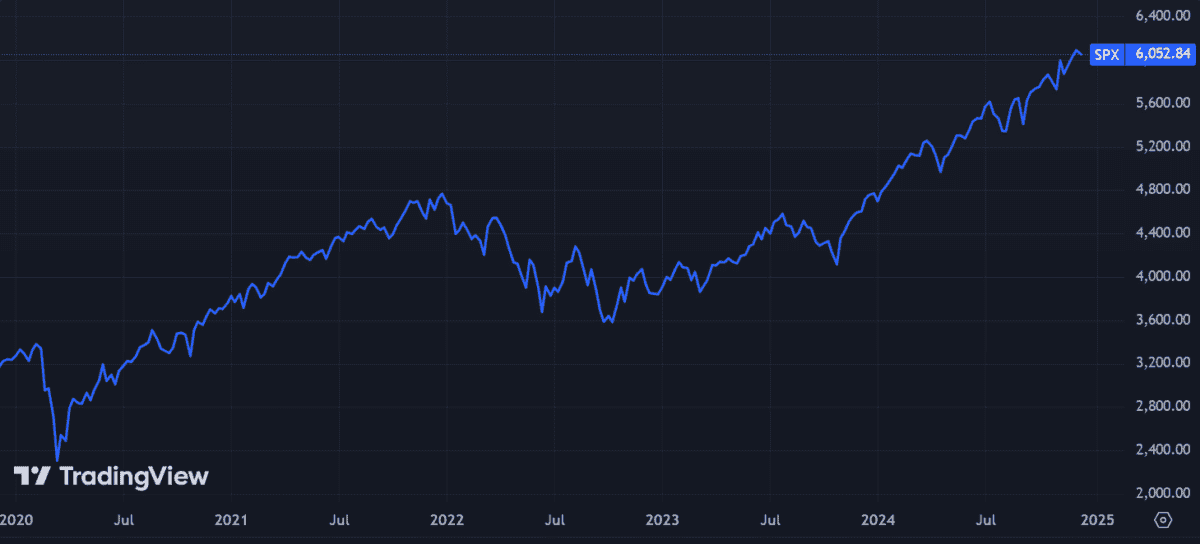

If an investor put £30,000 into the S&P 500 ten years ago, this is what they would have today!

Image source: Getty Images

Since its establishment in 1957, the S&P 500 – which includes the 500 largest US companies by market capitalization – has provided strong returns while helping shareholders effectively diversify their portfolios.

If someone had invested £30k 10 years ago, how much would they have now?

Strong returns

Since December 9, 2014, the S&P 500 has risen an astounding 196%. That equates to an average annual return of 11.4%.

But that does not include dividends paid during this period. With shareholder payouts included, the index’s average annual return rises to 13.7%.

To put that in context, the average annual return (including dividends) of FTSE 100 again FTSE 250 sit back, just over and under 6%, respectively.

So how much would a strong S&P 500 performance bring in monetary terms? If someone had invested £30,000 in an S&P 500 index fund back in late 2014, they could now – with dividends returned – sit on a whopping £117,148.

Technical focus

The largest companies in the US index are technology companies, a sector that is underrepresented in the UK. And I think these tech giants will continue to push the S&P 500 higher.

These businesses have grown in value amid investor frenzy about the evolving digital landscape. Recently, the market’s enthusiasm for artificial intelligence (AI) – helped by strong trading updates Nvidia, Alphabetsagain Microsoft – increase the demand for their shares.

But AI isn’t the only game in town. There are a number of other technology growth segments that could lift the S&P over the long term, including:

• Cloud computing

• Green technology (including renewable energy and electric vehicles)

• Robots

• Cybersecurity

• Quantum Computing

• Internet of Things (IoT)

• Private cars

The top stock I’m considering

To apply these themes myself, I added several US exchange-traded funds (ETFs) to my portfolio.

One is the broad one HSBC S&P 500 ETFwhich gives me exposure to every direction. Another i iShares S&P 500 Information Technology Sector ETF, which gives me highly targeted access to technology stocks.

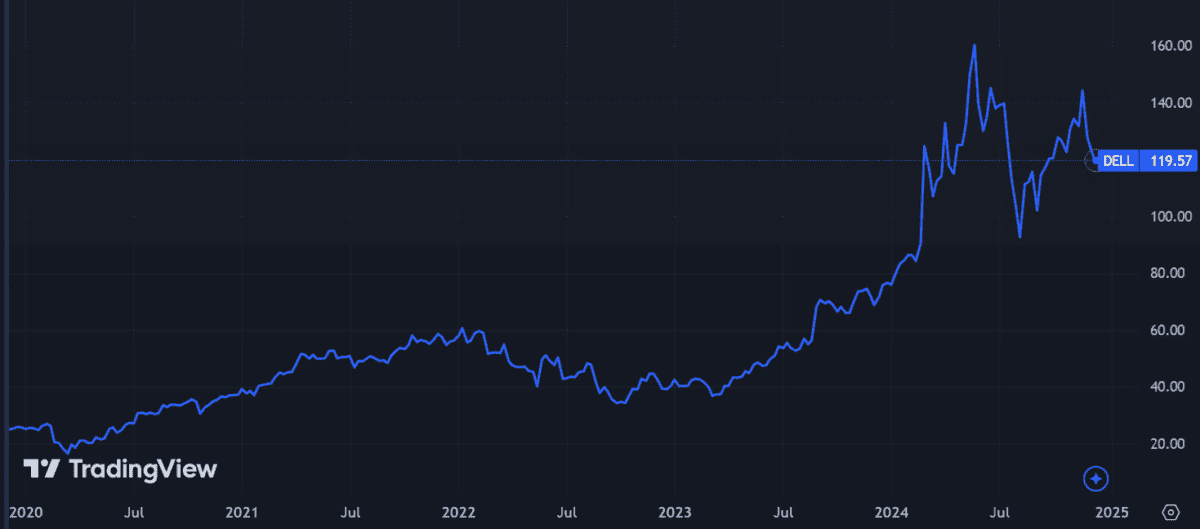

With my diversification quest met, I am also looking to increase my returns by buying some stocks. Dell Technologies (NYSE:DELL) is one US stock I’m thinking about today.

Like Nvidia, the business is also betting big on the AI revolution. But so far it hasn’t enjoyed the same good results, so it doesn’t have a sky-high rating like its technical rival.

Dell’s forward price-to-earnings (P/E) ratio is 15.8 times. That’s very low compared to the broader technology sector and below Nvidia’s hulking average of 47.1 times.

It may not be achieving as impressive results as Nvidia yet, but it has been making great strides in AI.

Between September 2023 and June, it sold $3bn worth of AI servers. It also hit a milestone in November by selling Blackwell server racks, the first to use liquid cooling technology. This could be a game changer in energy efficiency and server performance.

Although Dell faces a lot of competition in the AI space, I believe it’s an attractive stock to me given its recent encouraging progress – and especially at current prices.

Source link