In 3 steps, a new investor can start buying shares with just £500

Image source: Getty Images

One common plan at the beginning of the year is investing. But while many people see any year as the one to start buying stocks, such plans can fall by the wayside even before January is out.

A common reason for that is lack of funds. There always seem to be other demands on our money.

But in reality, it doesn’t have to take a lot of money to start buying stocks. Here’s how an investor can do this in January (actually this week), in three steps.

Step 1: set up an interactive account

When the time comes to actually buy stocks, there needs to be a way to do so. Updating the options for buying and selling may take time and may suspend the account.

So I think it makes sense to start by deciding on a trading account or Stocks and Shares ISA that suits one’s needs best and gets the ball rolling.

Step 2: understand some important investment concepts

Next I think it makes sense to understand some basic concepts about what makes a good investment.

For example, think an apple (NASDAQ: AAPL). The company’s share price has increased over time. Indeed, it has more than that three times in the last five years alone.

On top of that, the tech giant is making huge profits.

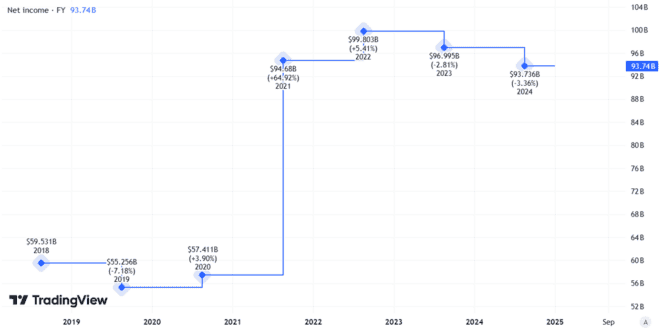

In recent years, the company’s annual revenue was not far from $100bn, which I find an amazing number.

Created using TradingView

However, notice that in the above chart the total income – although still large – has actually decreased.

That could reflect risks such as increased competition from price-competitive Asian phone companies, and rising costs from disrupted supply chains. I think both remain risks to Apple’s profits.

However, at the right price I would like to own a share. Its target market is large and it enjoys what Warren Buffett (Apple’s largest shareholder) calls a ‘moat’: competitive advantages such as its brand and proprietary technology.

But before I start buying shares in what I think is very good businessI think it would be great too investment. A large part of that would depend on what I pay for the share. A big business does not mean a big investment.

Therefore, from day one investors need to understand some basic valuation concepts.

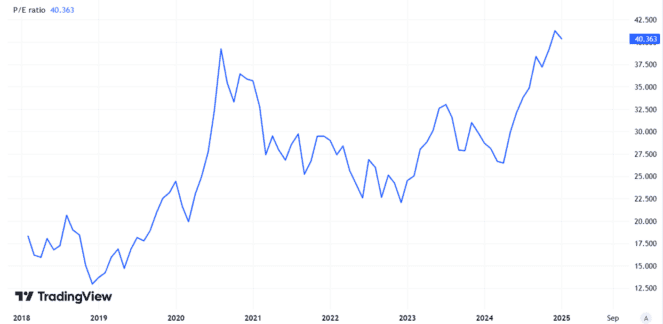

For example, Apple’s stock price is currently 40 times annual earnings per share. That’s too high for my taste and explains why I have no plans to buy the share. It is also nearing its highest level in years.

Created using TradingView

Step 3: start building a share portfolio

Now that I have been able to understand such concepts, I think that a new investor may be ready to make a shopping list and start buying stocks.

One simple but important risk management principle is diversification and £500 is enough to spread options over several different stocks.

Now the important question is: which ones?

Source link