My 2 ETFs for 2025!

Image source: Getty Images

I’m looking for some great exchange traded funds (ETFs) to add to my portfolio in the new year. Here are two that I think could explode in value over the next 12 months.

iShares Physical Gold An ETF

2024 proved to be an amazing year for the price of gold. It’s up 29% since January 1, at $2,666 an ounce, and has hit multiple records during that time.

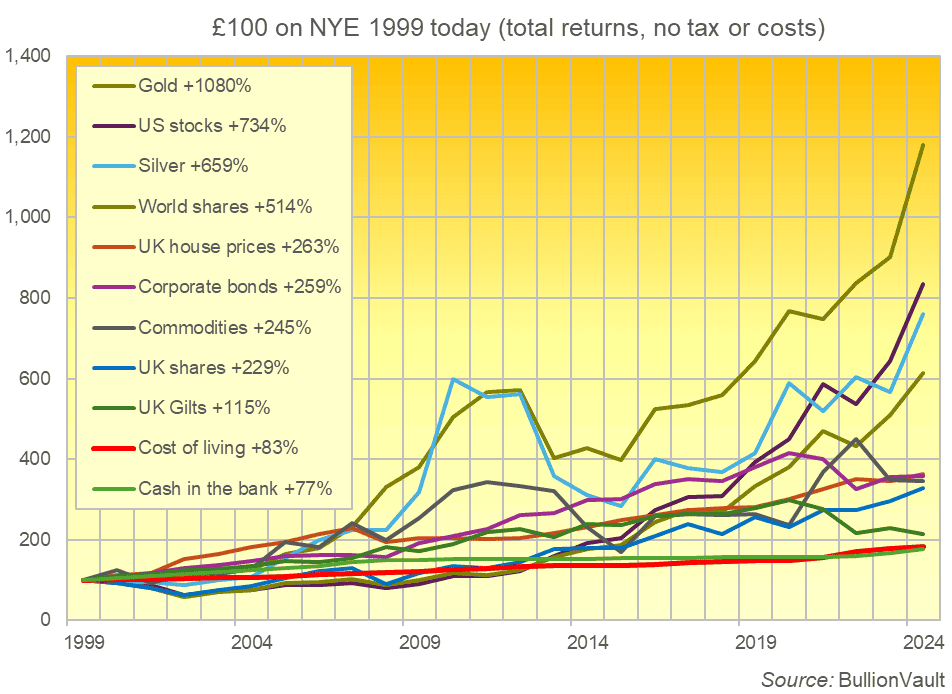

Gold’s strong performance is not rare. In fact, data from bullion dealer BullionVault shows that gold has delivered a total return of 1,080% since the end of the 20th century.

As the figure shows, that’s significantly better than all other major asset classes, including UK and US shares.

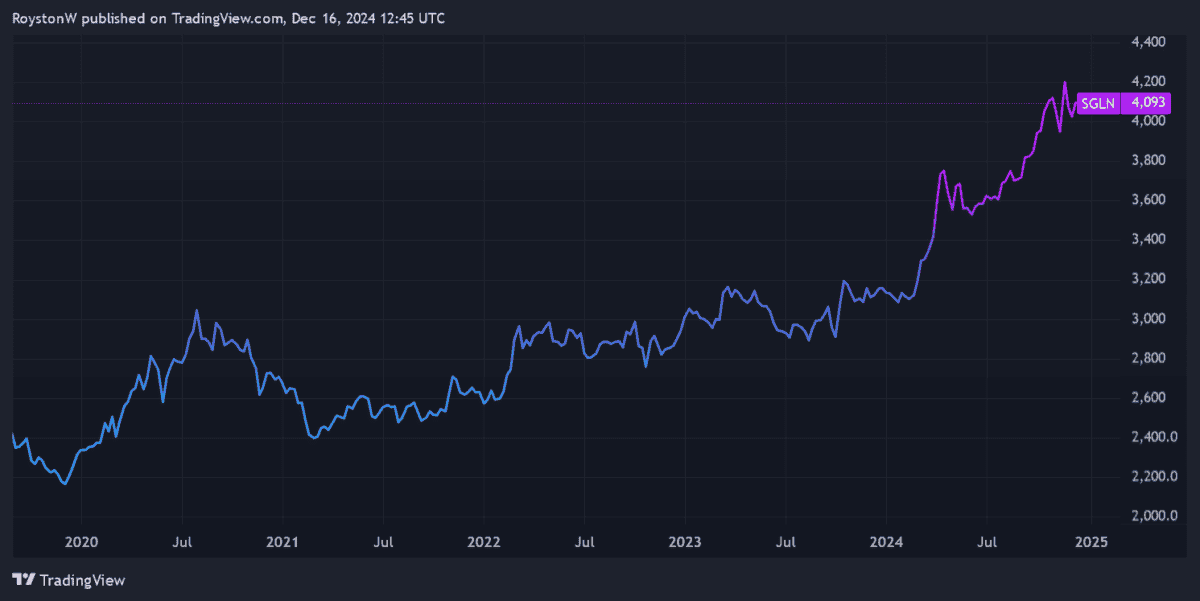

Gold’s incredible gains mean that an ETF based on the metal is worth serious consideration for long-term investors. One that I have been fascinated by recently is this one iShares Physical Gold An ETF (LSE:SLGN).

This fund is designed to only follow the movement of the gold price. It is therefore different from many other ETFs that track the performance of gold mining stocks, and which can deliver negative returns if a large company has performance problems.

Over the past 10 years, the fund has delivered an annualized return of 8.2%.

Past performance is no guarantee of future earnings. And returns here may be weaker if the US dollar appreciates, making it less expensive to buy commodities like gold.

But there are also many reasons to predict another price increase. Central bank gold purchases should remain firm as institutions diversify their reserves. A (expected) drop in interest rates should support the dollar amount.

On top of this, concerns about the political environment in the US and Europe, growing political tensions, and emerging problems in the global economy – exacerbated by new trade tariffs – may push safe-haven gold higher.

In this scenario, I believe that funds like iShares’ Physical Gold ETF can prove a smart investment.

Abrdn Physical Silver Shares ETF

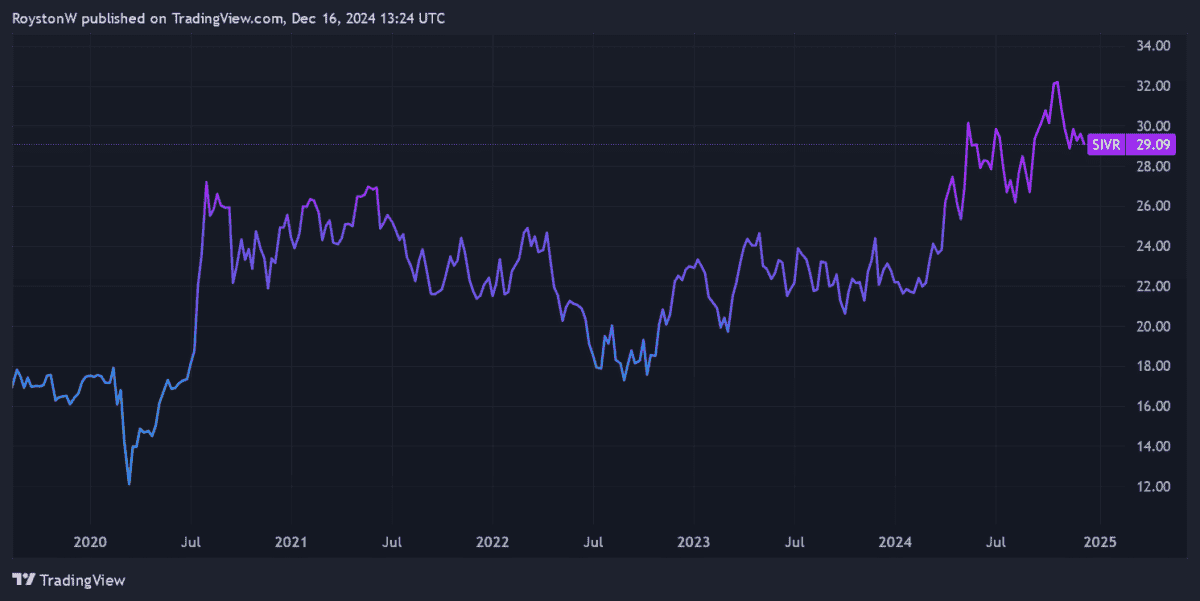

Silver is another precious metal that looks great in the new year. In fact, I think its dual role as an investment and industrial metal could see it surpass gold by 2025.

I Abrdn Physical Silver Shares ETF (NYSE:SIVR) is a fund that people can buy to capitalize on any upswing.

Like gold, silver is up 29% in value since January 1st. It last changed hands at $30.74 per ounce. But if economic conditions improve as interest rates fall, it could outperform the yellow metal given its large role in the industry.

About 50% of silver demand is for industrial applications such as electronics and photography. That compares to about 10% of gold.

Like the gold ETF I described above, this fund only tracks the prices of the metal. And since 2014, it has delivered a healthy annual return of 6.7%, which is roughly in line with FTSE 100.

Given the uncertain outlook, it can be a good way for investors to hedge their bets. That said, remember that returns can be disappointing if economic conditions become difficult.

Source link