Does 10% pay dividends? There could be great potential here for a secondary income

Image source: Getty Images

The consistent returns and growth potential that equities offer make them very attractive for secondary income. Whether they’re supplementing income or building a retirement fund, they’re a key part of many investment portfolios.

Whenever the conversation turns to income ideas in the UK, the word dividends is usually not far away. They are very popular right now as prices drop and yields increase. This means that FTSE 100 it is full of profitable opportunities.

One of my top income earners is Phoenix Group (LSE: PHNX), which comprises about 25% of my dividend yield this quarter.

Here, I will explain why I think it is currently one of the best stocks to consider for a secondary income.

Fixed requirement

Operating in the life insurance and annuity sector, Phoenix is likely to deliver fixed income for the indefinite future. Its business model focuses on managing life funds and closed pension books, which creates a predictable income stream that supports dividends.

Founded in 1857 as The Pearl Loan Company, the group is now the parent company of major British insurance companies Standard Life, SunLife, ReAssure and Ark Life. Employing 8,165 staff, it serves clients across the UK, Ireland and Germany.

Commitment to shareholders

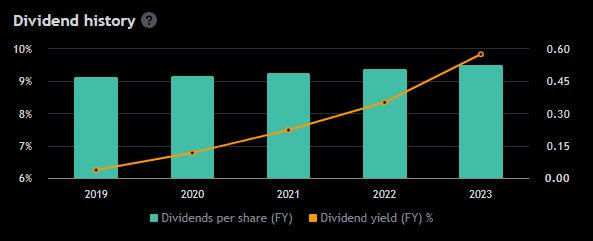

Phoenix prioritizes returning cash to shareholders through dividends. It has been increasing its annual dividend for almost a decade, rising from 40.52p per share in 2015 to 52.65p today. Growing at an average rate of around 3% per year, it is likely to exceed 54p by 2025.

Recently, the decline in the share price has pushed the yield up to 10%, making it very attractive. Not that it was always low. Over the past 10 years, it is up between 6% and 9%, above the FTSE 100 average of 3.5%.

Risks to consider

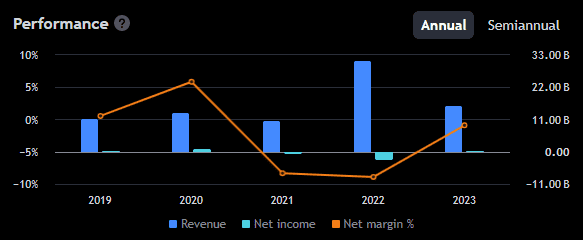

The economic slowdown following the pandemic has suppressed growth and the group has not been able to make a profit in 2021 and 2022. This has contributed to a 32% drop in share prices over the past five years and spurred efforts to develop new avenues for growth.

The group then raised more debt in its acquisition-led growth drive. At the moment, the debt looks manageable but if it worsens, it could reduce the cash we have for day-to-day operations.

An increase in the interest rate may cause a problem for the company, affecting both the payment of debts and the valuation of assets. It can also put a strain on the company’s profitability if prices drop too much. Considering the current uncertainty about where UK rates are headed, this is definitely a risk to watch out for.

A long-term vision

When planning an income investing strategy, it pays to think long term. A little patience can lead to noticeable gains down the road.

With the price of Phoenix now near its lowest level in 10 years, I expect bargain hunters to help spark the recovery in 2025.

In any case, I plan to keep drip-feeding money in stocks for years to come, with the goal of increasing my dividend income in retirement.

Source link