Here’s how I’m trying to build my ISA to get £5,000 in passive income every month

Image source: Getty Images

For me, the best way to get a second income is to put money into an ISA and follow a well-trodden investment strategy to build wealth. Of course, the more capital an investor has, the easier it is to generate more income.

Sadly, the majority of Britons still choose to build their wealth in savings accounts, which with annual returns typically less than 3%, that money doesn’t grow very fast.

Stock markets work better than savings

Investing in the stock market generally yields much higher returns compared to traditional savings accounts. Many people, especially beginners, choose tracking funds, which aim to replicate the performance of major market indices. Historical data underscores the long-term growth potential of such funds.

For example, the FTSE 100 has delivered an average annual return of 6.3% over the past 20 years, with FTSE 250 outperforming its large-cap counterparts. In the US, the S&P 500‘has reached an impressive 10.5% per year since its inception in 1957, rising to 13.3% over the decade to 2024. Likewise, Nasdaq it has posted an extraordinary return of 19.8% over the past decade.

These figures are in stark contrast to the relatively low interest rates offered by savings accounts, which emphasize the benefits of investing in the stock market to build wealth over time.

Doing math

Personally, I prefer to pick individual stocks, trusts and mutual funds, rather than index-tracking funds. That’s because I believe I can beat the market – after all, researching stocks is what I do.

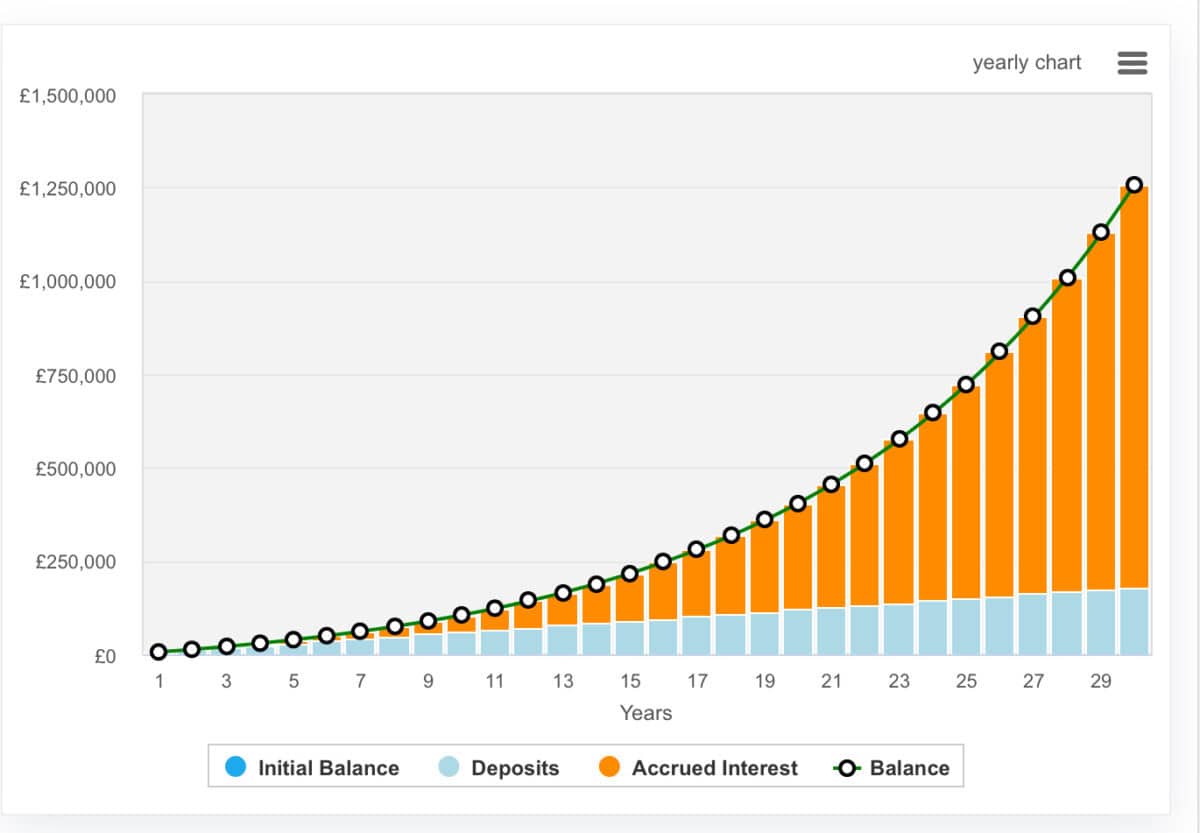

However, if an investor had chosen the track of any of the above major indexes over the past decade, he would have far exceeded the returns he would have earned in a savings account. Let’s assume an investor puts £500 a month into an index tracker. Here’s how that money can work for S&P 500 tracker, based on previously noted historical growth rates (but be aware, past performance is no guarantee of future success).

Why did I use S&P 500 data? Well, because it works out to just over £1.2m over 30 years. Investing that money in stocks with an average dividend yield of 5% would generate £5,000 of monthly income – and tax free. This is what I intend to do, but by cherry picking, I hope to increase my income quickly.

Please note that tax treatment depends on the individual circumstances of each client and may change in the future. The content of this article is provided for informational purposes only. It is not intended to be, and does not constitute, any form of tax advice. Students are responsible for conducting their own due diligence and obtaining professional advice before making any investment decisions.

Another thing to consider is the stage of growth

While index trackers are a good way to start investing, investors may want to consider mutual funds that focus on exciting growth such as mutual funds. Edinburgh Worldwide Investment Trust (LSE: EWI). It’s a bag owned by Baillie Gifford – like a celebrity Scottish Mortgage Investment Trust – and it’s a really interesting proposition, albeit a dangerous one. This fund aims to invest in business companies when they are still growing.

The trust’s largest investment is SpaceX, which represents a significant 12.3% of the portfolio. This is followed by PsiQuantum at 7.5% as well Alnylam Pharmaceuticals. This is a high-risk investment, but given the underpinnings in artificial intelligence (AI), space exploration, and quantum computing, this could be the right time to take a diversified approach to the emerging technology.

However, some holdings are not included in the public list, and only listed companies are required to disclose earnings reports, which means that important data on these private companies is not available, which increases uncertainty for investors.

Source link