Policy, Working, Docs & CRM is all in one place

This post is part of a professional part of the insurance.

MGA insurance and famous diets are complex and distributions distributing stunning tools, email messages, and outdated software. From taking and writing down in the administration of the manual management and communication, groups are legally compelled to be compiled in accordance with the work of transaction to do the work. That patchwork method creates unemployment, confusion, and risk.

A protected secured professional. By combining policy management, work flow, document management, and CRM in one modern area, we also restore how insurance teams apply. Shipment, documents, and broker interaction all resides in one accurate system, the direction of performance from the beginning to the end.

Policy and travel policy, connected out of seams

Protected technicians begin by changing complex processes into pure, visible activities. All distribution, rating, and policy following a well-defined method – separated by accurate categories – so your group remains where you are.

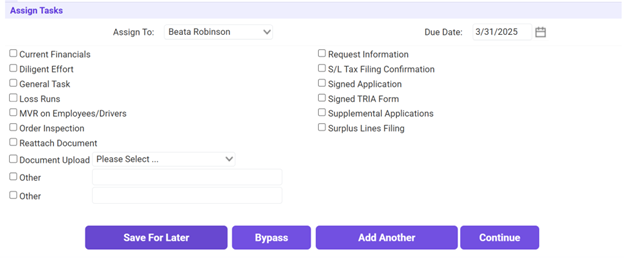

Image 1: The status bar indicates the delivery of delivery from the discharge.

During the delivery process, users can quickly see the file – whether it is waiting for permission, quoted, or ready to bind. This visual correction makes the tie easy and eliminated second guess.

![]()

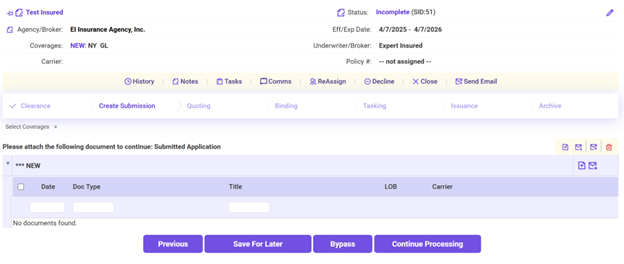

Image 2: A user of a user-related work lines indicate practical materials.

Each user sees their performance-based line, indicates exactly what presentations or policies are facing and what each paragraph has entered. Simply move the item to another user’s work – it is immediately forwarded, with full visibility which owns who owns and where to live in work.

Image 3: Tastering interface that allows users to give bonds to all groups.

In addition to the usual work of transit service, experts set out an insurance that support the changing work. Whether a person “owns” the submission or policy, can be assigned to follow something, questions, or interactive external seamlessly, without violations of the process.

Documents, embedded on where you work

Documents in the spine of all insurance – but in many programs, they are treated as back. It is stored in shared weddings, constantly shared in e-mail compiles, or named at odds in all folders, often hard to find. Verualization Insurance Changes directly directly to the LifeCycle Policy – therefore all stored, planned, and directly accessible.

Image 4: The required application document was set to the time of the shipping.

Whether you collect the app, signed rating, or supporting documents, all can be loaded with Drag-and-Drop directly in the system. You can label documents with custom tags (such as “losses running,” “Bened Binder,” or “to move broker”) to keep all planned and search. These documents are always attached to the policy or distribution, so there is no danger to them who have lost the shared drive or in another person’s inbox.

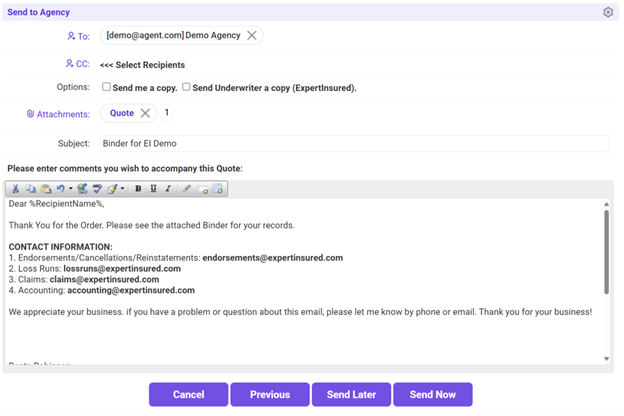

Image 5: Documents are sent to the seller by email without leaving the program.

Protected experts and make it easy to share The Scriptures, too. You need to send a letter of rate or request missing items? You can send emails directly to the system-no need to download or modify in Outlook or Gmail.

And works in another way, too. As technician is managed directly to your email, you can easily pull attachment from the Email is straight to Average click – None of the preserves, rename, or uploading required. Did you get a sales package in your inbox? Just select the email and drop the documents where they exist in the work travel.

With the full version of the translation, templates of the documentation of the document, as well as contacts and exit, the management of the Insurance documents not only part of your writing and functional process. Organized, audited audit, and directly where you expect.

CRM who works like you

Relationships the full insurance business, but traditional CRMs are often terminated on policy programs to support. CRM protected insurance directly on your daily walk, so all interactions are entered into a real business work.

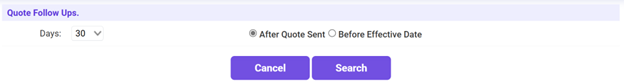

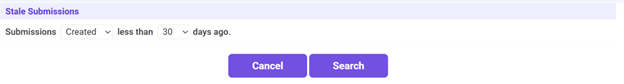

Image 6: Soon stale representations and send the intended tracking from within the program.

Track all the submission, rate, and dialog with your manufacturers in one place. You can set track reminders, search changers, and send them directly – without tools to change.

Because CRM remains within the same platform with your policy data, your details remain accurate, effective, and in the context. You do not only log in contact details – strengthens the relationship that strengthens the seller’s relationship with the driver’s money.

Conclusion: The power of the actual integration

A protected expert insurance is not only the UI clean – it is a change in the insurance and how it should work. In terms of policy activity, the management of the documents, and a whole CRM live in one area, quickly traveling groups, better interacting, and serving consumers effectively.

This compilation level removes conflict, improves the clarification, and supports the growth of growth – without the passing of many juggling programs. In the MGAs and the sellers who want to measure and work with confidence, the insurance technology is a system that lasts all together.

Source link