Does owning National Grid dividend stocks make sense for the risk-averse investor?

Image source: Getty Images

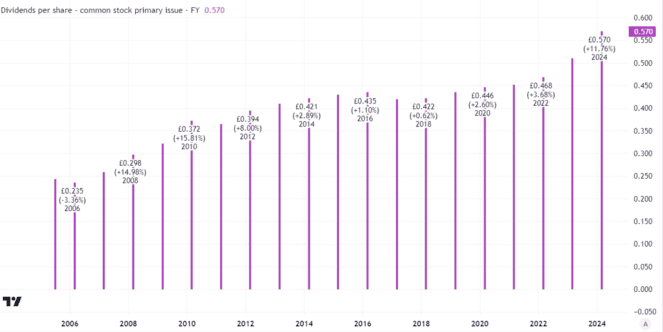

Different investors each have their own goals and risk tolerance. Many, especially as they get older, like stocks that are set to generate stable returns over time and offer a beefy dividend. National Grid (LSE: NG) initially seems to fit that bill. After all, the national power grid is difficult to replicate and benefit from long-term customer demand. National Grid shares yield 5.5% and have a strong track record of increasing their annual payout. Last year, the dividend per share grew by 6%.

Created using TradingView

I understand the appeal of that benefit. National Grid aims to increase its profits each year in line with the rate of inflation and has successfully achieved that in the last few years. That appeals to many investors – myself included – as it helps protect the real value of the payout.

The basis for success – and the challenge

However, maintaining dividend growth here is not as easy as it might seem at first. National Grid power is also a source of financial weakness, in my opinion.

If customer demand wasn’t as strong and robust as it is, we could be a cash cow, invest less in infrastructure and raise prices, generating more cash flow to fund the dividend.

But prices are controlled. Energy demand is set to remain high into the indefinite future, which means the National Grid needs to spend money to keep the lights on (so people can keep their lights on). Not only that, in recent years there has been a big change in where certain energy is produced and where it is needed.

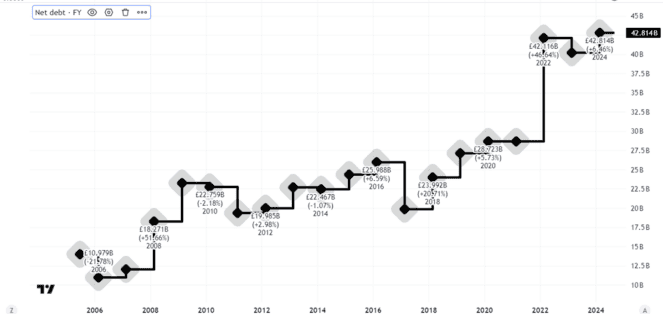

The bottom line is that the company, like similar firms in other markets, has to spend a lot of money to keep its network updated to meet current and potential needs. That led to a long-term increase in borrowing, as this chart of National Grid’s total debt shows.

Created using TradingView

Where things can go from here

That threatens the ability of this dividend stock to maintain let alone grow its dividend, in my view. The company raised around £7bn in a rights issue earlier this year, helping to strengthen the balance sheet, which I see as positive from a profitability perspective.

But it came at the cost of diluting existing shareholders. I see a similar risk in the future if National Grid’s capex costs remain stubbornly high.

Given that, I think the risk profile of National Grid shares is more than worth it.

I’m also skeptical about how long the company’s chunky dividend can be sustained without further fundraising or changes to the business model. At the moment, as a risk-averse investor, I have no plans to buy.

Source link