Long-term maintenance family system often does not literally show – a retirement research center

For those starting with $ 100,000, the Medicaid is not a simple option.

As part of an extended study in Retirement Relievies approaching retirement, we have recently eliminated a project that focuses on risks associated with long care costs.

As it appears, while medical risks are very confident and may be very expensive, most of these risks are intensified by Medicare (and Medicaid to the eligible for both programs). Dangers of long care, separately, have no insurance. Only 3 percent of the adults of Americans or 15 percent of those 65+ long-term insurance. And the greatest finds that people have a small sense of the need for long-term care or potential financial care.

Family Effects that look down their health risks that they may not be well organized to protect themselves from these risks. Apart from the relevant insurance or relevant resources, old homes may need to prepare for major changes or look at low-choice options. The question is, How reasonable are those emergencies?

The analysis was based on 2024 Chron and search survey of 508 people in 48-78 years of at least $ 100,000 in planted assets. The interview included a question about what respondent would think if they could not afford their medical or long medical expenses. These emergency programs were compared to the fact using data from Health and Retirement Study – A sample representing the country of those over 50 are not discussed every two years.

Interestingly, about 60 percent of the interviewees said they would think they were using the money down in Medicaid, and only 30 percent said they would process their balance or walk with their children (see Figure 1). However, many of these matters may not be realistic.

Many old families believe that it can always go back to the Medicaid may not see the income and the limits of the asset requires completion. In 2025, a monthly income limit of Medicaid fees for more than 65 are around $ 2,800 ($ 5,600 couple) and the limits of the property), but it varies in the form.

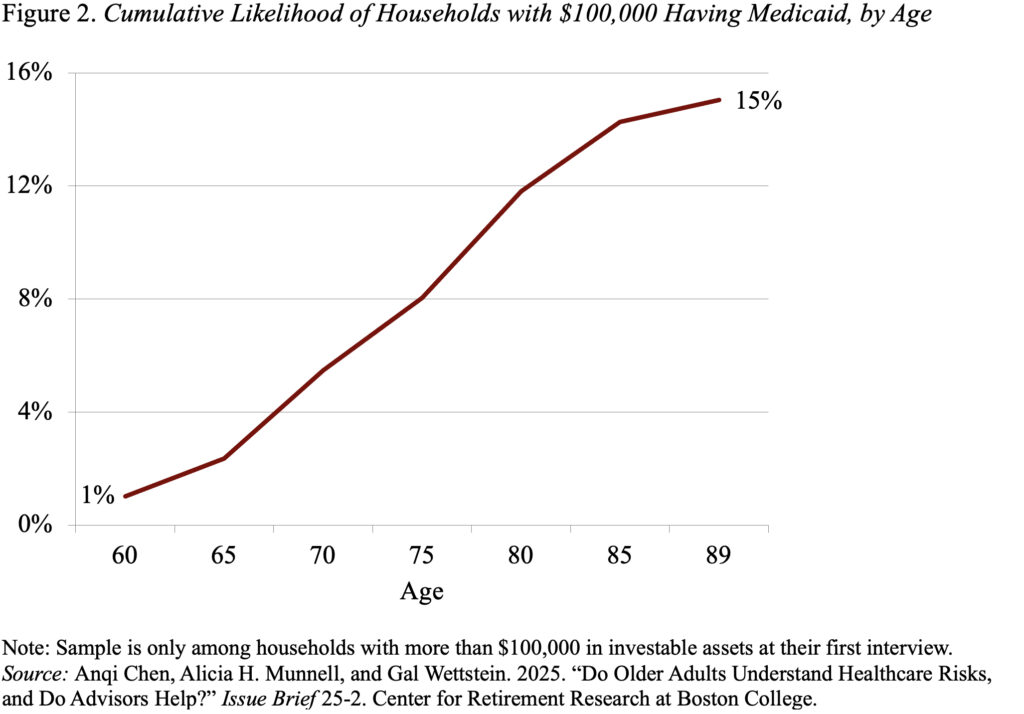

Between $ 100,000 of the investment of investment, such as those in our trial, almost no one will be eligible based on income legislation because their safety benefit and the benefits of the beneficiaries set above the limit. Several provinces have special laws for a long-term financial care for less limits. Even then, 70 percent of our sample sample family will not be eligible. In fact, only 15 percent of families have $ 100,000 in the first $ 100,000 permit (see Figure 2), compared to 60 percent of homes thinking that the medicaid money is getting.

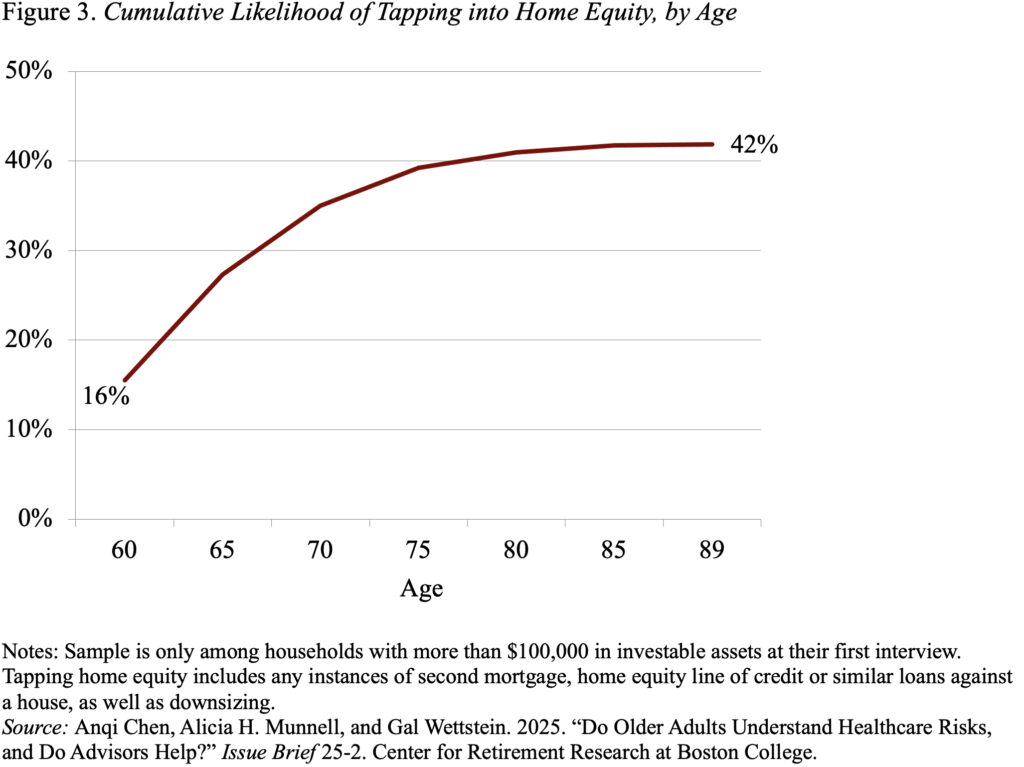

One of the most popular options to measure the cost of health care to arrest local balance. Under the third part of the families telling them they will see. However, in fact, more than 40 percent will affect equity at home in retirement – either a second loan, which applies for the Credit Directory or other loan.

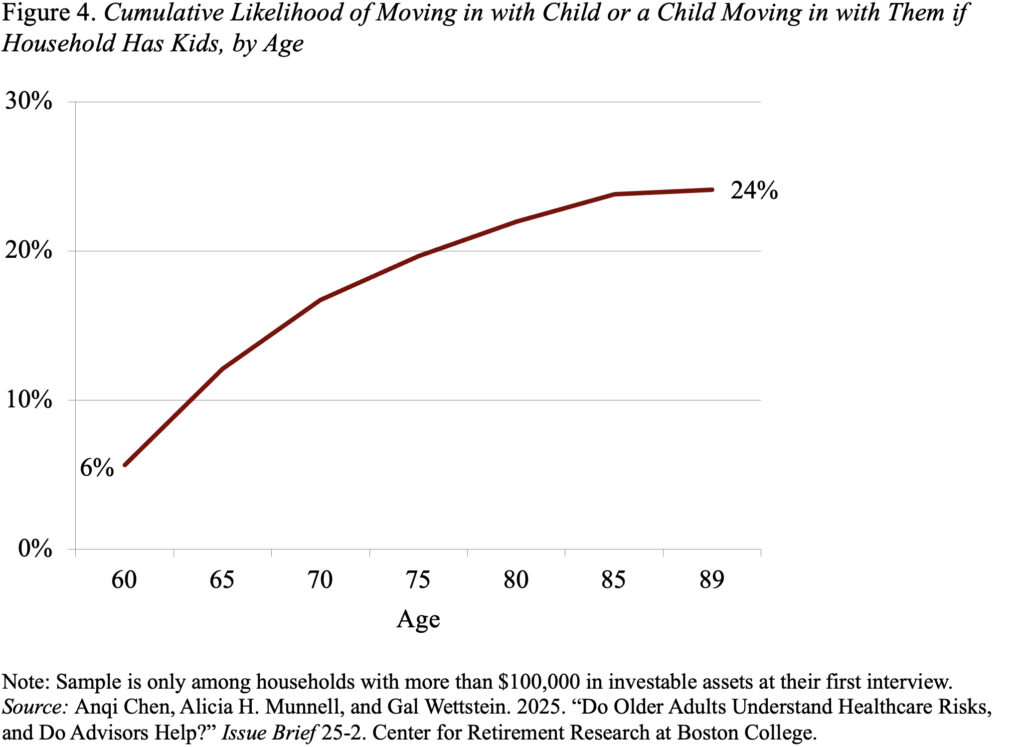

Eventually, another unpleasant option to control health needs between respondents travel with children. Also, under Third say they will process this option. Interestingly, in real world, likely a quarter of old households in our wealth team keeps living with their children (see Figure 4). Therefore, this approach looks like a very little back-up if the plans fail.

In short, parts that are not included in retirement costs when retirement – especially those that are associated with long care – either a great deal, and old families do not have an accurate idea of these risks. As a result, many will eventually enjoy insufficient resources. When participants in our research – people with $ 100,000 or more in planting assets – they were asked how they will cope, about 60 percent said they would use medicad. That is not a great logical option that has been given the strongest program requirements and estate requirements. In fact, only 15 percent of this group is probably good for Medicaid. Respondents were so actively involved in their home equity, but many (more than 40 percent), in fact, tap homelies as a source of support.

Source link