This practice has important consequences of the Social Security Security Age – Center Resources

New data shows strong relationships between receivables and the time of life.

As part of the recent proposal, social security responses have given one of the broader body of evidence that life is related to income and less distributed. This approach is especially important when processing the promotion to improve the development of public safety and any proposal to increase retirement age.

Numbers released by social security is based on all employees – not as many people as many other subjects, but they do not shape the results reported by some researchers for a few reasons. First, these statistics release all benefits from the Disability Insurance program – a low-income program that has a low risk of life that would reduce the lower level. Second, unlike the previous lessons looked at the 50-year-old life time, these numbers are about the age of 62 years of age; Eliminating those who died between 50 and 62 produces a healthy part of a perfect. Despite these good things, the pattern remains (see Table 1). Life time is randomly up financially, and the gap is raised.

This approach has important results in the development of public safety program. The main purpose of this program is distributing revenue from senior earning earning the continuous profit formula taking the higher quality formula. The gap at the end of life underestimate the effort because the low-income will receive 10 years benefits under the most earlier.

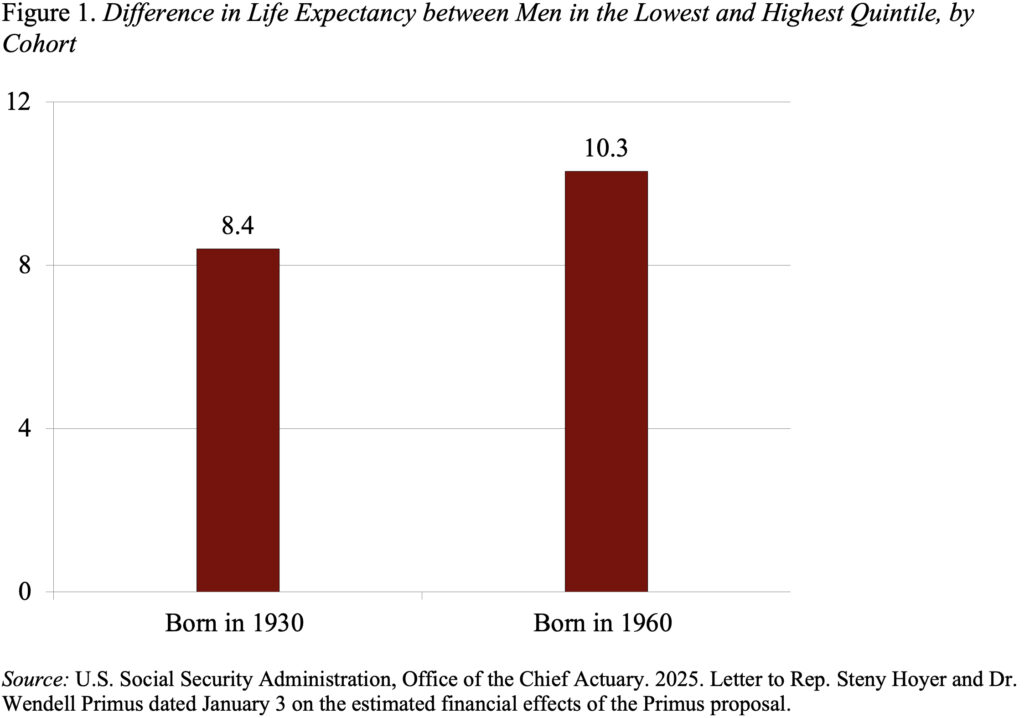

The middle relationships and revenue has important effects on the full-year retirement suggestions for responding to the full increase in long-term life. Yes, life time is increased to full time since the men born in 1930 to 20.9 men born in 1960. But the benefits of 20 percent were very high as 20 thousand, as well as the difference between the two groups of both increases so that senior men can now survive 10 years than men down (see Figure 1). That is, the men who are 20 percent of the receivables are expected to live about 77, and the high men are considered to live about 88.

As a result of this great variety of life, I am very popular with the Suggestion of Wendell Primus to increase only retirement age for those who can work. Under the ABSCAAAAes program, only 20 percent of each party sees an increase in the early years of retirement to 70, gradually entered the passage. Those with less than 60 Percentile earnings would not see changes. For those with money found between 60 and 80 Percentiles, the increase would measure.

This is not that this logical change may not be the full age of retirement.

The question that is left in my mind is linked to Mechanics. People need a warning about decades where they can apply full benefits. If the accounting received time for the expected time, was there 50 years, would that provide accurate guessing? Can 55 years old may be better? What kind of worker may not be misinterpreted? This suggestion requires less meat out, but it has a promise.

Source link