How do you know what kind of type you are

Here is this event: Holidays is still in the corner, and the customer rush sends your last excerent location. Similarly, local construction company requires the upcoming workouts without much time to plan. In both cases these items, these businesses do not have enough money to meet the growing demand and tap their money skill. One-one-place solution? A temporary money.

This type of financial system is useful for businesses that need to give him a quick supply of money without obstacles of long-term interest. Short-term support It is a very good way to cover new or unexpected expenses, while working with other operating costs.

In this article, we will examine various financial types, their benefits, how different the long-term loan, and how the business can qualify for this kind of financial.

Content

What is the temporary money?

Temporary temporary funds are borrowed from business or a line of credit Formal for the payment is to be the sooner of the long-term loan – usually between six and 18 months. You will usually receive temporary loan options available from banks, credit unions, or private credit borrowers.

When the loan has been approved, the entity shall receive a lump sum in its bank account. Normally paying and price will be pre-organized as part of the loan terms. These short-term holes may attract businesses seeking rapid theater, additional inventory, or New Emergency Rental.

Types of Temporary Financial

Businesses can choose from many species of short-term loan. The funding option to which you need will vary depending on your specific form, such as loan purposes and for how long in payment words. Here are three of the most common examples of temporary financial financial statements:

Credit lines

A A Line of Credit Business It works as much as credit card. This holder opens a line of credit, and you will be able to access any time when needed. Like any kind of rebellious debt, you can extract the credit limit and pay interest only in what you use. This method of funding may be reasonable with trained business owners who want to maintain their business debt.

Cash flow

According to the flow of cash, businesses can protect faster and simple money by installing future sales. This different financial form is often protected – meaning you will not need to install unpaid invoices, equipment, or property as a collateral. And you will not have a strong monthly payment schedule, as you can make payments according to your daily sales and change them to suit business performance.

The time loan

The time loan is just such – the loan expected to be returned over a fixed term. Small Business Loans usually runs between six to 18 months, while long-term loan – as SBAN Loan Loan (SBA) – Usually keeping anywhere from three to ten years. The purpose of the loan will help you identify the best of payment goals. For example, large equipment loan is usually a long term.

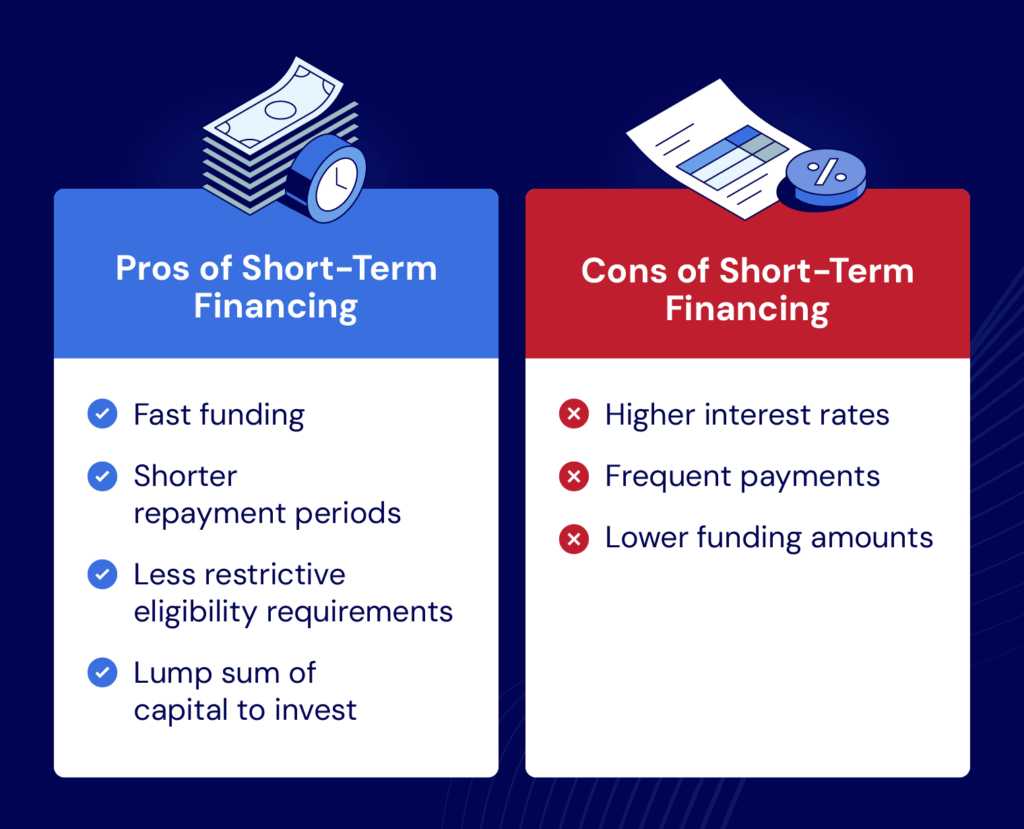

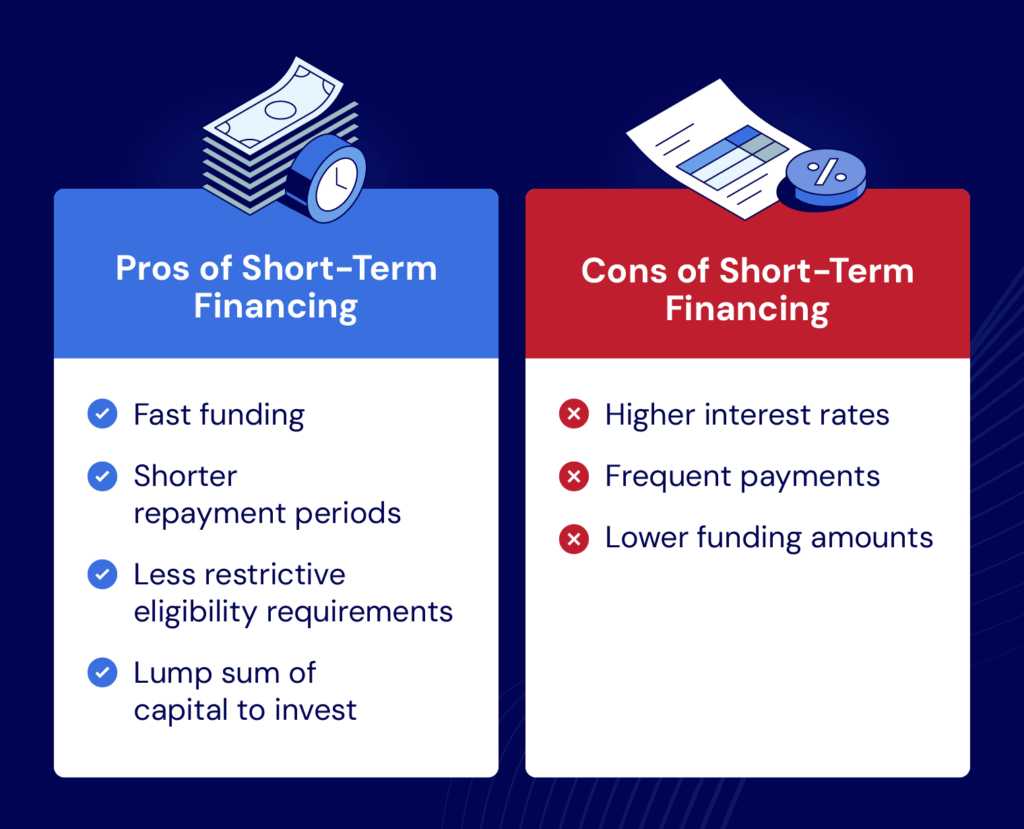

Benefits and Temporary Financial Benefits

Any form of loan will have its share of the benefits and the temporary period of time is not different. Let us count on some of the other benefits and the badness of this type of financial.

Benefits

I have a lot to love about temporary funding because there are many benefits. Some of those benefits include:

- Fast Financial Support: Some lenders can deposit money into your account within 24 hours.

- Short payment times: Conditions are usually valid between six to 18 months.

- Productive requirements: These loans also come with short terms and balances, so it’s easy to be ready.

Grim

Despite several benefits, the temporary financial budget does not arrive without issues. Some examples include:

- Top interest rates: Short-term financial support may come with higher interest rates with rules that are different about the state and diverse laws.

- Typical Payments: The payment schedule is determined in advance between you and the lender, but short-term loan is usually required for the most common fees than traditional financial options.

- Low Money Rates: This type of financial system is suitable for quick amounts of money but will not be reasonable for businesses with a large budget and complex financial needs.

The difference between short and long-term loan

As you can expect, for a while and Long Loan have a few differences. Here’s what you can expect.

| Short-term loan | Long Loan | |

| Duration length of length | 6-18 months | 2 to 10 |

| Presence for interest | Different / high | Formal / lower |

| Prices | Down (depending on business qualifications) | More (depending on business qualifications) |

| Validity | Slightly blocked | Mostly blocked |

How to Deliver a short-term loan

Length of payment of short-term loan is good, but the factors playing in the right of this spending may differ significantly based on the lender. That means, many loan suppliers will look at the same symptoms to earn money and length of time before approving funding. Other suitability requirements include:

- Business credit and personal credit: Like any loan, the borrower will look Credit scores Determines the integrity of the business when it comes to pay.

- Time in Business: If your business has been serviced for a while, you will have a better chance of the loan approved because this is about the functioning of your company. Many lenders will need you to be in business for at least six months in order to qualify.

- Annual Revenue: This gives the lender the best idea of working for your business, and many lender, you will need annual income to support payment. Some lenders may also need to calculate – as Establishment of Finance.

Rebuild Your Business Today

Here the capital of the National Business, we have a lot of loans to help your business in a short or long term. Our financial advisers may like to discuss with you, answer questions, and guide you to all the steps of the loan. Apply now To find the best financial options for your business.

.png?w=390&resize=390,220&ssl=1)