Expensive Markets Are Growing—Here’s Where Investors Can Buy Big

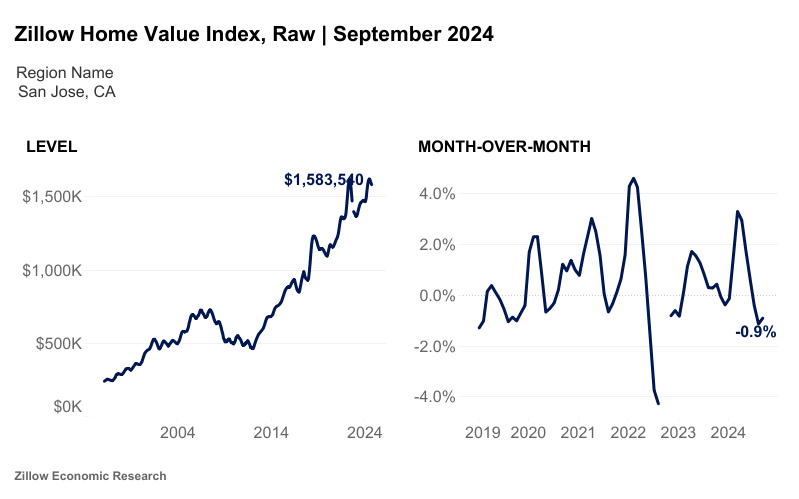

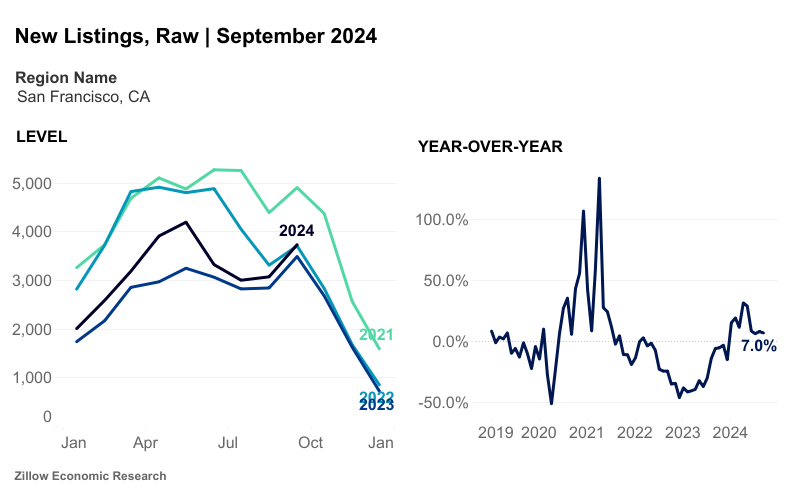

Despite the uncertainty of mortgage rates, the real estate market is booming in some of the most expensive cities in the country. According to the latter Zillow data, listings and homes under contract increased significantly in September. Cities at the lower end of the market, such as Seattle, Los Angelesagain San Joseit has shown the greatest benefits.

“In general, new listings and sales are close to pre-pandemic trends in September,” said Kara Ng, real estate economist at Zillow, told Yahoo! Finance. “We still have a long way to go principles of normalizing supply.”

Rate-Locked Buyers Are Coming to the Sides

The high end of the market has been stagnant amid post-pandemic interest rate hikes, with a number of homeowners foreclosed and unwilling to give up interest rates below 4% at 7% and above. The recent move higher may reflect optimism about future interest rate cuts and a desire to jump into the market before prices rise. It may also indicate the need to close a move, which has been suspended between interest rates and market uncertainty.

Despite softening a little in general, the surroundings 940,000 real estate sales across the country in September, the market is still 23% below the level it was at the same time in 2019. Realtor.com datalistings were up 25% or more last year in top cities and regions like Seattle, Silicon Valley, Denveragain Washington, DC.

Silicon Valley Helped Slow California’s High Market

The housing market on the West Coast has been a particular cause for concern in recent years, as 28% of the nation’s homeless population is in the middle. California. However, in the end, the increase in tax revenue, especially with Silicon Valley airlinesit could also help loosen the housing market in some price-locked regions, with workers opting to sell real estate stocks.

Similarly, cash-rich homeowners won’t be as affected by mortgage rate fluctuations as other buyers who need to borrow more.

California Housing Trend Speaks for Better Homes Nationwide

The idea that the housing market is becoming increasingly divided between the wealthy and the middle class has been reflected in the statistics throughout the year. Redfin’s first quarter report showed that overall real estate sales were down 4% nationwide. However, luxury real estate sales rose more than 2%, posting their best year-over-year gains in three years.

Residential data and listing company second quarter report showed that investor home purchases were up nearly 30% in Western-priced markets such as San Jose and Las Vegasfollowed by Sacramento, Los Angeles, and San Francisco. San Jose also saw the largest gain in overall home purchases, up 15.2% year-over-year in the second quarter. San Francisco came in second.

Most of the investor activity was in the single family home sector. Craig Pellegrini, a real estate agent in San Jose, when the report was released in August:

“San Jose has a lot of Overseas investors are buying the intangibles, and a lot of local fliers are buying up run-down homes, putting lipstick on them, and selling them for a profit. I also see parents buying second homes that they plan to rent for a while and then pass it on to their children, some of whom have just graduated from college and cannot buy for themselves.”

Zillow’s September price index report (mentioned earlier) is in line with the market trend. Finally, interest rates are low of concern for cash-rich buyers, who now have a year before prices rise amid further price cuts.

Outlook for the California housing market in 2025

The trajectory of increased activity at the end of the market is reflected in the California market outlook for 2025, according to California Association of Realtors. CAR President Melanie Barker, a Yosemite Realtor, said in a press release:

“The increase in homes for sale, along with lower borrowing costs, is expected to attract more buyers and sellers to the market in 2025. Demand will increase as we start the year with the lowest interest rates in more than two years, especially for first-time buyers. Meanwhile, would-be home sellers, constrained by the ‘lock-in effect,’ will have more flexibility to pursue the home that best suits their needs as mortgage rates continue to fall.”

CAR senior vice president and chief economist Jordan Levine added:

“Inventory is expected to loosen as prices ease; demand will increase with low mortgage rates and limited housing supply, to push higher home prices next year. Price growth is expected to slow, but the housing shortage will keep the market competitive without major economic constraints, so prices will still rise..”

How Investors Can Use Extra Capital to Capitalize on High-Level Markets

This all sounds good. But how do you make the most of them as an investor? Here are some strategies.

Identify the emerging markets that are located next to the most expensive ones

Buying on the edge of other expensive housing markets is a reliable strategy when predicting where to invest, such as there will always be people price from expensive cities. Whether investors are flipping homes or renting, there is likely to be a high demand for housing here. Check the emerging investment markets surround these cities, walking in safety.

Investigate homes

The risks and rewards are both high if revolving houses in expensive cities. However, if you are a well-funded home investigator, investigating here makes sense because the demand for housing will always be there. If you think you’re shopping the right way, there’s plenty of room for a high profit, whether you’re tearing down an old home, building a new one, or just doing cosmetic upgrades.

Connect with wealthy citizens to make deals

Many residents of expensive cities are flush with cash though I don’t have it time outside of their main property investment activities. This is where an experienced, well-organized investor comes into play.

Borrowing big large amounts of money or meeting a well-heeled silent partner requires a highly skilled flipper with a good track record who can deliver on their goals and who has a strong contingency plan for any possible downturn, where the investor is protected as much as possible.

High profit supermarket deals

In expensive markets, wholesalers must be honest and strictly follow local guidelines. If that means closing deals before selling, they’ll need cash to cover expenses. However, the potential profit can be high because of price points.

Buy long-term leases to get equity and cash flow equity

Another advantage of buying deals in expensive cities is that eventually, the market corrects many mistakes because properties continue to rise in price. Conservative investors can build their net worth by holding on to a property that pays for itself in rent but increases in appreciation. Over time, with rising rents and mortgage payments, these low-priced properties will begin to take off money flowsagain.

Final thoughts

Time emerging markets is where the gold is in real estate, but also a dangerous tryas it may mean being tied to homes that do not turn the corner as soon as expected.

If you can afford it, buying from established markets is a safe bet with few downsides, as long as you don’t use too much leverage. Given the market cycle, buying now as the market moving up as prices eventually fall would be a good move.

However, with the election and the new president, many investors have stopped buying plans, regardless of the outcome. This may indicate a gap in the market for well-financed buyers to make the move.

Discover the Hottest Markets of 2024!

Easily find your next investment hotspot with the new BiggerPockets Market Finder, which contains detailed metrics and information for all US markets.

A Note About BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BiggerPockets.

Source link