Not to be confused with Index – Center for Retirement Research

The current indicator is a good compromise.

It’s “social security COLA projection” season, and with it comes the annual debate about whether the government uses the right index to adjust benefits. I would argue that the current index is good enough; it can easily be considered as a compromise between the two main options – CPI-E, which reflects the spending of the elderly and increases more quickly, and Chained CPI, which allows for more changes and increases more slowly.

The government is currently adjusting Social Security benefits to align with the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index, which covers about 29 percent of the population, was the only one available when the Social Security COLA was first introduced in 1972. In 1978, the Bureau of Labor Statistics expanded the sample to all urban residents and created the CPI-U, which includes about 93 percent of the population, including many retirees. Despite the extensive coverage and prominence given to the CPI-U in the monthly inflation report, the government has stuck with the CPI-W for the Social Security COLA — likely because the two indices follow each other so closely.

For decades, critics have argued that the bulk of goods in the CPI-W are not representative of the spending patterns of retirees. say down inflation is actually what older Americans are experiencing. Specifically, older people spend more on health care than younger people and health care prices generally rise faster than other goods, so the CPI-W understates increases in the cost of living for retirees. In response, in 1988, the BLS introduced the CPI-E, which shows the spending patterns of people age 62 and older.

On the other hand, economists say that the current CPI overstates inflation, because it does not account for how people change their buying habits in response to price increases. The theory is that by switching to a nearby product or service, people can reduce the rising cost of living and be just as happy. Since January 1999, the geometric formula has allowed a modest change between the categories of 211 elements (that is, together with 38 areas, a total of 8,018 basic indicators). But it did not allow substitution in all categories of things, such as pork and beef. The “tied CPI” reflects changes in purchasing patterns that occur when the price of pork increases and the price of beef does not. In 2018, Congress permanently changed the inflation adjustment in federal income tax provisions to a CPI bracket.

Table 1 shows how each of these measures of consumer prices changed between July 2023 and July 2024. As expected, CPI-W and CPI-U are very close (in fact, they are the same here), CPI-E rose faster, and The bound CPI increased gradually.

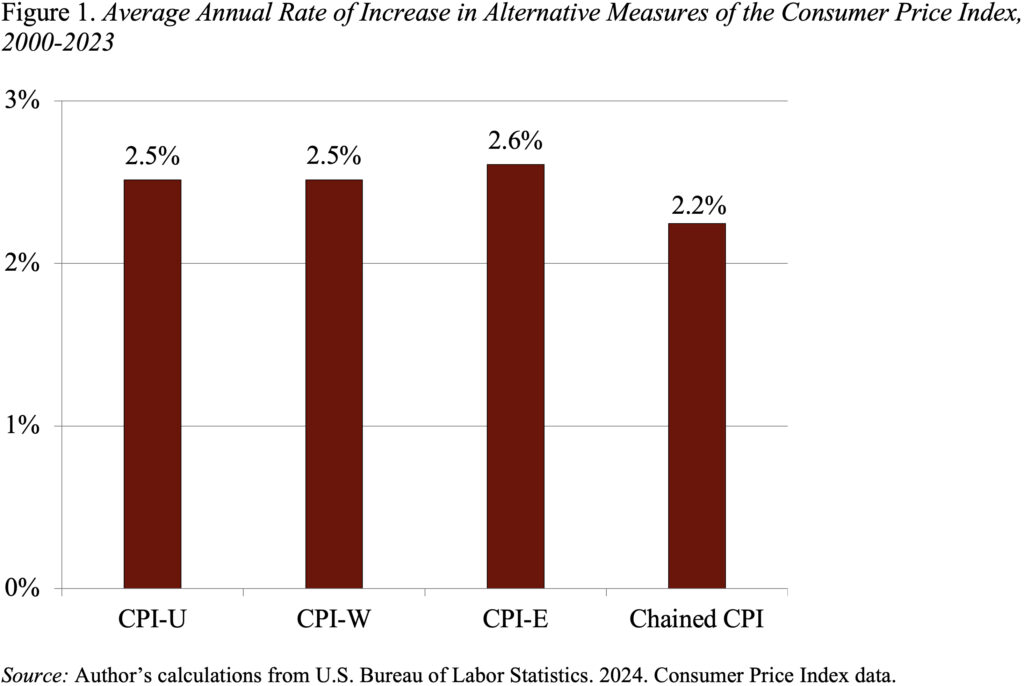

The same pattern can be seen if you look at the same indicators over a longer period of time (2000 – the first year for which “bound CPI” data is available – to 2023).

Switching from the CPI-W to the CPI-E or the tied CPI will have a significant impact on the cost of Social Security benefits over the next 75 years. In calculating these results, program statisticians think that the CPI-E can do it increase the COLA rate is 0.2 percentage points and the CPI is chained reduce the average COLA is 0.3 percentage points. Projections show that moving to CPI-E would increase the 75-year deficit by 12 percent, while switching to tied CPI would reduce the deficit by 17 percent.

One might argue that both the CPI-E and the chained CPI would provide a more accurate measure of the inflation experienced by retirees. Therefore, if we started with a price index that accurately reflects the consumption patterns of the elderly, then moving to a tied CPI may improve accuracy. (Although some experts question whether low-income seniors live too close to subsistence to change what they buy in response to price changes.) But given that we’re not starting at the right scale, the case for switching to a tied CPI is weak. Given the results of the reduction – 0.3 percent to exaggerate of inflation due to excluding the effect of change and an expected rate of 0.2%. to say nothing due to not reflecting the consumption patterns of older people – the current method of adjusting benefits appears to be correct.

Source link