If a 40-year-old puts £700 a month into a Stocks and Shares ISA, here’s what they could have in retirement.

Image source: Getty Images

A Stocks and Shares ISA is ideal for UK investors looking to build a nest egg for retirement. An annual contribution allowance of £20,000 is sufficient for this purpose, especially if the benefits are tax-sheltered.

In fact, with the right investments, one can build up a decent sized pension investing £700 a month. Here’s how a 40-year-old can do it, even if he’s starting from scratch.

Please note that tax treatment depends on the individual circumstances of each client and may change in the future. The content of this article is provided for informational purposes only. It is not intended to be, and does not constitute, any form of tax advice. Students are responsible for conducting their own due diligence and obtaining professional advice before making any investment decisions.

It considers portfolio risk

The first thing to note here is that stock markets can be volatile and unpredictable. And while the market goes up over time, it certainly doesn’t do it in a straight line!

That said, some stocks are more volatile than others. With thoughtful planning, it is possible to build a diversified portfolio that includes a combination of growth stocks, equities, funds, and trusts. This may include both UK and US stocks.

This diversification helps accelerate market volatility, reducing the risk of overexposure to one area or sector, such as technology or energy.

I think 15-20 different investments is a good goal to aim for when starting out.

Looking at the rate of return

I S&P 500 it has long surpassed that of the UK FTSE 100it delivers an average return of 12% per annum compared to the recent 7-8%.

However, there is no guarantee that it will happen every year. UK stocks may have a purple patch, while investors are sour on those listed in the US (on inflationary grounds, say).

By investing in both markets, I think you can probably aim for an average return of 10% over time. This is a ballpark figure for global stocks.

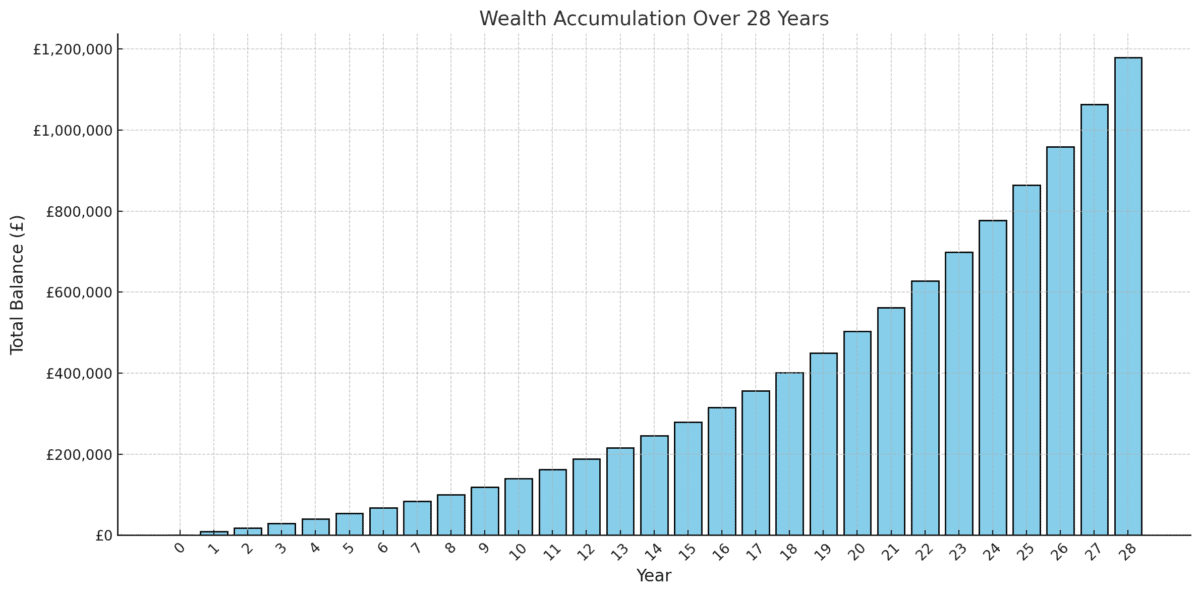

For a 40-year-old starting out, it means investing £700 a month at this rate of return would result in an ISA worth £1.18m after 28 years. This gets reinvested benefits and 68 years of State Pension.

According to Vanguard, a single retiree eligible for the full State Pension would need £488,688 of pension savings to cover the ‘average’ retirement, as defined by the Pensions and Lifetime Savings Association. So £1.18m would be a good result.

A bag that aims to return through the mountains

There are many stocks that an investor can buy to reap these benefits. Those starting out may want to consider it The Schiehallion Fund (LSE: MNTN).

This is an investment trust that supports fast-growing private companies. But in contrast, it ends up holding shares once they are already public, aiming to get a bigger return.

Today, there are about 44 stocks in the portfolio. They provide exposure to exciting areas that are poised for significant long-term growth.

Top 10 catches (as of 30 November)

| Stock | Explanation | Weight | |

|---|---|---|---|

| 1 | Confirm | It offers buy now, pay later services Amazon again Shopify. | 7.0% |

| 2 | ByteDance | The Chinese owner of TikTok. | 7.0% |

| 3 | SpaceX | He makes rockets, satellites and spaceships. | 6.7% |

| 4 | Smart | International money transfer. | 5.2% |

| 5 | Bending Spoons | Mobile application developer. | 5.0% |

| 6 | Tempus AI | AI-powered personalized healthcare. | 3.9% |

| 7 | Brex | Fintech. | 3.4% |

| 8 | Databricks | Data analysis and AI platform. | 2.7% |

| 9 | The stripe | Large online payments. | 2.7% |

| 10 | He heard | Developing automated driving technology. | 2.6% |

One thing to consider here is that managers are not guaranteed to get it right every time. As an example, the fund lost money in 2024 on an investment in Northvolt, a Swedish EV battery company that exploded. It cannot afford a high profile failure or its operations/strategy will be attacked.

However, the shares remain 63% off their 2021 high, while trading at a 16% discount to the fund’s total assets. I think Schiehallion can deliver market-leading returns from here, especially when the IPO market starts to heat up, which could happen as soon as 2025.

Source link