Here’s the latest growth and sharing the stock of NVIADIs stock

Picture Source: Pictures of Getty

The envid (Nasdaq: NVDA) Stock took minor injury in January, 13% down at the same time. However, it’s back and now it’s up to 3.4% in the year 2025. Over five years, it is not 1,817% unbelievable!

AI Chip King because of ordering its Q4 2025 to 36 February. Here, I will look at the latest predictions in the result report.

Amazing growth

As Chatgpt was released by the end of 2022, the quarterly quarter consequences of Wall Street ratings.

The table below indicates income and money earned by each money (EPS), and the amazing release of EPS expectations.

| Quarter * | Net worth | Surprise money surprise | EPS | EPS surprise |

|---|---|---|---|---|

| Q1 24 | $ 7.2 | 10.1% | $ 0.11 | 18% |

| Q2 24 | $ 13.5bn | 20.7% | $ 0.27 | 29.7% |

| Q3 24 | $ 18.1.1n | 11.2% | $ 0.40 | 18.5% |

| Q4 24 | $ 22.1.1n | 8.4% | $ 0.52 | 12.3% |

| Q1 25 | $ 26BN | 5.8% | $ 0.61 | 9.2% |

| Q2 25 | $ 30bn | 4.4% | $ 0.68 | 5.4% |

| Q3 25 | $ 35.1.1BN | 5.8% | $ 0.81 | 8.3% |

As we were able to see, Nvidia kept brightening measurements with twice as many-minute digits last year. However, as the AI transformation is taken and analysts have a better need for the chip needs, these ambulances have crossed the same digits.

Of course, that is impressive, and it means that unvidia has measured estimates in both high and lower ratings every single quarter from the beginning of 2023. And at that time, it adds added $ 2.8TNNRN CAPIALLIANZATION!

On Q4 25, the Waswall Street Road expects $ 38BN and EPS of $ 0.84. That can represent 72% of the growth in 72% and 64%.

These are the statistics of the investigators of the investment to consider. Although the item that will determine the pricing of the Share Property afterwards is the leading of the Q1 26 guide. Investors will want to know that AI Chip’s demand will remain strong this year.

Currently, analysts predicted revenue of $ 41.7bn and eps of $ 0.91 of the current quarter (Q1). If the company reviews this up, the stock can jump up, and the opposite.

Target of price

The prices of the price of sharing a broker should be taken through salt, especially when it comes to a fluctuating stock as Nvidia. In such a statement, they can provide an important understanding of market differences.

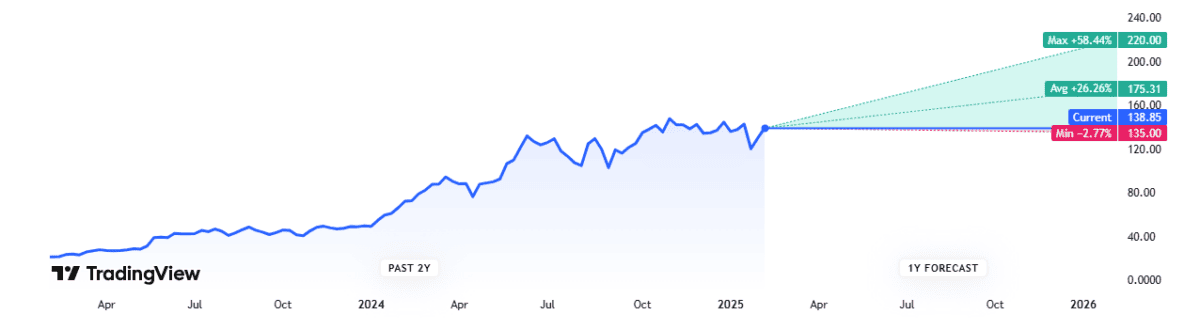

So, what’s the latest article with Via? Based on 52 critics who cover the stock, a 12-month price rate for $ 175. That is about 26% over the current sharing price of $ 138.

Scale of a particular item

Finally, we have a balance. Based on current FY26 limit, stock sells 31 times earning. That doesn’t look what is most wanted for me, a quick growth in the company.

Collecting this with a $ 175 price, it could be made a convincing case that this is the booming stock that we should think about buying.

What can go wrong?

However, as the Stanford Computer Roy scientist Mara once said: “We often fall over the effect of technology in short run and underestimate long run effect. ”

In other words, the new variable technology is usually avoiding the first bubbles thought to all history. The Internet was the most famous example, even though there have been others.

In addition, about 36% of the sale of Lvidia came from just three customers in the last quarter. If these customers view their AI infrastructure expenditure after the first exit, the Chipmaker can find a speedy decrease in income growth.

With the offer of this doubt the medium time, I will not buy stock in today’s price.

Source link