Windfalls AI App Review: Can This AI Really Increase Your Financial Winnings?

In today’s economy, with prices rising on everything from groceries to electricity, we are all experiencing pressure on our wallets. Finding ways to limit our daily expenses is no longer just a smart choice—it’s a necessity. For those like me, using credits and subscriptions in hopes of identifying savings opportunities is time-consuming. Fortunately, there is a service that does all this for you, offering you a solution to reduce your debts: Windfalls.

This AI-powered bill reduction service is a new discovery for me, and so far, it seems legit. Windfalls promises to analyze your bills, identify potential savings, and negotiate with service providers to reduce your costs. The best part? It is almost completely automatic. I have been using Windfalls for over a week now, and here is my review of the Windfalls AI app.

Ease of use

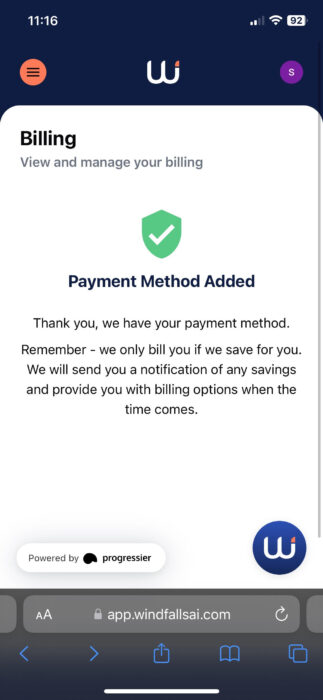

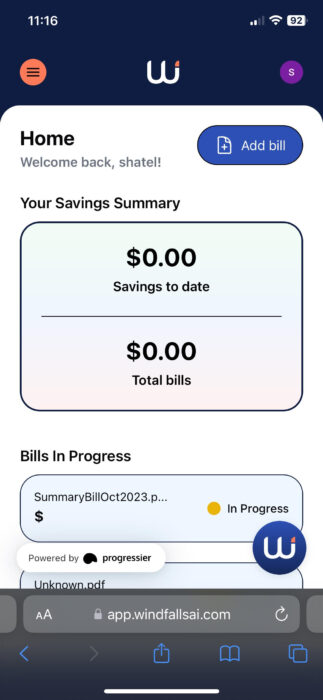

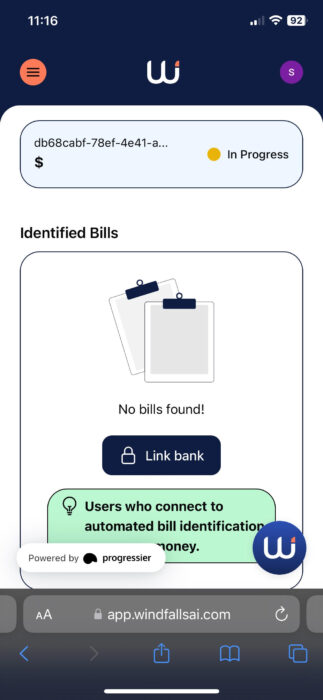

One of the first things I noticed about Windfalls is how intuitive and user-friendly the website is. Within minutes of landing on their home page, I was able to create an account and begin the process of applying for my loans. Windfalls gives you two ways to get started: you can upload your bills manually, or you can connect your bank account, let AI scan your transactions and issue recurring payments automatically.

Personally, I had trouble linking my bank account when I first tried using my phone—the connection wouldn’t go through. However, I switched to my computer and was able to connect my account, although it did not load my transaction history. This was a bit of a hiccup, but it didn’t stop me from continuing the process. Instead I uploaded five bills, which only took a few minutes. The platform is clear and straightforward, although some bills (such as internet and phone) require additional information, such as account pass codes or specific provider information.

Overall, the process of getting started with Windfalls was easy, and it took me about 20 minutes to set up my account, upload the necessary documents, and sit back while the AI started its work.

Reimbursement Excluding Advance Fees

One of the most attractive features of Windfalls is its pricing model. This service works on a “no savings, no money” basis, meaning you pay nothing unless it saves you money. There are no upfront costs or hidden fees—if the AI finds a way to reduce your debt, you keep 60% of your savings, and they take 40%. While this may sound like a big cut, it’s a worthwhile trade-off when you consider the luxury and craftsmanship that Windfalls brings to the table.

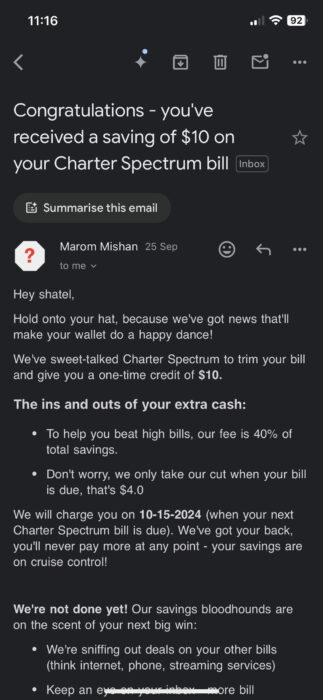

Within a week of using Windfalls, I was already seeing results. The service was able to get me a one-time $90 credit on my T-Mobile phone bill and a $10 credit on my internet bill. Not bad for just a few minutes of setup! I also uploaded two hospital bills and a utility bill, which are still being reviewed, but I’m hoping for potential savings.

The good thing about this service is the peace of mind it provides. Knowing that you only pay when Windfalls delivers savings removes the financial risk, making it easier for anyone looking to cut costs.

Technology and Safety: Plaid Makes It Safe

When it comes to managing your finances online, security is a major concern. Windfalls are used Plaid technology to connect your bank and credit card accounts, which is reassuring because Plaid is widely regarded as a reliable and secure system. Many top financial apps use Plaid, so it’s great to see Windfalls integrate this technology into their platform.

By linking your bank account, AI can quickly analyze your recurring payments and negotiate with companies on your behalf to get you better deals. Windfalls also allows you to link your email account, giving AI access to online receipts and payment confirmations, further simplifying the tracking process and reducing your debts.

I appreciate the level of security and encryption Plaid provides, especially since it’s something I’m familiar with from other financial services I use. Although my first attempt to link my bank didn’t work, this was a minor technical problem, as Plaid is generally reliable.

Results: Real Savings in Record Time

The main reason to use Windfalls is to save money, and from what I’ve seen so far, the service delivers. Within just a week of signing up, I saw over $100 in credits added to my accounts. The process is ongoing, so I’m eager to see what else Windfalls will tell me over time.

What makes Windfalls stand out is how hands-off the process is. AI does all the hard work—from identifying savings opportunities to connecting with service providers. However, there is a slight downside to this. Currently, once a bill has been uploaded and marked as “in progress,” there is no transparency about what is going on behind the scenes. You don’t get updates or details on how the conversations are going, which can leave you feeling in the dark. More detailed status updates or notifications can go a long way in improving the user experience.

Advantages and Disadvantages of Windfalls

Like any service, Windfalls has its pros and cons. Here is an explanation based on my experience:

Good:

- No prepayments: You only pay if Windfalls saves you money, making it risk-free.

- Ease of use: The website is easy to use, and loading bills or linking accounts takes just minutes.

- Automatic savings: AI handles the negotiation process, saving you time and effort.

- Actual results: I saved over $100 in the first week with Windfalls, and the potential for future savings is exciting.

Disadvantages:

- Bank connection problems: I had trouble connecting my bank account to my phone, and even after successfully connecting it to my computer, the transaction data did not load.

- Transparency: The service does not provide much information about ongoing negotiations or the status of ongoing loans.

- Limited control: While the hands-off approach is simple, it also means you have little say in how your debts are negotiated.

Windfalls AI App Review: Is It Worth It?

All in all, Windfalls offers you an automatic and easy way to lower your debts without much effort on your part. The platform is easy to use, the savings are real, and the fact that you only pay when you save money is a huge advantage. Although there are some minor flaws and areas where the lighting could improve, Windfalls is a service with great potential.

If you’re like me and dread the thought of spending hours negotiating with service providers or hunting for discounts, Windfalls can be a game changer. The savings I’ve seen so far are encouraging, and I look forward to seeing what else this service can do in the coming months.

Check out Windfalls AI for yourself by signing up here.

Source link