How much should investor consider putting the stock market to return £ 250 a week?

Picture Source: Pictures of Getty

Investors often try to calculate their ability to earn money when investing in stock market. This is an important part of building a salary strategy, as the outcome depends on certain conditions. Significantly, it is important to know how much you can invest when you intend to achieve some return

For example, investor wants to get extra $ 250 to add current income. That is equivalent to the return of $ 1,000 per month (or £ 12,000 per year). How much will invest in investment to repay the $ 12,000 income of money per year?

To make a strategy

Investment provides reconciliation with the capital and appreciation. The income investors tend to be divided due to standard payments.

Shares of the best classification of income is those with a long record of growth. This reduces the risk of determined partition.

High harvest and essential – but not too high that it is not detective. Percourance of risk and diversity is also an important way to consider. Various variety of portfolio can provide a higher restoration at risk of great losses.

For example, the differences and marketplace technology can be dangerous. However, the opportunity to grow good. Otherwise, consumer goods or health care shares are less hazardous but slowly growing.

How much is investing

Think of the portfolio with a 7% of harvest and 3% of growth. For $ 120,000 planted, you can return for about £ 12K a year.

That amount can be reached by investing £ 200 a month for 20 years. It may need to restore money to raise money for investment.

By increasing monthly offering on £ 300, time may be reduced to 15 years. Also an investor with $ 20,000 savings can reduce and only 11 years. Of course no of those guaranteed returns.

What kind of stock experience those processes?

In appropriate, portfolio should contain 10 to 20 shares at the cost between 5% and 9%. They should take a list of different industries and learning areas.

One example I think is worth considering by the FTTE 250 invest Urvice (Lese: Inver). The International Wealth Management Group is one of the largest companies in the indiation, with £ 4.66bn cap. The largest shares-cap are tend to change less.

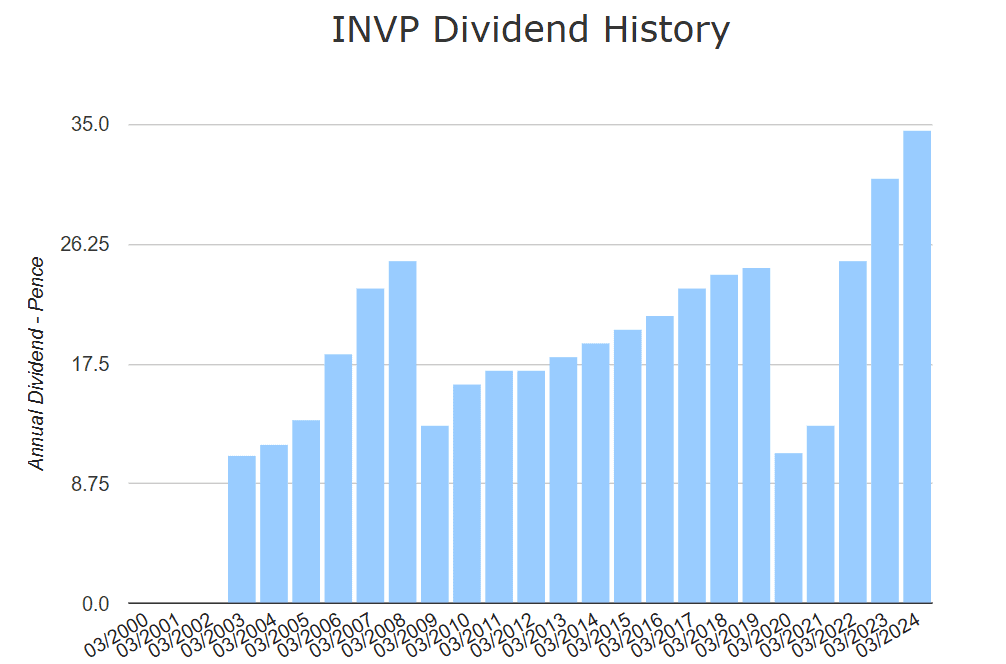

Keeps stable harvest between 5% and 7%, higher than average. Although it made two cuts in the last 20 years, assignments grew up at 6.9%.

As an investment company, Interiatec is at high risk from the Croeconomic factors that lead to market conversion. This includes the changes of interest rates, geopolical conflicts and provisions and access issues. Profit and may suffer if the company is automatically investing in its debt or falls in managing.

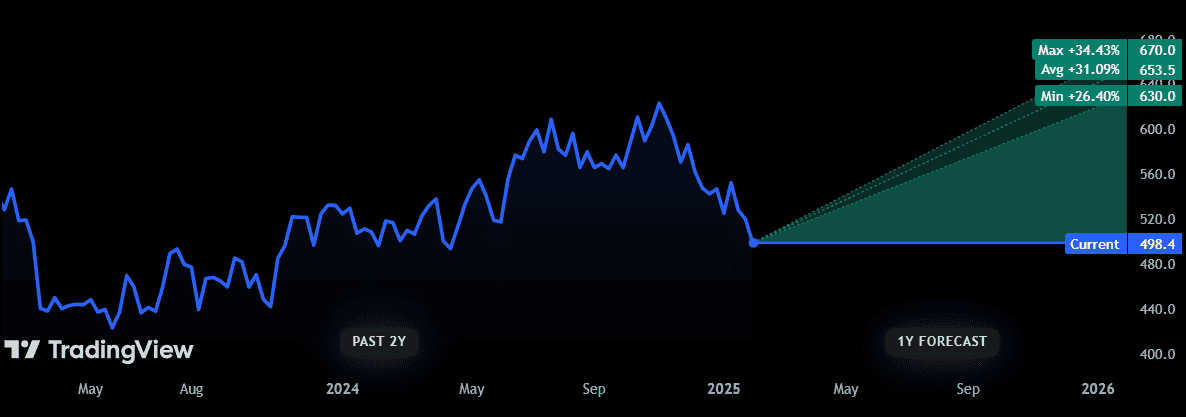

To date, it seems that you make good investment decisions. Analysts on average awaiting the price of 12 months of 653p, 31% higher than today.

The sharing price increases at an annual 7.3% decent decade ago. That makes it attractive to the incoming portfolio, as tax shares often have lower pricing growth.

And it has good rates, with a capital fee only by 6.7 and prices for 0.87.

Source link