Earn up to £100 in points with Tesco Clubcard Challenges

The brand new Tesco Clubcard Challenge can win you up to £50 to spend at Tesco, doubling to £100 with partners.

£10 sign up bonus: Earn easy money by watching videos, playing games, and taking surveys.

Get a £10 sign up bonus when you join today.

Join Swagbucks here >>

There is a new way to earn Tesco points with their new “Clubcard Challenges”.

This new feature of the Tesco app uses AI to reward regular shopping tips with extra Clubcard points.

Over six weeks, you can complete up to 10 challenges and earn a total of £50 in Clubcard points to spend at Tesco, or £100 when spent with a Rewards Partner.

Let’s explain what this means for you and how you can get involved.

What Are the Challenges of the Tesco Clubcard?

From 30 September 2024, Tesco will launch a six-week trial of its new Clubcard Challenges. (This is the second trial).

This program uses advanced AI technology to provide personalized challenges to consumers.

These challenges are tailored to your shopping habits, meaning they can include buying things like fresh fruit and coffee or trying a plant-based diet.

If you are among the selected Clubcard holders selected for this trial, you can collect up to £50 in Clubcard points.

These points can be doubled by Tesco’s reward partners, giving you a potential £100 to spend on activities such as a movie night at Cineworld or a day out at Thorpe Park.

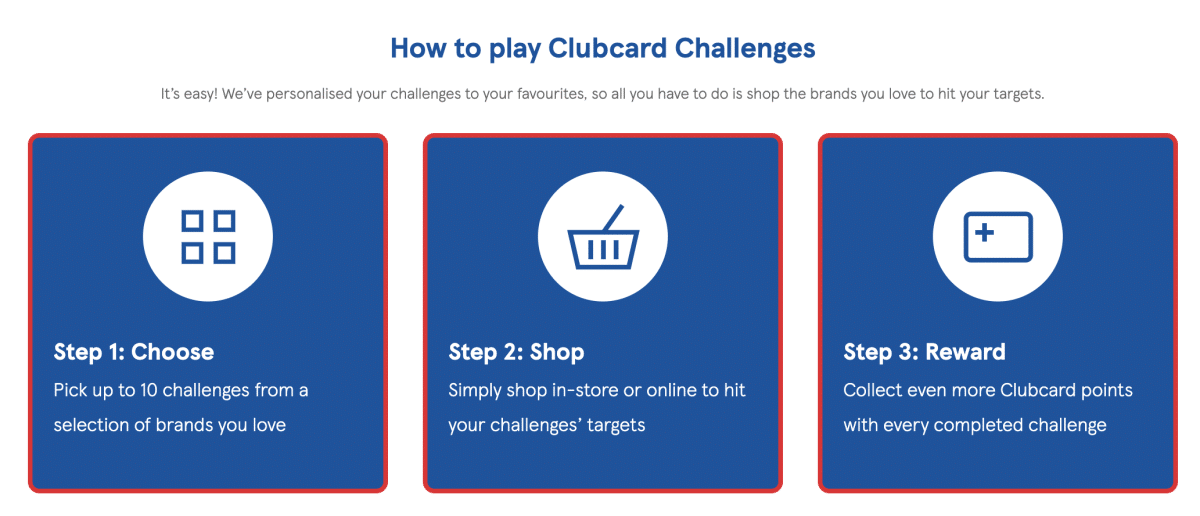

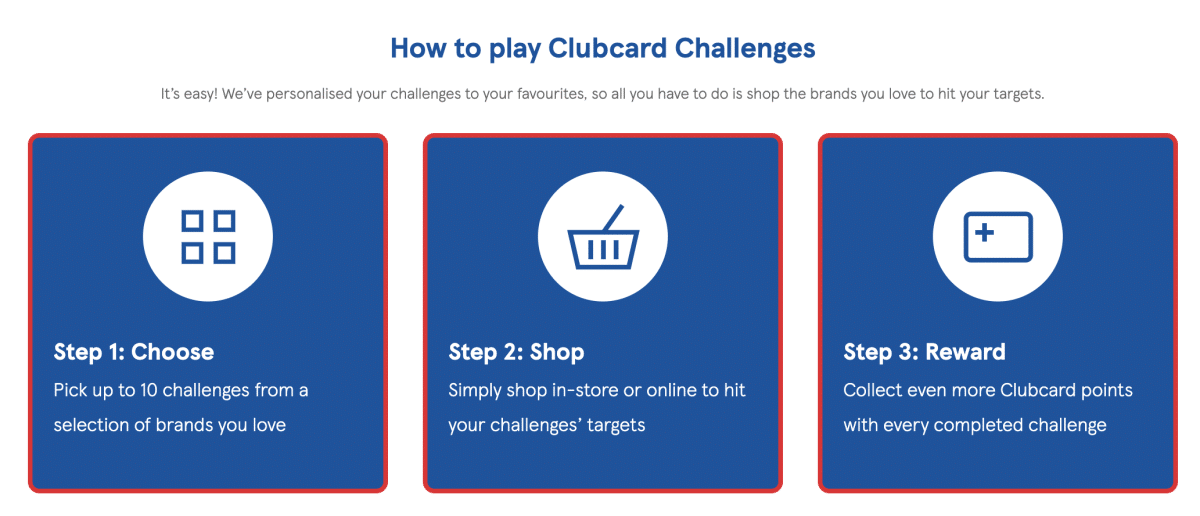

How to take part in Clubcard Challenges

To take part in Clubcard Challenges, check your email and the Tesco Grocery and Clubcard app.

If you are eligible, you will receive an invitation and you can start with challenges through the app.

You will be given a combination of about 20 different challenges and you can complete up to 10 of them.

This can mean spending a certain amount on a range of products (so balance whether you need to spend more today to get more points tomorrow!)

The offer will be personalized, meaning it’s for things you usually spend money on anyway, and will likely be different from your neighbor’s. So, for me, I have fresh fruit, Whiskers cat food, and sandwich deals – which are great since they’re products we buy regularly.

After completing the challenge, you will earn more Clubcard points.

You can earn a maximum of 5,000 points, or £50, which can be doubled with a partner into £100 worth of rewards.

As you know, the challenge will last more than six weeks. You can speed up some of the challenges so you don’t overspend from one week to the next.

Not everyone will get an invitation.

More than 20 million people have a Clubcard, making it one of the most popular loyalty cards in the country, but only 3 million will receive an invitation. However, they may extend it to more people if it works well.

Even if you do not participate in the challenges, you will continue to earn Clubcard points on your purchases as usual.

You can earn more by checking out the Clubcard section of the Tesco app. Click Coupons on the card screen, and you can add points vouchers to your card.

If you’re a Sainsbury’s shopper instead, they’re also running a very similar promotion where you can earn up to 900 Nectar points from their Nectar Shop Points Challenge. Again, it’s invitation only.

Source link