Homeowners Who Recently Refinanced See Largest Improvement in Mortgage Rates in Decades

When mortgage rates dropped to 6% in August, homeowners jumped at the chance to refinance.

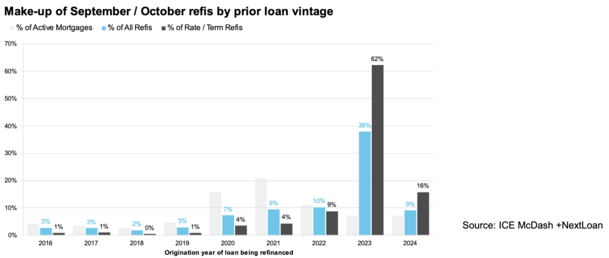

In the months of September and October, more than 300,000 borrowers closed refinances, including nearly 150,000 foreclosures and foreclosures, according to the latest Mortgage Monitor report from ICE.

This pushed refinance rates to their highest level in more than two and a half years.

And over the October quarter mortgage lending was part of a rebound in a market that has long been dominated by home equity loans.

Perhaps most interestingly, borrowers who refinanced these months saw the largest rate improvement in decades.

The Average Refinancer Got a Home Loan Estimate About 120 Basis Points Less

You have probably heard the expression “marry the house, the day is the quality”. But if you haven’t already, it’s basically a hassle to buy a home if you want it, and you’re hoping to refinance quickly rather than get a better price.

In other words, the home is a retainer, but the mortgage is disposable. This did not work well in early 2022 as mortgage rates almost tripled from 3% to 8% in late 2023, but it has worked recently.

Per ICE, the average homeowner who applied for a rate and repayment term lowered their mortgage rate by more than a full percentage point in both September (-1.07%) and October (-1.17%).

This resulted in monthly savings of $310 and $320 respectively, which is a great reason to refinance.

At the same time, nearly one-third of these lenders were able to lower their mortgage rates by 1.5% or more, marking the best time for rate and term restructuring in decades.

As you can see in the chart above, the part shaded in the darkest blue (denoting a rate improvement of 1.5%+) has jumped in recent months.

And the light shade of blue (1-1.49%) also increased a lot, which means it was a very good time to look for a low loan amount.

The reason was because the 30-year default appeared to have risen to about 8% in October 2023, then fell to about 2% in less than a year.

That massive spread resulted in “the largest rate improvement we’ve seen in the last 20 years,” according to ICE.

In fact, this mini refi boom has only been eclipsed by the 2020-2021 refi boom and the low-quality environment seen in 2012/2013.

So despite being short lived, it had a positive impact on participating borrowers.

Most of the Refinancers held for only 15 months

Do you ever think about how long you will hold on to your mortgage?

It’s an important question to ask yourself because you can decide whether it makes sense to pay mortgage points and/or choose a type of home loan.

After all, why go with a 30-year fixed if you expect to sell or refinance a few short years later? Why not choose an adjustable rate loan like a 5/6 ARM or 7/6 ARM?

Sure, there’s risk involved if the rate isn’t fixed, and discounts aren’t always good, but it’s an important consideration to make instead of just going with the default option.

However, it turns out that the average and term refinancer only held their mortgage for 15 months before refinancing.

This was the shortest period of time in the nearly 20 years that ICE has been tracking the metric, which tells you how many times people have called a date for the average strategy.

New technology alerts lenders to reach out to borrowers

Although it seems like lenders are on top of you, you may be able to thank new technology for that.

Lending companies have gotten much better at reaching potential customers when mortgage rates drop.

There are automated systems that will compile a database of loan originators and when rates reach a certain point, they can send letters to prospective customers.

This may explain why despite mortgage rates peaking again in late September, such a large number of borrowers were still able to save a lot of money.

Roughly speaking, about $47 million in monthly payment savings were locked up by homeowners in September and October alone, before rates dropped after the Fed’s rate cut.

I expect another refi boom to appear soon if mortgage rates continue on their current downward path.

And chances are borrowers and developers will be ready to jump in again.

Source link

.png?w=390&resize=390,220&ssl=1)