Is a stock market crash coming? And what should I do now?

Image source: Getty Images

The Santa Rally of early December now seems like a long, long time ago. Today, the stock markets are in a sea of red, with some predicting that a A US stock market crash is likely.

So what’s going on? And what steps should investors like me take?

Here is what happened

Prospects of interest rate cuts in 2024 and 2025 boosted global stock markets this year. A reduction in base rates provides economic stimulus and lowers borrowing costs, increasing business profits.

But recent sticky inflation suggests that this extreme rate cut may not be on the horizon. Suspicions like these exploded following the latest meeting of the US Federal Reserve yesterday, December 18.

As expected, the central bank also lowered the benchmark rate, to 4.25% from 4.5%. But Fed chairman Jerome Powell warned that “from this point forward, it is worth going carefully and watching the progress in inflation.”

Adding that inflation can take “another year or two” to reach the bank’s 2% target, higher interest rates may last longer than expected.

What’s next?

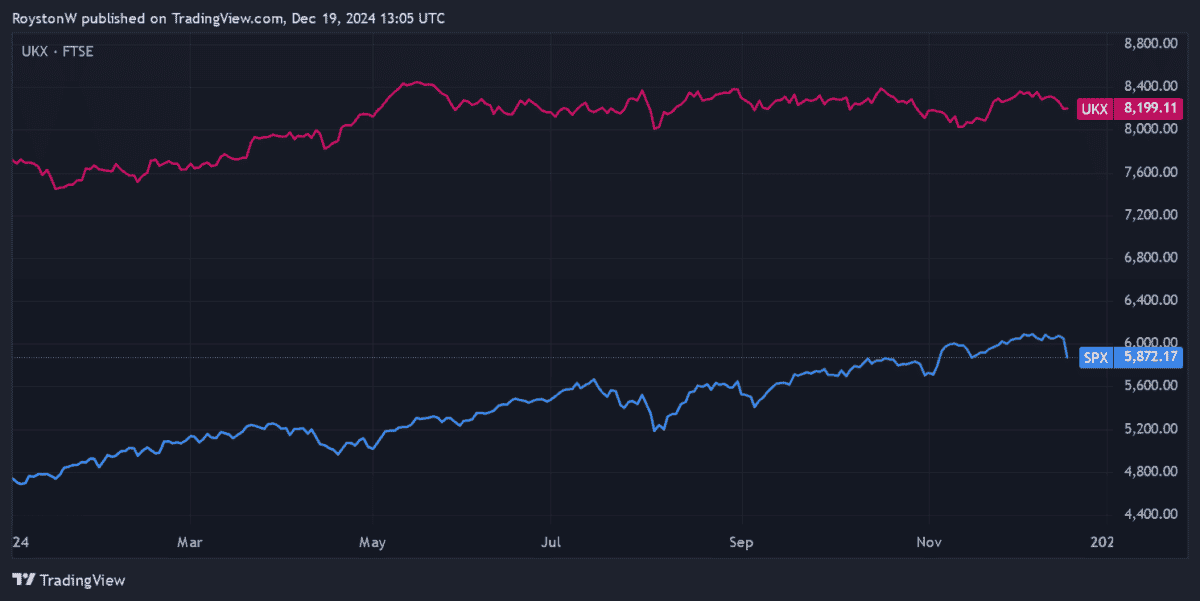

As a result, stock markets have gone global. London, i FTSE 100 it fell to a one-month low of more than 8,000 points today. Yesterday, i S&P 500 The US stock index fell to six-week lows.

Since previous rallies were built on expectations of rate cuts, this pullback is not surprising. Even after wiping out the last 24 hours, the S&P 500 remains up 23% for the year to date.

Could this be the beginning of bloodshed? Many analysts say global stocks are more valuable given issues such as China’s struggling economy, potential new trade tariffs, and signs of continued inflation.

In this case, more fall may be around the corner.

This is my plan

Accurately predicting how stock markets will behave in the near term is a very difficult task. At any given time, stock prices are affected by a range of macroeconomic and geopolitical factors. Surprises can also occur in those volatile asset prices, as we have just seen.

My guess is that a market crash is unlikely. But like I said, I can never be sure.

But whether the near-term outlook is bad or good, my investment strategy remains the same. Market volatility is common, but investing in equities can still deliver impressive long-term returns. So reducing my share of holdings makes no sense.

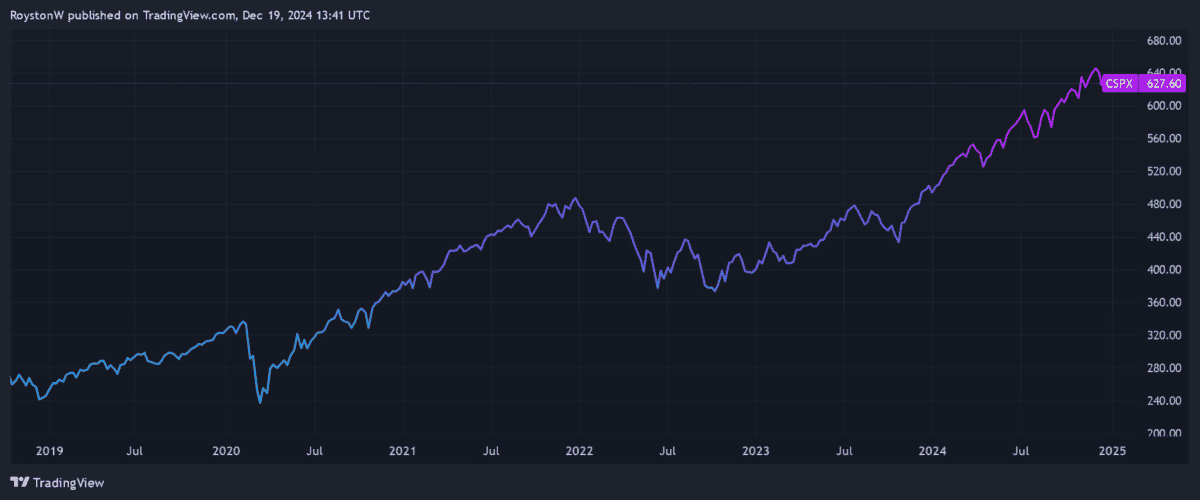

The S&P 500, for example, has provided an average annual return of 12.7% over the past decade. It has delivered these huge returns despite problems such as the Covid-19 pandemic, rising national conflicts and high interest rates.

At times like these, I therefore look for underperforming stocks, funds and trusts to buy. And the iShares S&P 500 ETF (LSE:CSPX) is another one that I consider buying more following the sharp decline in the index.

As the name suggests, it gives me exposure to the entire S&P 500, which helps me spread the risk. Having said that, it also has great potential for growth due to its high weighting of technology stocks Nvidia again Microsoft.

With an ongoing fee of 0.07%, it is one of the least expensive funds that track the US index as well.

Past performance is not a reliable guide to future returns. But if the long-term returns of this iShares fund remain unchanged, a £10k investment today could change more than three times to £36,365 ten years from now.

Source link