What People Should Know About Various Types of Personal Finance Blogs

Personal Finance Blogs are primarily falling into three major paragraphs. First, there is a “out of debt”. Second, there is “just from college” personal finance blogs. Third, there are “Career Track Policy Blogs. Of course there are many categories such as retirement blocks or in-lottery blogs, but these are too big.

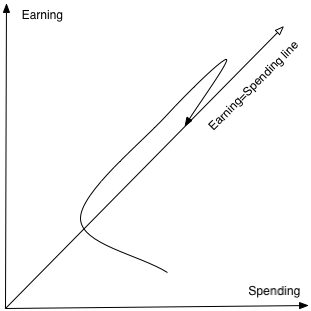

The deduction below is a graph showing this company.

Ix-axis shows the use of money. Iy-axis shows lead. The diagonal line shows when earnings are equal to spending money. Those in debts have been spending more than the one has been lodged and they slept under diagonal line. “Graduates” (young people) have a low amount of money but hope and low amounts. At that time in life there is a tendency to spend a lot of money that you get because the income is low. The biggest group is what I am the lack of better name I call blogs followed by work. Here to spend 15% under earnings. This track continues for 30 to 40 years as money and spending progressively as a regular line of retirement system is saved. Since one particular blog shows slump during a person’s financial time, planning all bloggers at one time indicating A common financial method taken by a person in our society. It looks like this. If there are any amateur star scholars that think of this thinking about the starvation of the star’s general in Hertzsprung-Russell Diagram. No, no concealment of Cosmic hidden value here

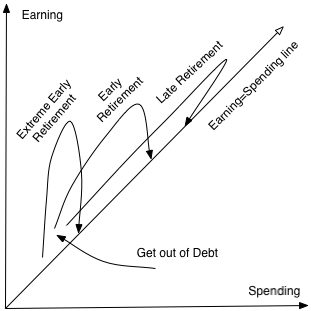

A person in this drawing can begin in debt or use of a detection. As the income income is slowly increased to 15% of the storage. As the income continues to increase the spending is properly repaired. After 30 or 40 years of retirement by spending dignified currency (no restaurants for restaurants and no visit) can sound amazing or impossible.- 10 Alternatives. That hope puts everything in a vision.  It is evident that the above routine is just one of the most possible method. The ordinary method that is relevant to the student’s debt, then for a work for 30-40 years at the end paying the debt and collects a large amount of money (1 million dollars Retirement at a higher level of spending What little concern is how money is spent. Retirement early hours may be 40-50 years. This requires others to control the budget to retire from premature retirement.extremerament available with student decisions (or perhaps no student debts) and maintaining 50-80% 5 to 10 years. This makes it possible for us to retire between 30 and 40 years. This requires great power management and clay skills. Another one-half should also learn the “unusual” blogs to see what other methods may occur.

It is evident that the above routine is just one of the most possible method. The ordinary method that is relevant to the student’s debt, then for a work for 30-40 years at the end paying the debt and collects a large amount of money (1 million dollars Retirement at a higher level of spending What little concern is how money is spent. Retirement early hours may be 40-50 years. This requires others to control the budget to retire from premature retirement.extremerament available with student decisions (or perhaps no student debts) and maintaining 50-80% 5 to 10 years. This makes it possible for us to retire between 30 and 40 years. This requires great power management and clay skills. Another one-half should also learn the “unusual” blogs to see what other methods may occur.

Copyright © 2007-2023 EagereRetirementExtreme.com

This feed is of personal, non-trade use.

Use of this feed on other Break Copyright. If you see this notification elsewhere in another center, it makes the page you view with copyright violation. Other sites use non-opposite algorithms to implement origins. Find the real version of this post of this post to AtAssteretiremententeXemententeXementeCe.com. (Digital Fingerprint: 47D7050E5790442c7FA8cab55461E9ce)

At first, it sent 2008-02-28 07:18:59.

Source link