Forget Lloyds shares! I prefer to buy this FTSE 100 dividend growth stock

Image source: Getty Images

Lloyds (LSE:LLOY) shares remain in high demand among equity investors. At first glance, it’s not hard to see why.

High-quality banks provide important services such as loans, mortgages, credit cards and current accounts. As a result, they often enjoy a stable cash flow that they can use to pay fixed dividends.

On top of this, the financial regulator wants banks to hold significant capital, providing dividends with more stability.

Finally, the annual yield on Lloyds shares is 6% through 2024, up from 3.5% FTSE 100 average over a large distance. The yield rises to 6.2% and 7.1% in 2025 and 2026 again.

Well, I’m not going to touch the Dark Horse Bank with a boat pole right now. If I wanted dividends, I’d better add a support services provider Bunzl (LSE:BNZL) in my portfolio.

Share growth

First, let’s look at Bunzl’s dividend forecasts for the next three years.

| A year | Share of each share | Share growth | Return yield |

|---|---|---|---|

| 2024 | 73.89 p | 8% | 2.1% |

| 2025 | 79.61 p | 8% | 2.3% |

| 2026 | 84.83 p | 7% | 2.5% |

As you can see, these dividend yields are much lower than those on Lloyds shares. But let’s look beyond the last column for a moment.

Instead, let’s look at annual dividend growth. If the broker’s predictions for 2026 are correct, Bunzl will have increased the annual fee dramatically. 34 years on the spin.

Payout growth has been very positive at Lloyds recently. It raised full-year dividends by 15% through 2023, well ahead of Bunzl’s nearly 9% rise.

But I wouldn’t buy a stock based on dividends.

Amazing returns

Income is an important part of my investment strategy. Stocks that pay decent and growing dividends give me money that I can reinvest, an idea that – through the mathematical miracle of compounding – can allow me to grow my portfolio further.

But returns are only one part of the investment equation. The income provided by the company may be ignored by a falling or declining share price, leading to disappointing overall profits.

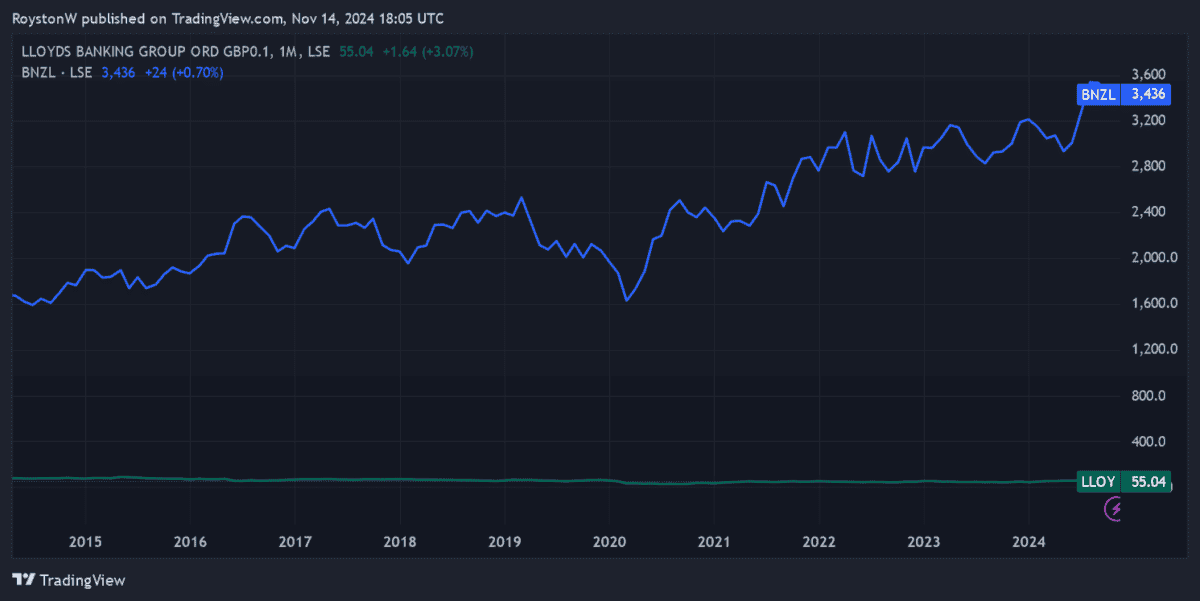

Taking stock price movements and dividends into account, Lloyds has delivered a relatively small shareholder return of 2% since 2014. That’s significantly less than the 131% Bunzl offered at the time.

Lloyds vs Bunzl

Past performance is no guarantee of future returns. But I believe the inverse performance of these FTSE 100 stocks will continue.

Indeed, Lloyds is an industrial giant in the UK, and has significant brand power to draw upon. But its growth potential is limited given Britain’s aging banking industry and poor economic conditions. And Lloyds could face billions of pounds in fines if it is found to have financed poor car sales in recent years.

Both of these are likely to limit the value of shares and potential profits.

In contrast, Bunzl has more opportunities to raise money as it continues its acquisition-based growth strategy. M&A strategies like this carry more risk, but the company’s strong track record is very encouraging.

Bunzl also has significant exposure to the US economy, as well as operations in fast-growing emerging markets. If I had cash to invest today, I’d rather put it here than buy Lloyds shares.

Source link