses associated with long-term care. It is true, the medical risk is very definitely expensive, but most of these risks is motivated by the Medicare (and Medicaid to those ready for both programs).

Dangers of long care, separately, have no insurance. Only 3 percent of US adults or 15% of these 65+ percent of the Medicaid Insurance, a public insurance system.

However, 80 percent of the ages of 65 years of age will need a long care at a particular time over their health balance (see Table 1). And while the extent of the extent of these long care needs varies greatly, about 40 percent will require more than a year.

Given broadcasts and lack of insurance, family members often cover most of the care hours of careers with low demands and cannot be paid care as the requirements increase. LTC was paid, however, mostly expensive – 2023, the annual costs were $ 116,800 in the private household, $ 74,500 to assist.

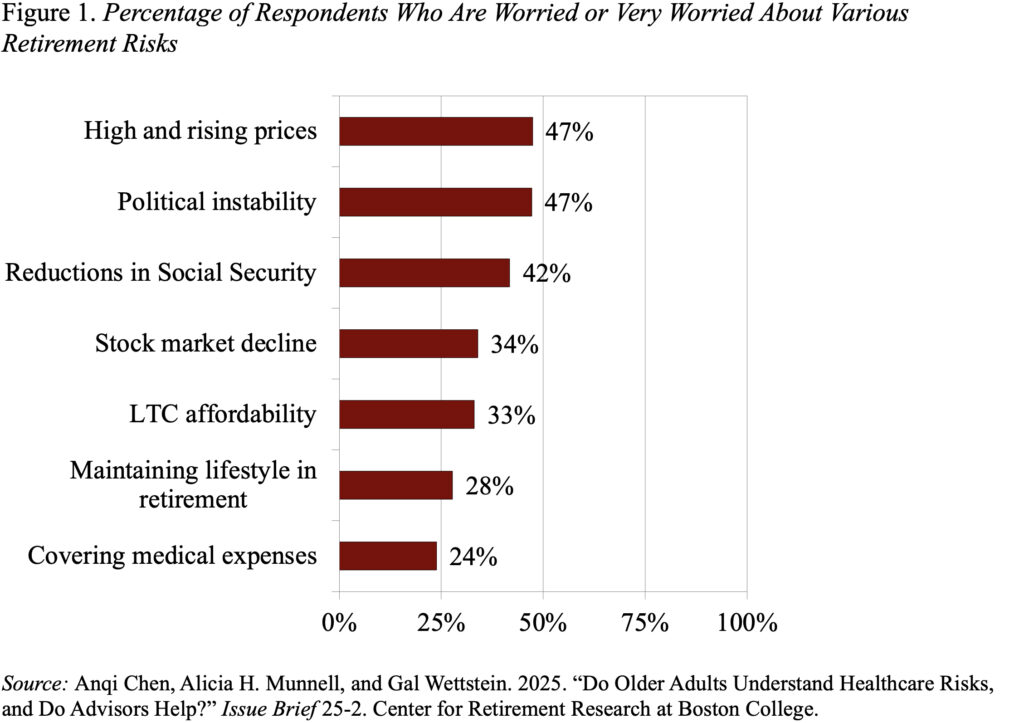

Viewing Home Views About Health Care Accountability, Greenwald Care of the 2018-78 Internet Survey of 100 $ 100,000 Care of Long-Time List (See Figure 1) – Finding Finding and Other Studies.

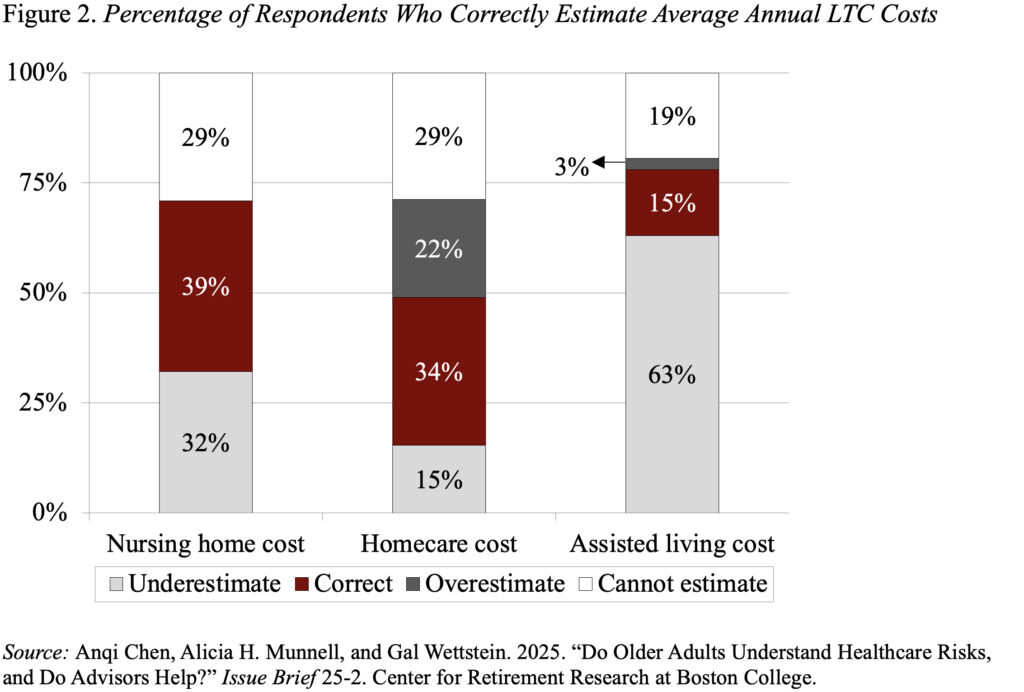

In addition, only 39% in old families can measure the cost of the elderly home, 34 percent of domestic care services, and only 15 percent of living areas (see Figure 2).

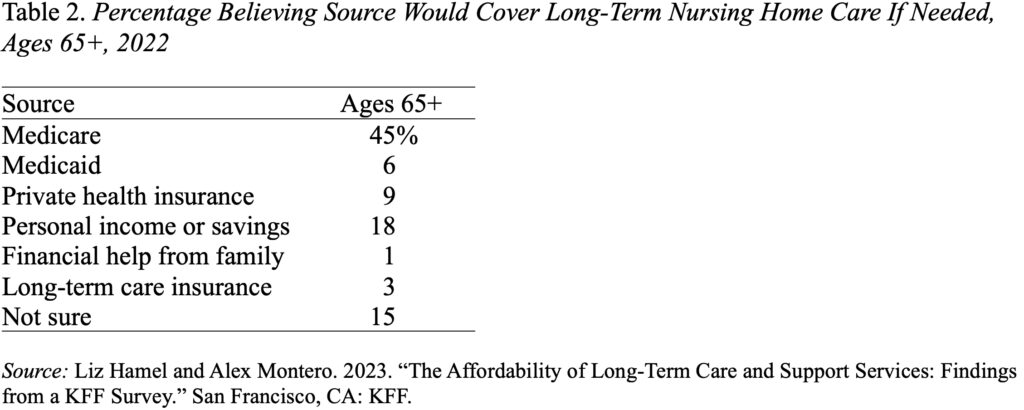

The first reason is that such great ideas and long-term monitoring costs is a test after the study after receiving the survey that the Medicare believes the Medicare includes LTC. The most recent example from KKF shows that 45 percent of the respondents 65 + think Medicare will pay for their LTC and 9 percent think their cost will be covered by private health insurance.

Health care risks – especially the risks of long-term care needs – they have actual expenses. Homes are not tax deductions for long-term care or adventurer in advance for such an event. Instead, they have been left alone with insufficient resources and complex, complex, and challenging.

Source link